Supplier Power - BYU Marriott School

advertisement

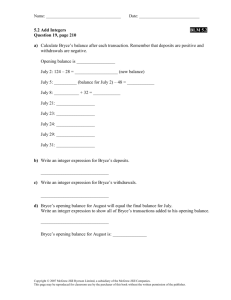

The Power of Suppliers MANEC 387 Economics of Strategy David J. Bryce David Bryce © 1996-2002 Adapted from Baye © 2002 The Structure of Industries Threat of new Entrants Bargaining Power of Suppliers Competitive Rivalry Threat of Substitutes From M. Porter, 1979, “How Competitive Forces Shape Strategy” David Bryce © 1996-2002 Adapted from Baye © 2002 Bargaining Power of Customers Market Supply Curve • The supply curve shows the amount of a good that will be produced at alternative prices. • Law of Supply – The supply curve is upward sloping Price S0 Quantity David Bryce © 1996-2002 Adapted from Baye © 2002 What Shifts Supply? • • • • • • Input prices Technology or government regulations Number of firms Substitutes in production Taxes Producer expectations David Bryce © 1996-2002 Adapted from Baye © 2002 The Supply Function • An equation representing the supply curve: QxS = f(Px , PR ,W, H,) – – – – – QxS = quantity supplied of good X. Px = price of good X. PR = price of a related good W = price of inputs (e.g., wages) H = other variable affecting supply David Bryce © 1996-2002 Adapted from Baye © 2002 Change in Quantity Supplied Price A to B: Increase in quantity supplied S0 B 20 A 10 David Bryce © 1996-2002 Adapted from Baye © 2002 5 10 Quantity Change in Supply S0 to S1: Increase in supply Price S0 S1 8 6 5 David Bryce © 1996-2002 Adapted from Baye © 2002 7 Quantity Producer Surplus • The amount producers receive in excess of the amount necessary to induce them to produce the good. Price S0 P* Producer Surplus Q* David Bryce © 1996-2002 Adapted from Baye © 2002 Quantity Market Equilibrium • Balancing supply and demand QxS = Qxd • Steady-state David Bryce © 1996-2002 Adapted from Baye © 2002 If price is too low… Price S 7 6 5 D Shortage 12 - 6 = 6 6 David Bryce © 1996-2002 Adapted from Baye © 2002 12 Quantity If price is too high… Surplus 14 - 6 = 8 Price S 9 8 7 D 6 David Bryce © 1996-2002 Adapted from Baye © 2002 8 14 Quantity Applications of Demand and Supply Analysis • Event: The WSJ reports that the prices of PC components are expected to fall by 5-8 percent over the next six months. • Scenario 1: You manage a small firm that manufactures PCs. • Scenario 2: You manage a small software company. David Bryce © 1996-2002 Adapted from Baye © 2002 Scenario 1: Implications for a Small PC Maker • What happens to your business? Do prices rise or fall? Are profits likely to rise or fall? David Bryce © 1996-2002 Adapted from Baye © 2002 Big Picture: Impact of decline in component prices on PC market Price of PCs S S* P0 P* D Q0 David Bryce © 1996-2002 Adapted from Baye © 2002 Q* Quantity of PC’s Scenario 2: Software Maker • More complicated chain of reasoning to arrive at the “Big Picture” • Step 1: Use analysis like that in Scenario 1 to deduce that lower component prices will lead to – a lower equilibrium price for computers – a greater number of computers sold. • Step 2: How will these changes affect the “Big Picture” in the software market? David Bryce © 1996-2002 Adapted from Baye © 2002 Big Picture: Impact of lower PC prices on the software market Price of Software S P1 P0 D* D Q0 Q1 David Bryce © 1996-2002 Adapted from Baye © 2002 Quantity of Software Suppliers and Performance • Firms incur costs as they use inputs to produce outputs • Suppliers are our sources of inputs – – – – Materials Technology/Equipment Labor Management • Suppliers have power to raise our input costs through the strength of their bargaining power David Bryce © 1996-2002 Adapted from Baye © 2002 The Power of Suppliers Suppliers have bargaining power over firms when: • Supplier’s products are highly differentiated • Suppliers are not threatened by substitutes • Suppliers threaten forward vertical integration • Supplier’s products are a large fraction of a firm’s final costs • Firms in an industry are relatively unimportant customers of the supplier – low purchasing volumes, high switching costs, supplier product important to quality of product David Bryce © 1996-2002 Adapted from Baye © 2002 Manager’s Role • Procure inputs in the least cost manner • Provide incentives for workers to put forth effort • Failure to accomplish this results in a point like B David Bryce © 1996-2002 Adapted from Baye © 2002 Costs TC(Q) B $100 80 A Q Output Methods of Procuring Inputs • Spot Exchange – When the buyer and seller of an input meet, exchange, and then go their separate ways. • Contracts – A legal document that creates an extended relationship between a buyer and a seller. • Vertical Integration – When a firm shuns other suppliers and chooses to produce an input internally. David Bryce © 1996-2002 Adapted from Baye © 2002 Key Features of Procurement Methods • Spot Exchange – Specialization, avoids contracting costs, avoids costs of vertical integration. – Possible “hold-up problem” • Contracting – Specialization, reduces opportunism, avoids skimping on specialized investments – Costly in complex environments • Vertical Integration – Reduces opportunism, avoids contracting costs – Lost specialization, organizational costs David Bryce © 1996-2002 Adapted from Baye © 2002 Transaction Costs • Costs of acquiring an input over and above the amount paid to the input supplier – includes: – Search costs – Negotiation costs – Other required investments or expenditures David Bryce © 1996-2002 Adapted from Baye © 2002 Specialized Investments • Investments in “specific assets” made to allow two parties to exchange • Specific assets have little or no value outside of the exchange relationship – – – – Site specificity Physical-asset specificity Dedicated assets Human capital • Lead to higher transaction costs and the problem of “holdup” David Bryce © 1996-2002 Adapted from Baye © 2002 The Problem of Holdup David Bryce © 1996-2002 Adapted from Baye © 2002 Specialized Investments and Contract Length MC $ MB1 Due to greater need for specialized investments MB0 Longer Contract L0 David Bryce © 1996-2002 Adapted from Baye © 2002 L1 Contract Length Optimal Input Procurement Spot Exchange Substantial specialized investments relative to contracting costs? No Yes Complex contracting environment relative to costs of integration? No Contract David Bryce © 1996-2002 Adapted from Baye © 2002 Yes Vertical Integration Suppliers of Labor & Management Problems of the Agency Relationship • Agency relations exist when a “principal” delegates binding decision-making authority to an “agent” – e.g., stockholders delegate to executives; managers delegate employees • Agency problems arise when – Agent has different incentives than the principal – It is costly to monitor the agent’s behavior • Agency theory designs governance mechanisms to align the incentives of the principal and the agent David Bryce © 1996-2002 Adapted from Baye © 2002 The Principal-Agent Problem • Occurs when the principal cannot observe the effort of the agent – Example: Shareholders (principal) cannot observe the effort of the manager (agent) – Example: Manager (principal) cannot observe the effort of workers (agents) • Problem – principal cannot determine whether a bad outcome was the result of the agent’s low effort or due to bad luck David Bryce © 1996-2002 Adapted from Baye © 2002 Solving the Problem Between Managers and Workers • • • • • • • Profit sharing Revenue sharing Employee stock options Piece rates Commissions Bonuses Time clocks and spot checks David Bryce © 1996-2002 Adapted from Baye © 2002