CFG_Apr_2014_Presentation - Canadian Foresight Group Ltd.

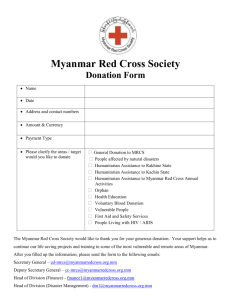

advertisement

This presentation (the "Presentation") contains forward-looking information relating to, among other things, (a) the future financial performance and objectives of Canadian Foresight Group Ltd. (the “CFG”) and (b) plans and expectations of the Corporation. Such information may be identifiable by the terminology used, such as, but not limited to "plan," "anticipate," "predicts", "projects", "believes", "seeks", "intends," "expects," "estimate," "budget," "forecast," "will," "may," "should," "would," or other similar wording. The forward-looking statements are based on the Corporation’s current expectations, assumptions, estimates and projections about future events. The forward-looking information is subject to numerous known and unknown risks, uncertainties, and other factors, most of which are beyond the control of the Corporation, which may cause actual results, levels of activity and achievements to differ materially from those expressed or implied by such information. Readers and prospective investors are cautioned not to place undue reliance on any forward-looking information contained in this Presentation. The Corporation undertakes no obligation to update or revise forward-looking information contained in this Presentation, whether as a result of new information, future events, or disclose the occurrence of unanticipated events or otherwise. All information and material included in this Presentation is current as of April 2014, unless otherwise stated. Please be cautioned that all forward-looking information contained in this Presentation is expressly qualified by this cautionary statement. Canadian Foresight Group Limited (“CFG”) is founded by a group of investors and key team members of an oil company operating in Canada. CFG has a very experienced management team with expertise in both onshore (Canada) and offshore oil/gas exploration particularly in Asia and development with over 180 years industry working experience. CFG was established to pursue international E&P opportunities in Asia. CFG has very strong financing support from existing share holders and financial institutions from North America and Asia Shares outstanding: 145.5 million shares Capital raising: Planning to raise US$30 million to US$100 million by mid-2014 at $0.50/share Backing from major institutions and investors from Asia and North America Major strategic and potential location for regional trade and transport hub Richly endowed with natural resources Large and relatively young population Rich cultural heritage Strong economic growth potential Multi-TCF potential of the underexplored offshore blocks Myanmar is still considered as frontier land with an estimated 3.2 recoverable billion barrels of oil out of estimated 540 billion barrels in place and 18 TCF of proven gas reserves out of estimated 89 TCF potential gas reserves Myanmar’s domestic gas demand is increasing and energy security a concern. There exist an exceedingly robust domestic gas demand from neighboring countries such as Thailand, China and India Infrastructure for oil and gas delivery is built YADANA GAS PROJECT •Estimated gas reserves of 6.7 TCF. Started operating in 1998. Gas production is 870 MMSCFD. 17 wells in total are connected to 3 platforms. •Located in blocks M5 and M6 with an area of 26, 140 sq. km. •Operated by Total and partnered with PTTEP, Myanmar Unocal, and MOGE •Gas exported from gas field to Thailand •There are a number of discovered gas fields being developed in these blocks that are prospective. ZAWTIKA PROJECT •Estimated gas reserves of 8 TCF with targeted production of 300 - 400 MMSCFD. First gas production was in Feb 2014. 35 wells in total are connected to 3 platforms. •Located in block M9 and small NE part of M11 with an area of 11,746 sq. km. Zawtika, Gawthaka, and Kakonna gas fields were discovered in 2007. •Operated by Thai state-owned enterprise PTTEP (80%) and partnered with MOGE (20%). 2/3 of gas exported to Thailand and the rest is for Myanmar’s domestic use. YETAGUN GAS PROJECT •Estimated gas reserves of 4.2 TCF with 2013 Q4 production of 442 MMSCFD and liquids condensate of 10,431 bbls/d. This has one platform with 10 wells. •Located in blocks M12, M13, and M14 within an area of 24,130 sq km. •Operated by Petronas and partnered with PTTEP, Nippon, Mitshubishi, MOGE (10 wells). •Production started in April 2000. SHWE GAS PROJECT •Estimated gas reserves of 9.1 TCF with production of 700 MMSCFD. •Located in blocks A1 and A3, in the Rakhine offshore . It has 11 wells on the platform and 4 wells in the subsea wellhead. •Operated by Daewoo and partnered with ONGE, GAIL, KOGAS, and MOGE •Export of gas to China started in 2013. •The gas pipeline from Myanmar to China carries the gas extracted from Shwe gas project located offshore of the Bay of Bengal. •The crude oil pipeline is designed to carry approximately 22 million tonnes of oil per year. •The design capacity of the natural gas pipeline is 13 Bm³. It is expected to deliver 12 Bm³ of gas to China every year, while reserving1Bm³ of gas for Myanmar's domestic use •Gas extracted from the Yetagun project started flowing to Thailand in 2000 at about 200 mmcfd. In August 2004, this figure doubled after four new wells went online. With the new wells, overall production climbed to 500 mmcfd, with 400 mmcfd exported to Thailand. •The offshore Yadana gas project, where Total is the operator of the project, exports 600 mmcfd to Thailand. About 200 mmcfd are used to meet Myanmar’s domestic needs. CFG participated in Myanmar’s Nov. 2013 offshore bidding round along with Transcontinental Resource Group (TRG) and Myanmar’s KMA Group. Under the terms of the bidding agreement, TRG will be carried through the seismic program after which it needs to elect to participate for a 10% interest or convert to a 0.33% GOR. KMA will receive a10% carried interest through the exploration program. CFG was awarded Shallow Offshore Block M-15 on March 2014. Under the terms of joint bid, CFG will undertake a seismic program and drill two wells. Block M-15 is located in the Andaman Sea, within the Tanintharyi Offshore basin, which is off Myanmar’s southern Tanintharyi coast. The area of block M-15 covers 12,150 square km. One of the biggest offshore gas fields in Myanmar, Yetagun gas field, is located 60 km to the north of M-15. The Yetagun field contains an estimated 4.2 trillion cubic feet of recoverable gas. Daily production is about 400 mmcf/day with 12,000 bbl/day condensate. According to regional magnetic information, M-15 is located at the Transgression/regression channel area from Eocene to Miocene age. Both Clastic and Carbonate reservoirs are prospective targets within this block. One well, M15-B1, was drilled in January 2005. The well was drilled to 3440 ft and abandoned. An evaluation of the data has led to the determination that the well was drilled too shallow. Approximately 1753 line km of 2D-seismic has been acquired. Previous geophysical and geological work had identified several prospects with potential from 1 TCF to 5 TCF gas and indicate significant structural and stratigraphic traps. Additional 2D and 3D seismic work are required to identify the most promising closures. The objective of drilling M15B-1well was to test the hydrocarbon potential of the Oligocene/Early Miocene Carbonate reef build up which is a combination of stratigraphic/structural play. lower Miocene clastic sandstone reservoir. Upper Oligocene reservoir Spud Date -12 January 2005 Depth -3440 ft Water Depth -925 ft Primary objective found at 1152 ft . Porosity 27% . Temperature gradient is 1.94 deg F/ 100’. Plug & Abandon . (Yetagun Temp. gradient is 2.65 deg F/ 100’) Bank: Royal Bank of Canada Legal Firm: McCarthy Tétrault LLP, DFDL Engineering: D&M Kevin Flaherty Executive Director Canadian Foresight Group Ltd. Mobile: +84 978 706 255 Email: kevin.flaherty@saigonam.com TMS Building, 12th Floor 172 Hai BaTrung Street, District 1 Ho Chi Minh City, Vietnam Telephone: +84-8-54043488