Production and Cost - BYU Marriott School

advertisement

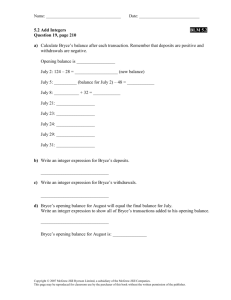

Production and Supply MANEC 387 Economics of Strategy David J. Bryce David Bryce © 1996-2002 Adapted from Baye © 2002 The Structure of Industries Threat of new Entrants Bargaining Power of Suppliers Competitive Rivalry Threat of Substitutes From M. Porter, 1979, “How Competitive Forces Shape Strategy” David Bryce © 1996-2002 Adapted from Baye © 2002 Bargaining Power of Customers Production and Supply • Firms acquire inputs from suppliers • Economics of production determines demand for inputs • Inputs are transformed into outputs through a productivity relationship defined by the “production function” • For example, consider the Cobb-Douglas production function: a b Q = f(L,K) = AL K David Bryce © 1996-2002 Adapted from Baye © 2002 Total Product The Cobb-Douglas Production Function Q = f(K,L) = K0.5L0.5 • Assume that in the very short run, capital (K) is fixed at 16 units • Short run production function: Q = 160.5 L0.5 = 4 L0.5 • What is total product (output) when we use 100 employees? Q = 4 (1000.5) = 4 (10) = 40 units David Bryce © 1996-2002 Adapted from Baye © 2002 Product of Labor • Marginal product of labor – MPL = DQ/DL – Measures the output produced by the last worker – Slope of the production function • Average product of labor – APL = Q/L – Measures the output of an “average” worker David Bryce © 1996-2002 Adapted from Baye © 2002 Productivity in Stages Q Increasing Marginal Returns Diminishing Marginal Returns Negative Marginal Returns Q=F(K,L) AP MP David Bryce © 1996-2002 Adapted from Baye © 2002 L Optimal Choice of Input Levels How much of an input do I need? • Use enough input such that marginal benefit equals marginal cost • Logic – if one more unit provides more value (PQQ) than it costs (PLL), firm is better off – use another unit David Bryce © 1996-2002 Adapted from Baye © 2002 TVP PLL Q* PQQ L* Input L Tangency means MVP=MC Marginal Rate of Technical Substitution – Cobb-Douglas • Isoquants represent the combinations of inputs that produce a particular level of output • Slope of isoquant gives the rate at which we can trade one input for another leaving output unchanged – marginal rate of technical substitution (MRTS) David Bryce © 1996-2002 Adapted from Baye © 2002 Input K Q3 Q2 Q1 Input L Q1 < Q2 < Q3 Linear Isoquants Perfect substitutes – Perfect Complements Leontief (fixed proportion) technology K K Q3 Q2 Q1 Q2 Q1 Q3 L David Bryce © 1996-2002 Adapted from Baye © 2002 L Optimal Choice of Input Combinations • Choose optimal inputs such that marginal rate of technical substitution equals the price ratio • Logic – if MRTS > price ratio, you can get more production/$ from L than from K. Add more L until its marginal contribution equals that of K Input K K* PL/PK L* Input L Tangency means MRTS = price ratio David Bryce © 1996-2002 Adapted from Baye © 2002 Input Factor Demands How much do we need from suppliers? Input K When the price of labor rises, firm demand for labor falls and demand for capital rises K1 K0 PL/PK L1 David Bryce © 1996-2002 Adapted from Baye © 2002 L0 Input L Input Factor Demand The firm’s demand for an input (from a supplier) is derived from each new equilibrium point found on the isoquant as the price of the input is varied. K L $ P0 P1 DL L0 L1 David Bryce © 1996-2002 Adapted from Baye © 2002 L Elements of Cost Firms Incur Costs Using Inputs • Total cost is an (always) increasing function of output and assumes that firms produce efficiently. • Variable cost is the cost of variable inputs (e.g., direct labor, raw materials, sales commissions) and varies directly with output. • Fixed costs remain constant as output increases $ TC(Q) = VC(Q) + FC VC(Q) FC Q David Bryce © 1996-2002 Adapted from Baye © 2002 Properties of Cost • The properties of cost are determined by the shape of total cost function • Average cost (AC(Q)) is the average cost per unit (TC(Q)/Q) • Marginal cost (MC(Q)) is the cost of the last unit and defines the rate at which cost changes as quantity changes David Bryce © 1996-2002 Adapted from Baye © 2002 $ MC ATC AVC AFC Q Fixed Cost Q0(ATC-AVC) $ = Q0 AFC MC ATC = Q0(FC/ Q0) = FC AFC ATC AVC Fixed Cost AVC Q0 David Bryce © 1996-2002 Adapted from Baye © 2002 Q Variable Cost $ Q0AVC MC ATC = Q0 [VC(Q0)/Q0] = VC(Q0 ) AVC ATC AVC Variable Cost Q0 David Bryce © 1996-2002 Adapted from Baye © 2002 Q Total Cost $ Q0ATC MC ATC = Q0 [TC(Q0)/Q0] = TC(Q0 ) AVC ATC AVC Total Cost Q0 David Bryce © 1996-2002 Adapted from Baye © 2002 Q Time and Cost • Once a firm commits to a technology, it cannot immediately change scale – costs are more fixed in the short-run • In the long-run, firms can change technology and scale – costs are more variable • The long-run average cost is the minimum of all short-run cost curves over time. David Bryce © 1996-2002 Adapted from Baye © 2002 Cost SRAC SRAC1 5 SRAC 3 LRAC Quantity Decision-Making and Cost • Accounting costs inform external constituents. • Economic costs inform internal decision makers and include opportunity costs. • Sunk costs have already been incurred and cannot be avoided. – Economic decisions depend on avoidable costs. – When fixed costs can be redeployed or sold, they are not entirely sunk. – Sunk costs are the basis for strategic commitment. David Bryce © 1996-2002 Adapted from Baye © 2002