Threat of Entry - BYU Marriott School

advertisement

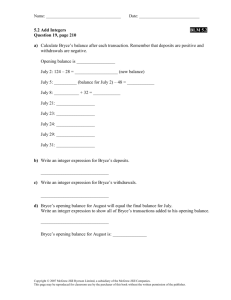

Threat of Entry: Factors that Reduce Market Share Potential for New Entrants MANEC 387 Economics of Strategy David J. Bryce David J. Bryce © 1996-2002 Some portions adapted from Baye © 2002 The Structure of Industries Threat of new Entrants Bargaining Power of Suppliers Competitive Rivalry Threat of Substitutes From M. Porter, 1979, “How Competitive Forces Shape Strategy” David J. Bryce © 1996-2002 Some portions adapted from Baye © 2002 Bargaining Power of Customers Barriers to Entry • A barrier to entry is any factor that – Increases the costs born by potential entrants (relative to incumbents), after they enter the market – Decreases the market share potential of entrants upon entering the industry – Other factors • Trade restrictions (tariffs, quotas, voluntary export restraints, infant industry protection, embargoes) • Government regulation of industries • Industry certification boards (CPAs, Actuaries) David J. Bryce © 1996-2002 Some portions adapted from Baye © 2002 Barriers Limiting Market Share • • • • Product differentiation Advertising/Brand image Access to distribution Customer switching costs – exploiting network externalities • Expected retaliation David J. Bryce © 1996-2002 Some portions adapted from Baye © 2002 Branding • A primary means of erecting a differentiation barrier is to build “brand equity” – Brand equity is represented by cumulative investments in raising awareness and/or improving the image of a brand usually through advertising David J. Bryce © 1996-2002 Some portions adapted from Baye © 2002 Examples • Brand as Barrier: – Intel Inside campaign • Rapid Brand Building for a New Entrant: – AstraZeneca’s “Purple Pill” campaign – AZ (re)entered the market for heartburn therapy with a major effort to build brand equity David J. Bryce © 1996-2002 Some portions adapted from Baye © 2002 David J. Bryce © 1996-2002 Some portions adapted from Baye © 2002 Access to Distribution • Examples: – Coke and Pepsi access to bottlers and distribution to outlets (economies of scale in bottling) – Ready-to-eat cereal in getting and allocating scarce shelf space. – Energizer just entered the razor market. Why? David J. Bryce © 1996-2002 Some portions adapted from Baye © 2002 Networks and Network Externalities • Network – a collection of nodes connected by links • Externality – the benefits/costs of a decision are not internalized by the decision-maker – Negative externalities impose costs on others – Positive externalities spread benefits on others • Network externality – positive externality where the decision to join a network gives benefit to the existing members of the network. Value to customer depends on the number of other customers. David J. Bryce © 1996-2002 Some portions adapted from Baye © 2002 Economics of Demand in a Network The nature of demand and dynamic adjustments to reach equilibrium differ under a network externality. Network Externality Price Price Traditional Demand Demand Supply Demand Supply Q Dynamic Adjustment David J. Bryce © 1996-2002 Some portions adapted from Baye © 2002 Q Dynamic Adjustment Typology of Network Externalities • Direct effects – Telephone networks and fax – QWERTY – Internet and E-Bay • Indirect effects – complementary networks and “increasing returns” – Availability of software and service – Platforms and standards David J. Bryce © 1996-2002 Some portions adapted from Baye © 2002 Strategies for Network Externalities How do you become the standard? • • • • • Pricing – IBM vs. Apple Licensing – VHS vs. Betamax Alliances – Sony, Philips, and the Compact Disk Pre-emption – Osborne, Japan and HDTV Other examples – Netscape vs. Explorer David J. Bryce © 1996-2002 Some portions adapted from Baye © 2002 Strategic Implications of Network Externalities • A product with increasing returns is so difficult to displace that its competitive advantage may be insurmountable. – Lock-in through increased switching costs – First-mover advantages imply that even a brief head start may be critical (time matters) – Inferior technologies may persist (history matters) • To replace a standard, the value of a new product must exceed the combined value of the entrenched product and its network. David J. Bryce © 1996-2002 Some portions adapted from Baye © 2002 Overcoming Barriers to Entry • Existing firms in other industries can leverage their capabilities as a platform for entry (economies of scale, knowledge, funds, brands, distribution channels) • • • • Technological change/Disruptive technologies Second mover advantages Changing legal/regulatory environment Acquire incumbent firms Costs of entry must be less than the profits of entry David J. Bryce © 1996-2002 Some portions adapted from Baye © 2002 The Logic of Exit • Short-run: firm produces as long as it covers marginal cost (MR>MC). • Long-run: firm ceases production and exits if it does not expect to cover fixed costs (MR<ATC). • Exit reduces supply, price rises, firm profits rise to zero. David J. Bryce © 1996-2002 Some portions adapted from Baye © 2002 The Problem of Barriers to Exit • Barriers to exit exist when the costs of exit are greater than the losses of continued production. – Book value of assets greater than market value – Emotional ties to continued operation – Uncertain demand and high startup costs (real options) – Government support of “strategic industries” • These barriers perpetuate oversupply and heighten price competition. • Worse conditions than perfect competition David J. Bryce © 1996-2002 Some portions adapted from Baye © 2002 Barriers to Entry and Sustainability of Economic Profits • Without barriers to entry, economic profits will attract entry that competes profits away. • Effective barriers need only make the cost of entry greater than the potential profits or impose restrictions that limit market share and thus business viability • Incumbents are concerned with whether barriers are high enough to protect current market structure. • Potential entrants are concerned with how they can overcome entry barriers and still have other potential entrants deterred. David J. Bryce © 1996-2002 Some portions adapted from Baye © 2002