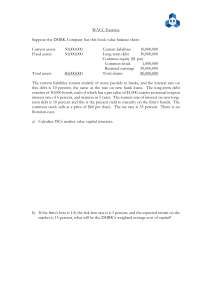

Cost of Capital Problem

advertisement

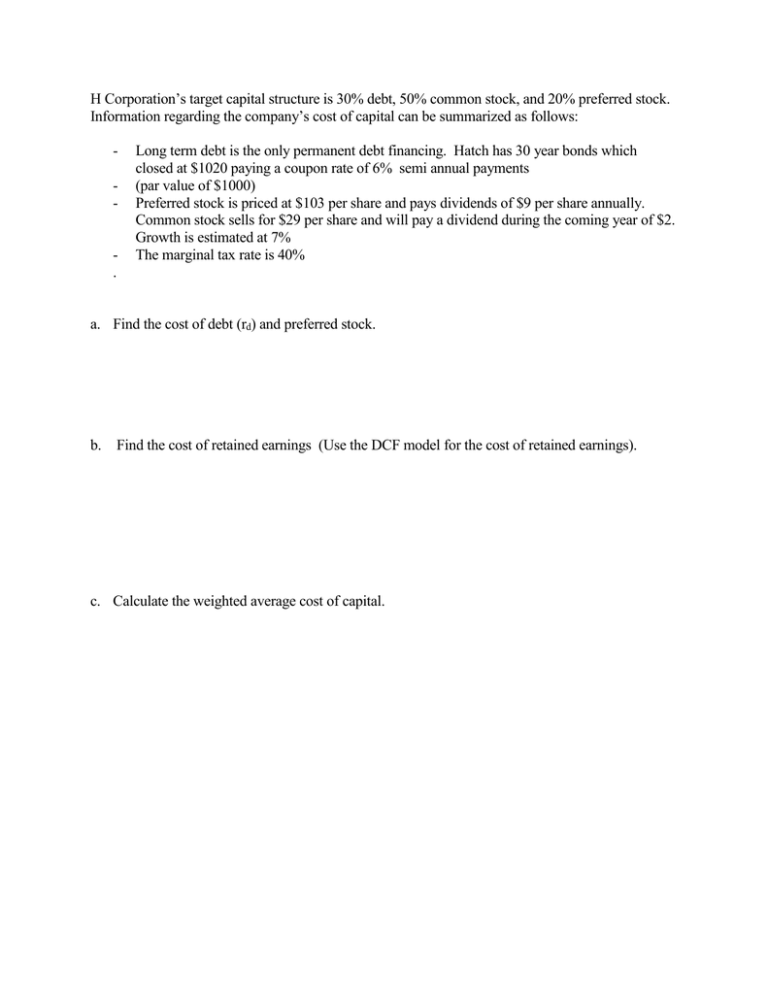

H Corporation’s target capital structure is 30% debt, 50% common stock, and 20% preferred stock. Information regarding the company’s cost of capital can be summarized as follows: - . Long term debt is the only permanent debt financing. Hatch has 30 year bonds which closed at $1020 paying a coupon rate of 6% semi annual payments (par value of $1000) Preferred stock is priced at $103 per share and pays dividends of $9 per share annually. Common stock sells for $29 per share and will pay a dividend during the coming year of $2. Growth is estimated at 7% The marginal tax rate is 40% a. Find the cost of debt (rd) and preferred stock. b. Find the cost of retained earnings (Use the DCF model for the cost of retained earnings). c. Calculate the weighted average cost of capital.