Chapter 6.3 & 6.4

advertisement

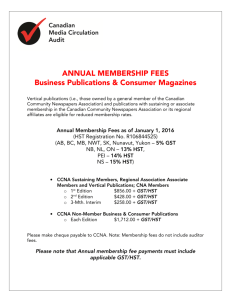

Tax dollars generated from business transactions 1. Tax dollars are charged to the buyer of goods 2. The tax dollars are collected by the seller and recorded in a separate liability account 3. The tax dollars rightfully belong to the government 4. The seller sends the tax dollars to the government at appoint times in Canada is commonly called Provincial Sales Tax (PST) because it is a tax charged by some provincial governments. The tax is calculated as a percentage of the price of a good and is paid by the consumer Harmonized sales Tax- 13%, July 1, 2010 Percentage tax based on price of goods/ services sold to consumer Used by government to collect revenue to spend on services 2008 PST: 8%, GST: 5% The Seller or Vendor – is responsible for administering the HST and remitting it to the Federal Government, which includes: › Calculating the taxes (PST & GST) + adding it into the price of goods / services › Collecting tax from customers + remitting (to pay) to levels of government Bank (cash sales) or A/R Sales Invoice › Revenue › HST Payable (13%) liability account to accumulate tax. Is responsible for accounting for HST on purchases related to the operations of the business and by submitting the Input Tax Credit for the appropriate refund Assets/ Expense HST Recoverable › Bank or A/P Cheque Copy Purchase Invoice “Contra liability” account used to recover taxes paid on purchases for operating business complete “input tax credit” for refund of HST (DR) Small business pays (remits) annually Mid-size business remits quarterly (3 months) Large business remits by the 15th the following month Sales to Customer HST PAYABLE 13 13 13 39 Tax Paid on Purchase HST RECOVERABLE 13 13 26 Remittance HST Payable – Recoverable = 39 – 26 = 13 DR 39 HST Payable HST Recoverable Cash To record HST Remittance CR 26 13 Sales to Customer HST PAYABLE 13 13 26 Tax Paid on Purchase HST RECOVERABLE 13 13 13 39 Refund HST Recoverable > Payable = 39 – 26 = 13 HST Payable Cash HST Recoverable To record HST Refund DR 26 13 CR 39