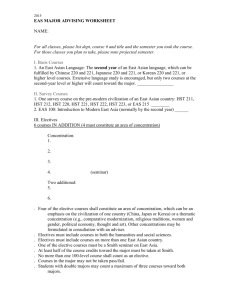

CONTENTS - Carswell

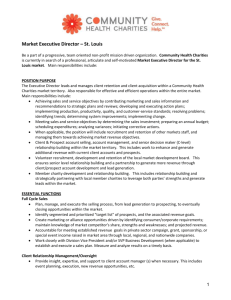

advertisement

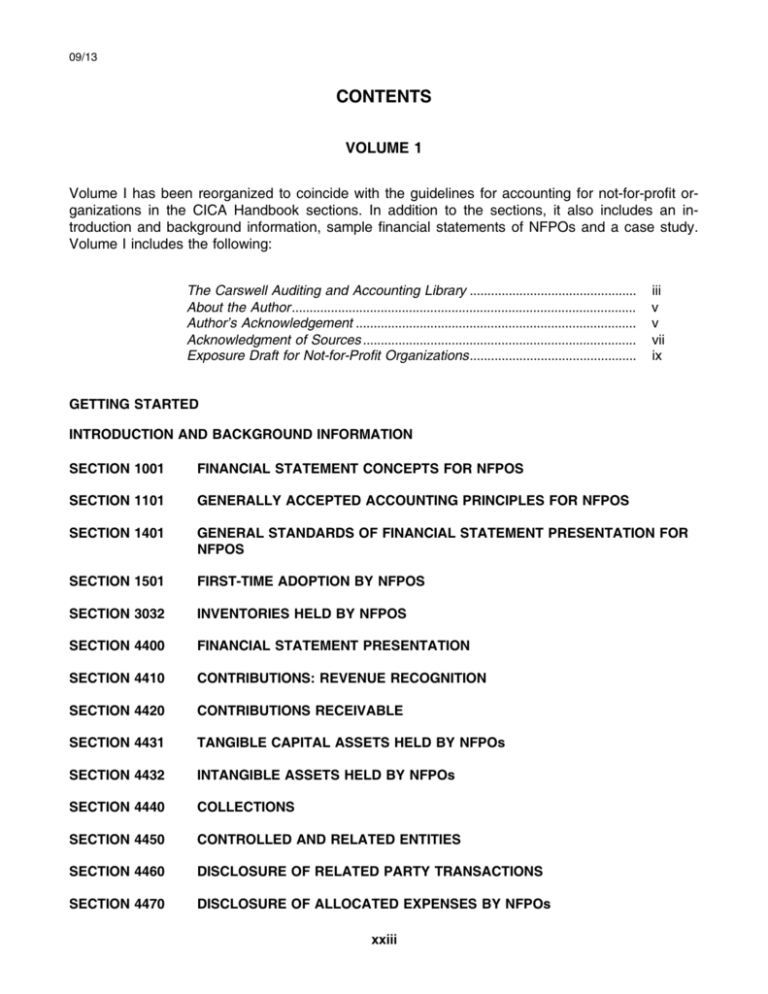

09/13 CONTENTS VOLUME 1 Volume I has been reorganized to coincide with the guidelines for accounting for not-for-profit organizations in the CICA Handbook sections. In addition to the sections, it also includes an introduction and background information, sample financial statements of NFPOs and a case study. Volume I includes the following: The Carswell Auditing and Accounting Library ............................................... About the Author................................................................................................. Author’s Acknowledgement ............................................................................... Acknowledgment of Sources ............................................................................. Exposure Draft for Not-for-Profit Organizations............................................... iii v v vii ix GETTING STARTED INTRODUCTION AND BACKGROUND INFORMATION SECTION 1001 FINANCIAL STATEMENT CONCEPTS FOR NFPOS SECTION 1101 GENERALLY ACCEPTED ACCOUNTING PRINCIPLES FOR NFPOS SECTION 1401 GENERAL STANDARDS OF FINANCIAL STATEMENT PRESENTATION FOR NFPOS SECTION 1501 FIRST-TIME ADOPTION BY NFPOS SECTION 3032 INVENTORIES HELD BY NFPOS SECTION 4400 FINANCIAL STATEMENT PRESENTATION SECTION 4410 CONTRIBUTIONS: REVENUE RECOGNITION SECTION 4420 CONTRIBUTIONS RECEIVABLE SECTION 4431 TANGIBLE CAPITAL ASSETS HELD BY NFPOs SECTION 4432 INTANGIBLE ASSETS HELD BY NFPOs SECTION 4440 COLLECTIONS SECTION 4450 CONTROLLED AND RELATED ENTITIES SECTION 4460 DISCLOSURE OF RELATED PARTY TRANSACTIONS SECTION 4470 DISCLOSURE OF ALLOCATED EXPENSES BY NFPOs xxiii 09/13 INVESTMENTS AND INVESTMENT INCOME CASE STUDY APPENDIX VOLUME 2 Volume 2 has been reorganized by separating the small NFPOs from the larger NFPOs. Volume 2 contains the following: Canada Revenue Agency Announcement....................................................... v CHAPTER 1 INTRODUCTION AND BACKGROUND INFORMATION CHAPTER 2 SMALL ORGANIZATIONS CHAPTER 3 LARGE ORGANIZATIONS — OVERVIEW CHAPTER 4 LARGE ORGANIZATIONS — PROCESSING TRANSACTIONS — REVENUE, ACCOUNTS RECEIVABLE & CASH RECEIPTS CHAPTER 5 LARGE ORGANIZATIONS — PROCESSING TRANSACTIONS — PURCHASES ACCOUNTS PAYABLE & CASH DISBURSEMENTS CHAPTER 6 LARGE ORGANIZATIONS — PERFORMING MONTH-END PROCEDURES CHAPTER 7 PROCESSING PAYROLLS CHAPTER 8 INCOME TAX CONSIDERATIONS — NPOs CHAPTER 8A GST/HST INFORMATION FOR NFPOs CHAPTER 9 INCOME TAX CONSIDERATIONS — CHARITIES CHAPTER 9A HST INFORMATION FOR CHARITIES CHAPTER 10 ASSISTING THE EXTERNAL AUDITORS CHAPTER 11 SPECIALIZED NFPOs CHAPTER 12 UNIVERSITIES, COLLEGES AND PRIVATE SCHOOLS CHAPTER 13 PERFORMING ARTS ORGANIZATIONS CHAPTER 14 CEMETERIES CHAPTER 15 CONDOMINIUM CORPORATIONS xxiv 09/13 CHAPTER 16 BUDGETING INDEX xxv