Sequential Games - BYU Marriott School

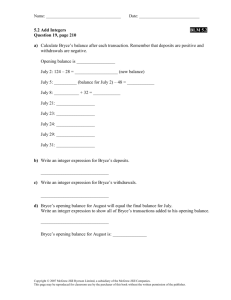

advertisement

Game Theory: The Competitive Dynamics of Strategy MANEC 387 Economics of Strategy David J. Bryce David Bryce © 1996-2002 Adapted from Baye © 2002 The Structure of Industries Threat of new Entrants Bargaining Power of Suppliers Competitive Rivalry Threat of Substitutes From M. Porter, 1979, “How Competitive Forces Shape Strategy” David Bryce © 1996-2002 Adapted from Baye © 2002 Bargaining Power of Customers Competitor Response Concepts from Game Theory • Sequential move games in normal form – Simultaneous vs. sequential move games – hypothetical Boeing v. McDonnell-Douglas game (bullying brothers) • Sequential move games in extensive form – Backward induction – Subgame-perfect equilibria David Bryce © 1996-2002 Adapted from Baye © 2002 Fundamentals of Game Theory 1. Identify the players 2. Identify their possible actions 3. Identify their conditional payoffs from their actions 4. Determine the players’ strategies – My strategy is my set of best responses to all possible rival actions 5. Determine the equilibrium outcome(s) – equilibrium exists when all players are playing their best response to all other players David Bryce © 1996-2002 Adapted from Baye © 2002 Simultaneous-Move Bargaining • Management and a union are negotiating a wage increase • Strategies are wage offers & wage demands • Successful negotiations lead to $600 million in surplus, which must be split among the parties • Failure to reach an agreement results in a loss to the firm of $100 million and a union loss of $3 million • Simultaneous moves, and time permits only one-shot at making a deal. David Bryce © 1996-2002 Adapted from Baye © 2002 The Bargaining Game in Normal Form Union David Bryce © 1996-2002 Adapted from Baye © 2002 W=$10 W=$5 W=$1 Management W=$10 W=$5 500 100* -3 -100 -3 -100 -3 -100 300 300* -3 -100 W=$1 -100 -3 -100 -3 100 500* “Fairness” – the Natural Focal Point Union David Bryce © 1996-2002 Adapted from Baye © 2002 W=$10 W=$5 W=$1 Management W=$10 W=$5 500 100* -3 -100 -3 -100 -3 -100 300 300* -3 -100 W=$1 -100 -3 -100 -3 100 500* Lessons in Simultaneous-Move Bargaining • Simultaneous-move bargaining results in a coordination problem • Experiments suggests that, in the absence of any “history,” real players typically coordinate on the “fair outcome” • When there is a “bargaining history,” other outcomes may prevail David Bryce © 1996-2002 Adapted from Baye © 2002 A Sequential Game - Single Offer Bargaining • Now suppose the game is sequential in nature, and management gets to make the union a “take-it-or-leave-it” offer • Write the game in extensive form – – – – – Summarize the players Their potential actions Their information at each decision point The sequence of moves and Each player’s payoff David Bryce © 1996-2002 Adapted from Baye © 2002 Step 1: Management’s Move 10 M 5 1 David Bryce © 1996-2002 Adapted from Baye © 2002 Step 2: Append the Union’s Move Accept U Reject 10 M 5 Accept U Reject 1 Accept U Reject David Bryce © 1996-2002 Adapted from Baye © 2002 Step 3: Append the Payoffs Accept 100, 500 Reject -100, -3 Accept 300, 300 Reject -100, -3 Accept 500, 100 Reject -100, -3 U 10 M 5 U 1 U David Bryce © 1996-2002 Adapted from Baye © 2002 Multiple Nash Equilibria Accept U Reject 10 M 5 Accept U Reject 1 Accept U Reject David Bryce © 1996-2002 Adapted from Baye © 2002 100, 500 * -100, -3 300, 300 * -100, -3 500, 100 * -100, -3 Step 7: Find the Subgame Perfect Nash Equilibrium Outcomes • Outcomes where no player has an incentive to change its strategy at any stage of the game, given the strategy of the rival, and • The outcomes are based on “credible actions;” that is, they are not the result of “empty threats” by the rival. David Bryce © 1996-2002 Adapted from Baye © 2002 Sequential Strategies in the Game Tree • Final player chooses the option that maximizes her payoff • The previous player chooses the option that maximizes his payoff conditional on the expected choice of the final player, and so on • This is backward induction – work backward from the end “sub-game,” each player makes optimal choices assuming that each subsequent rival chooses rationally • The equilibrium is called sub-game perfect David Bryce © 1996-2002 Adapted from Baye © 2002 Only One Subgame-Perfect Nash Equilibrium Outcome Accept 100, 500 Reject -100, -3 Accept 300, 300 Reject -100, -3 U 10 M 5 U 1 Accept U Reject David Bryce © 1996-2002 Adapted from Baye © 2002 500, 100 * -100, -3 Re-Cap • In take-it-or-leave-it bargaining, there is a first-mover advantage. • Management can gain by making a take-it or leave-it offer to the union. • Management should be careful, however; real world evidence suggests that people sometimes reject offers on the the basis of “principle” instead of cash considerations. David Bryce © 1996-2002 Adapted from Baye © 2002 Moroni, Zarahemna and Credible Threats (or Bush, Saddam and those pesky WMDs) M Payoffs 0 100* -200 -100 Z 200 -200 M -150 See Alma 44, Book of Mormon David Bryce © 1996-2002 Adapted from Baye © 2002 -50 Moroni – Zarahemna and Credible Threats Payoffs 0 100 M -200 -100 Z 100 Z ? M -175 -100 200 -200 M See Alma 44, Book of Mormon David Bryce © 1996-2002 Adapted from Baye © 2002 -150 -50 * Summary and Takeaways • The reasoning of game theory supplies a useful way to predict the outcome of competitive interactions • By diagramming a game, players can identify their best potential strategies • Threats of retaliation must be credible • Incumbents may be able to deter entrants by making major strategic commitments (credible threats) David Bryce © 1996-2002 Adapted from Baye © 2002