Lecture 5 - Capital Cost and Structure

advertisement

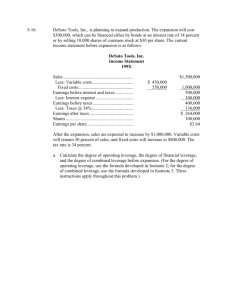

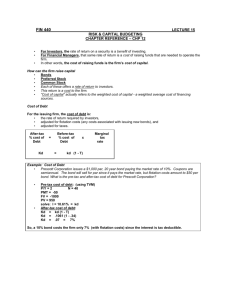

How Much Does It Cost to Raise Capital? Or How Much Return Do Security-Holders Require a Company to Offer to Buy Its Securities? Lecture: 5 - Capital Cost and Structure THREE TOPICS COVERED I. Calculate the Costs (the k’s) of Various Securities in a Company’s Capital Structure Using CAPM and Other Methods and Combine to Get an Overall k. Note: Required return, opportunity cost of capital, and weighted average cost of capital (WACC) are used interchangeably. II. Capital Structure Theory - What Percent of Capital Should Be Raised Through Selling Stock, Bonds and Preferred? III. Consider Fixed Costs in a Firm’s Risk a. Business or Operating Risk b. Financial Risk Calculating a Firm’s Marginal (Weighted) Cost of Capital Lecture: 5 - Capital Cost and Structure A Firm’s Marginal Cost of Capital (MCC) General Formula MCC = Wdebtki + Wpskps + Wsks where, Wdebt = weight of debt in firm’s capital structure Wps = weight of preferred stock Ws = weight of common stock ki = after-tax cost of debt kps = after-tax cost of preferred stock ks = after-tax cost of common stock Note: After tax costs are used because after-tax cash flows are used for capital budgeting. To get MCC, calculate the individual weights and costs and combine. Use MCC, if: a. Project Risk is Average for the Firm b. Proportions of Debt and Securities are Expected to Stay Approximately Constant Calculating the After-Tax Cost of Debt Lecture: 5 - Capital Cost and Structure After-Tax Cost of Debt - Debt has a cost advantage because interest payments are a tax deductable expense while dividends are not. Ki = Kb(1 - T) = after-tax cost of debt where, Kb = Before Tax Cost of Debt Financing T = Marginal Corporate Tax Rate To get Kb, solve for ? in the bond pricing equation BNP = I(PVA?,n) + PAR(PV?,n) where, BNP is the Net Proceeds From Bond Issuance (Gross Proceeds Minus Flotation Costs) An Example of Calculating the After-Tax Cost of Debt Lecture: 5 - Capital Cost and Structure Example: Suppose Firm A issues a 10 year bond that has a$1000 Par; a coupon rate of 10% paid annually; flotation costs are $30 per bond; and the marginal tax rate is 40%. Find the before-tax and after-tax cost of debt. Find before-tax cost BNP = I(PVA?,n) + M(PV?,n) ($1000 - $30) = 100(PVA?,10) + 1000(PV?,10) ( M B NP ) n M .6( B NP M ) I Approximation = = (1000 970) 10 1000.6(970 1000) 100 = [100+3]/[1000-18] = 10.5% After Tax ki = 10.5%(1 - .4) = 6.3% After-Tax Cost of Preferred Stock Lecture 5 - Capital Cost and Structure After-Tax Cost of Preferred Stock General Formula Kps = Divps/Pnp = Dividends on Preferred / Net Proceeds per Share Example: Suppose that Firm A issues a $100 Par Preferred Stock with a $10 dividend and flotation costs are $10/Share. What is the After-Tax Cost of the Preferred Stock? Kps = Divps/Pnp = 10/90 = .1111 = 11.11% Note: No adjustment is made for taxes because dividends are paid after-tax. Calculating the After-Tax Cost of Common Stock Lecture 5 - Capital Cost and Structure Two Methods to Raise Common Stock - Different Costs 1. Generate common stock internally by retaining earnings - avoids flotation costs 2. Sell common shares to external investors -must hire investment bankers and brokers and issue prospectuses -> flotation costs Three Methods to Calculate the Cost of Common Stock 1. Use the DCF growth model 2. Use the CAPM 3. Use the bond yield plus risk premium method Note: As a final measure of the cost of equity you can average the results from the three methods or select the one that you believe is the most precise given the situation. Three Methods For Calculating the After-Tax Cost of Internally-Generated Common Stock Lecture 5 - Capital Cost and Structure After-Tax Cost of Common Stock - Internally Generated 1. DCF - Constant Growth Method ks = D1/P0 + g = D0(1 + g)/P0 + g where D1 = next year’s dividend P0 = present stock price g = growth in dividends 2. CAPM ks= krf + Bi(km - krf) where, krf = risk-free rate (T-bill Rate), km = expected market return (S&P 500) Bi = stock i’s beta 3. Bond Yield Plus Risk Premium ks = kb + Risk Premium where kb = before-tax cost of debt Examples of the Three Methods For Calculating the After-Tax Cost of InternallyGenerated Common Stock Lecture 5 - Capital Cost and Structure DCF METHOD Suppose the Market Price of a stock is $50, its dividend is $10, and it is expected to grow by 5%. What is ks? ks = 10/50 + 5 = 25% CAPM METHOD Suppose the T-bill rate is 10%, expected return on the S&P 500 is 17.5% and beta is 2. Find ks. ks = .10 + 2(.175 - .10) = .25 = 25% BOND YIELD PLUS RISK PREMIUM METHOD Suppose a common stock is very risky and should earn a 15% premium over its bonds which have a yield to maturity of 10.36%. What is ks? ks = .1036 + .15 = .2536 = 25.36 Note: No adjustments for flotation costs. One Method For Calculating the After-Tax Cost of Externally-Generated Common Stock Lecture 5 - Capital Cost and Structure After-Tax Cost of Common Stock - Externally Generated 1. DCF - Constant Growth Method ks = D1/PNP + g where PNP = net proceeds per share Example: Suppose a firm’s market price is $50, but the flotation costs are $1/share, and the stock must be issued at $1 below its market price. Its dividend is $10 and it grows by 5%. ks = 10/48 + .05 = .258 = 25.8% MCC - Marginal Cost of Capital “The cost of the last dollar of additional funds secured; the firm’s opportunity cost of capital (equals WACC).” Lecture 5 - Capital Cost and Structure Marginal Cost of Capital MCC = Wdebtki + Wpskps + Wsks Example: From previous calculations of ki = 6.3%, kps =11.11%, external ks = 25.8% and internal ks = 25%. For capital structure, assume the firm has a target of 50% Debt, 10% Preferred Stock, and 40% Common Stock. What is the MCC? (Internally Generated Common) MCC = .5(6.3%) + .1(11.11%) + .4(25%) = 14.26% (Externally Generated Common) MCC = .5(6.3%) + .1(11.11%) + .4(25.8%) = 14.58% Calculating Capital Structure Weights From Market Prices If Firm Has No Target Weights Lecture 5 - Capital Cost and Structure FIRM SECURITIES VALUES Common stock = 1,000,000 shares * $50/share= 50 mm Debt = 50,000 bonds * $950/bond = 47.5 mm Preferred = 100,000 shares * $90/share = 9 mm 106.5 mm Figure the Weights? Weights Ws Wd Wps = 50/106.5 = 47% = 47.5/106.5 = 45% = 9/106.5 = 8% MCC = .45(6.30) + .08(11.11) + .47(25) = 2.84 + .89 + 11.75 = 15.48 Note: You may need to make adjustments for projects that are not average risk projects such as projects for different divisions. Capital Structure Refers a Firm’s Various Sources of Long-Term Financing as a Proportion of Total Capital Lecture: 5 - Capital Cost and Structure Manager’s Goal: Increase EPS Through Leverage, But by Enough to Offset the Increase in Risk so that Stock Price Increases. Two Capital Structure Theories of Leverage a. Traditional - Share Price will Increase with Leverage up to a Point (Too Much Risk) b. Net Operating Income Theory - Any Increase in Leverage and EPS will be Offset by Increased Risk (Assuming No Taxes) Leaving the Share Price Unchanged. Illustration using the constant growth model. P = D1/ (ks - g) Increasing leverage may increase D1 and g but will increase beta (risk) so that ks will increase. Theoretically, P stays the same because the positive effect of the increase in D1 and g is just offset by the negative effect of the ks increase. Traditional Theory - As Debt is Added, D/E Rises But kavg Falls Because Debt has Lower Cost. Eventually kE and kD Rise Due to Rising Bankruptcy Probabilities, Pushing kavg Up Lecture: 5 - Capital Cost and Structure Ke Cost of Capital Kavg minimum Kd optimal Debt to Equity Ratio Net Operating Income Theory - (Modigliani and Miller) No optimal capital structure and no advantage of debt over equity financing. kavg stays constant no matter what the debt level. Unlike in the graph above, the kavg line would be flat with no minimum kavg (assumes no taxes). Net Operating Income Theory - Modigliani and Miller With Corporate Taxes Changes the Theory’s Implications Lecture: 5 - Capital Cost and Structure REMEMBER: The Value of the Firm Is the Discounted Value of It’s After-Tax Cash Flows Going to Bondholders and Stockholders. Without Income Taxes - income goes to 1. stockholders 2. bondholders With Income Taxes - income goes to 1. stockholders 2. bondholders 3. government. Because interest paid on debt is tax deductable we can reduce the amount going to the government (and increase the amount going to bondholders and stockholders) by increasing the amount of debt in the capital structure. Lecture: 5 - Capital Cost and Structure Initial Capital Structure Increase Debt Financing S S B G B G S is the portion of EBIT paid to Stockholders B is the portion of EBIT paid to Bondholders G is the portion of EBIT paid to Government Value of the Levered Firm With Corporate Taxes Is the Value of the Unlevered Firm Plus the Present Value of the Debt’s Tax Shield Lecture: 5 - Capital Cost and Structure Assume no growth in EBIT. The unlevered firm’s value, is Vu = EBIT (1- T) k su where EBIT = earnings before interest and taxes T = corporate tax rate ksu = the unlevered cost of equity capital Then the value of the levered firm, VL is VL = VU + (present value of the tax shield from debt) VL = VU + (tax rate)(value of debt) = VU + (T)(B) When there is a difference in personal tax rates on bond and stock income then adjust the equation above to VL = VU + [1 - (1 - T)(1 - Ts)/(1 - TB)]B where T Ts TB B = corporate tax rate = stock tax rate = bond tax rate = face value of bonds Because bondholders demand the same after tax rate of return as stockholders (assuming equal risk), if TB > Ts, then interest rates on bonds must be higher than stock returns so that after tax returns will be equal. This reduces the advantage of debt. Lecture: 5 - Capital Cost and Structure Example: SI Inc. is an all-equity firm that generates EBIT of $3 million per year. Its cost of equity capital is 16 percent, its marginal corporate tax rate is 35 percent, and it has 1 million shares outstanding. a What is SI’s market value? b. If SI issues $4 million of debt and uses it to buy back some shares, what will be its new market value and new equity value? c. Show that the change in per-share value goes up even though total equity decreases. a. Vu = $3,000,000(1 - .35) / .16 = $12,187,500 b. VL = $12,187,500 + (.35)($4,000,000)=$13,587,500 equity = $13,587,500 - $4,000,000 = $9,587,500 c. Before buyback, share price= $12,187,500/1,000,000 = 12.187 After buyback of $4,000,000/12.187 = 328,218 shares we get a new price of P =$9,587,500/(1,000,000 - 328,218) = 14.27 Fixed Operating Costs Produce Operating Leverage and Fixed Financing Costs Produce Financial Leverage But Leverage Creates Risk Lecture: 5 - Capital Cost and Structure Business Risk - Factors Affecting: a. Sensitivity of Sales to Business Cycle b. Firm Size and Industry Competition c. Operating Leverage (Proportion of Fixed to Variable Operating Costs in Total Costs) d. Input Price Variability e. Ability to Adjust Output Prices Degree of Operating Leverage DOL = % Change in EBIT / % Change in Sales = [Sales - Variable Costs] / EBIT = 1 + Fixed Cost / EBIT Lecture: 5 - Capital Cost and Structure Financial Risk - Factors Affecting: a. Variability of Shareholder EPS b. Financial Risk Increases with Leverage Degree of Financial Leverage DFL = % Change in EPS / % Change in EBIT = EBIT / [EBIT - I - L - d/(1 - T)] where, I = Interest, L = Lease Payments, and d = preferred dividends (Grossed Up by [1 - T] because there is No Tax Deduction) Degree of Combined Leverage: Operating and Financial DCL = DOL x DFL = % Change in EPS / % Change in Sales = [Sales - Variable Costs] / [EBIT - I - L -d/(1 - T)] Note: The larger is DCL, the larger the firm’s return variance . Leverage - DOL, DFL, and DCL “DOL - As sales rise, fixed cost per unit falls. DFL - Fixed Cost Financing causes EPS to fluctuate. DCL - Combined effects of operating and financial leverage.” Lecture 5 - Capital Cost and Structure Example: Clark Comp. has the following income statement in millions. Sales Variable Costs Revenues Before Fixed Costs Fixed Costs EBIT Interest EBT Taxes (30%) EAT 50 24 26 13 13 3 10 3 7 a) Calculate DOL, DFL, and DCL. b) If sales increase by 20%, by what % will EAT increase and to what amount? a. DOL = (50-24)/13 = 2.0 DFL = 13/(13-3) = 1.3 DCL = 2 x 1.3 = 2.6 b. EAT % Increase = .20 x 2.6 = .52 = 52% EAT Amount Increase = 7 x 1.52 = $10.64