Loanable Funds Market: AP Macroeconomics Web Activity

advertisement

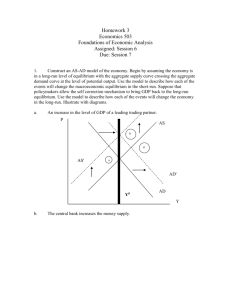

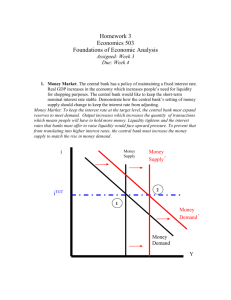

Name ________________________ Date _________ Period____ AP Macroeconomics Web Activity Market for Loanable Funds http://highered.mcgraw-hill.com/sites/0072819359/student_view0/chapter29/interactive_graphs.html# Please answer the following questions after going to the website above. 1. What do supply and demand forces in the market for loanable funs determine in the economy? 2. Who makes funds available to financial markets? Who demands funds? 3. Why is the supply for loanable funds upward sloping? 4. Why is the demand for loanable funds downward sloping? 5. Using the graphs below show the movement of the supply and demand curves for the 4 scenarios. a. How would the interest rate be affected by an increase in the desire of households to save additional amounts of their income? b. New technologies have increased the productivity of capital investment opportunities over the past decade. All else equal, what would this development do to the equilibrium rate of interest? c. During the latter part of the 1990s, the federal government's budget position moved from deficit to surplus. How did this change affect the equilibrium interest rate? d. As the federal government's budget position moved into deficit in 2001, what might have accounted for the continued low interest rates? Graph a Graph b Graph c Graph d Using the website below write a one sentence summary for each of the scenarios in the Market for loanable funds. http://www.reffonomics.com/TRB/chapter23/LoanableFundsGraphInteractive/loanablefundsgraph.html 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15.