Saving & Investment in National Income Accounts

advertisement

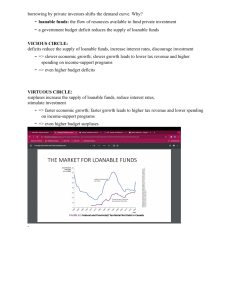

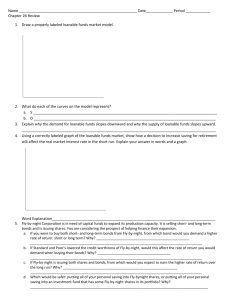

Saving & Investment in National Income Accounts • Some important identities • T = taxes minus transfer payments •S=Y–C–G • S = (Y – T – C) + (T – G) • Private saving, Y – T – C • Income that households have left after paying for taxes and consumption • Public saving, T – G • Tax revenue that the government has left after paying for its spending 1 Saving & Investment in National Income Accounts • Some important identities • Budget surplus: T – G > 0 • Excess of tax revenue over government spending • Budget deficit: T – G < 0 • Shortfall of tax revenue from government spending 2 2 Saving incentives increase the supply of loanable funds Interest Rate Supply, S1 S2 5% 1. Tax incentives for saving increase the supply of loanable funds . . . 4% Demand 0 2. . . . Which reduces the equilibrium interest rate . . . $1,200 $1,600 Loanable Funds (in billions of dollars) 3. . . . and raises the equilibrium quantity of loanable funds. A change in the tax laws to encourage Americans to save more would shift the supply of loanable funds to the right from S1 to S2. 3 4 The effect of a government budget deficit Interest Rate S2 1. A budget deficit decreases the supply of loanable funds . . . Supply, S1 2. . . . which raises the equilibrium interest rate . . . 6% 5% Demand Loanable Funds (in billions of dollars) 3. . . . and reduces the equilibrium quantity of loanable funds. 0 $800 $1,200 4 In a “Liquidity Trap” Can’t lower interest rate -> No Change in Investment 5 In “Normal” Times Decrease in Budget Deficit -> Increase Supply of Money/Loanable Funds -> Lowers Interest Rate -> Increases Investment 6 Interest Rates During the Great Recession (2008) 7