Issues in Partnership Accounts (2)

Success Coaching Centre

Sec-4 & sec-14

Ph.9782016302, 9672269750, 9784094650

Issues in Partnership Accounts

Q.No.-1. Ram and Rahim started business with capital of Rs. 50,000 and Rs. 30,000 on 1 st January, 2010. Rahim is entitled to a salary of Rs. 400 per month. Interest is allowed on capitals and is charged on drawings at 6% per annum.

Profits are to be distributed equally after the above noted adjustments. During the year Ram withdrew Rs. 8,000 and

Rahim withdrew Rs. 10,000. The profit for the year before allowing for the terms of the partnership Deed came to Rs.

30,000. Assuming the capitals to be fixed, Prepare the capital and Current Accounts of the partners.

Q.No.-2. Lee and Lawson are in equal partnership. They agreed to take Hicks as one-forth partner. For this it was decided to find out the value of goodwill. M/s Lee and Lawson earned profits during 2007-2010 as follows.

Year Profit Rs.

2007

2008

2009

2010

1,20,000

1,25,000

1,30,000

1,50,000

On 31.12.2010 capital employed by M/s Lee and Lawson was Rs. 5, 00,000. Rate of normal profit is 20%.

Find the value of goodwill following various methods.

Q.No.-3. Wise, Clever and Dull were trading in partnership sharing profits and losses 4:3:3 respectively. The accounts of the firm are made up to 31 st December every year.

The partnership provided, inter alia, that:

On a death of a partner the goodwill was to be valued at three years’ purchase of average profits of the three years Upto the date of the death after deducting interest @ 8% on capital employed and fair remuneration of each partner. The profits are assumed to be earned evenly throughout the year.

On 30 th June, 2010, wise died and it was agreed on his death to adjust goodwill in the capital accounts without showing any amount of goodwill in the Balance Sheet.

It was agreed for the purpose of valuation of goodwill that the fair remuneration for work done by each partner would be Rs. 15,000 per annum and that the capital employed would be Rs. 1, 56,000. Clever and Dull were to continue the partnership, sharing profits and losses equally after the death of Wise.

The following were the amounts of profits of earlier year before charging interest on capital employed.

Rs.

2007

2008

2009

2010

67,200

75,600

72,000

62,400

You are requested to compute the value of goodwill and show the adjustment thereof in the books of the firm.

Q.No.-4. Vasudevan, Sunderarajan and Agrawal are in partnership sharing profit and losses at the ratio of 2:5:3. The

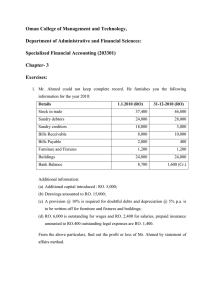

Balance Sheet of the Partnership as on 31.12.2010 was as follows:

Balance Sheet of M/s Vasudevan, Sunderarajan & Agrawal

Liabilities Rs. Assets Rs.

Capital A/c

Vasudevan

Sunderarajan

Agrawal

Sundry Creditors

85,000

3,15,000

2,25,000

30,000

6,55,000

Sundry Fixed assets

Stock

Debtors

Bank

5,00,000

1,00,000

50,000

5,000

6,55,000

The partnership earned profit Rs. 2, 00,000 in 2010 and the partners withdrew Rs. 1,50,000 during the year.

Normal rate of return 30%.

Find out the value of goodwill on the basis of 5 years’ purchase of super profit. For this purpose calculate super profit using average capital employed.

1 AVINASH JAIN

Success Coaching Centre

Sec-4 & sec-14

Ph.9782016302, 9672269750, 9784094650

Q.No.-5. Messers Dalal, Banerji and Mallick is a firm sharing profit and losses in the ratio of 2:2:1. Their Balance Sheet as on 31 st March, 2010 is as below:

Liabilities Rs. Assets Rs.

Sundry Creditors

Outstanding Liabilities

General Reserve

Capital A/c

Mr. Dalal 12,000

12,850

15,00

6,000

Land & Buildings

Furniture

Stock of goods

Sundry Debtors

Cash in hand

25,000

6,500

11,750

5,500

140

Mr. Banerji 12,000

Mr. Mallick 5,000 29,000

Cash at Bank 960

49,850 49,850

The partners have agreed to take Mr. Mistri as a partner with effect from 1 st April, 2011 on the following terms:

1) Mr. Mistri shall bring 5,000 towards his capital.

2) The value of stock should be increased by Rs. 2,500 and Furniture should be depreciated by 10%.

3) Reserve for bad and doubtful debts should be provided at 10%.

4) The value of land and buildings should be enhanced by 20% and the value of the goodwill be fixed at Rs. 15,000.

5) The value of the goodwill be fixed at Rs. 15,000.

6) General Reserve will be transferred to the partner’s Capital a/c.

7) The net profit sharing ratio shall be : Mr. Dalal 5/15, Mr. Banerji 5/15, Mr. Mallick 3/15 and Mr. Mistri 2/15.

8) The goodwill account shall be written back to the partner’s account in accordance with the new profit sharing proportion.

The outstanding liabilities include Rs. 1,000 due to Mr. Sen which has been paid by Mr. Dalal. Necessary entries were not made in the books.

Prepare (i) Revaluation Account, and (ii) The capital Accounts of the partners, and (iii) the Balance sheet of the firm as newly constituted (Journal entries are not required)

Q.No.-6. Fairbrother, Greatbatch and Kristen were partners sharing profit and losses at the 2:2:1. Kristen wants to retire on 31-12-2010. Give below the balance sheet of the partnership as well as other information:

Liabilities Rs. Assets Rs.

Capital A/c

Fairbrother

Greatbatch

Kristen

Reserve

Sundry Creditors

1,20,000

80,000

60,000

10,000

50,000

3,20,000

Sundry Fixed assets

Stock

Debtors

Bills Receivable

Bank

1,50,000

50,000

50,000

20,000

50,000

3,20,000

Fairbrother and Greatbatch agree to share profits and losses at the ratio of 3:2 in future. Value of goodwill is taken to be

Rs. 50,000. Sundry fixed assets are revalued upward by Rs. 30,000and stock by Rs. 10,000. Bills Receivable dishonored

Rs. 5,000 on 31-12-2010 but not recorded in the books. Dishonor of bill was due to insolvency of the customer.

Fairbrother and Greatbatch agree to bring sufficient cash to discharge claim of Kristen and to make their capital proportionate. Also they wanted to maintain Rs. 75,000 bank balance for the working capital. However they did not want to show goodwill in the books of accounts. Pass necessary journal entries and draft the Balance Sheet of M/s

Fairbrother and Greatbatch.

2 AVINASH JAIN

Success Coaching Centre

Sec-4 & sec-14

Ph.9782016302, 9672269750, 9784094650

Q.No.-7. P, Q and R were partners sharing profits and losses in the ratio of 3:2:1, no partnership salary or interest on capital being allowed. Their balance sheet on 30 th June, 2011 is as follows:

Liabilities Rs. Assets Rs.

Fixed Capital

P 20,000

Q 20,000

R 10,000

Current Accounts:

P 500

Q 9,000

Loan from P

Trade Creditors

50,000

9,500

8,000

12,400

Fixed Assets:

Goodwill

Freehold Property

Plant and Equipment

Motor Vehicle

Current Assets

Stock

Trade Debtors 2,000

Less: provision (100)

Cash at Bank

Miscellaneous losses

R’s Current Account

Profit and Loss Account

40,000

8,000

12,800

700

3,900

1,900

200

400

12,000

79,900 79,900

On 1 st July, 2011 the partnership was dissolved. Motor Vehicle was taken over by Q at a value of Rs. 500 but no cash passed specifically in respect of this transaction. Sales of other assets realized the following amounts:

Rs.

Goodwill

Freehold Property

Nil

7,000

Plant and Equipment 5,000

3,000 Stock

1,600 Trade Debtors

Trade Creditors were paid Rs. 11,700 in full settlement of their debts. The costs of dissolution amounted to Rs. 1,500.

The loan from P was repaid, P and Q both fully solvent and able to bring in any cash required but R was forced into bankruptcy and was only able to bring 1/3 of the amount due.

You are required to show:

(a) Cash and Bank Account

(b) Realisation Account, and

(c) Partners fixed Capital Accounts (After transferring Current Account’s balances).

Q.No.-8. Amal and Bimal are in equal partnership. Their Balance Sheet stood as under on 31 st March, 2012 when the firm was dissolved:

Liabilities Rs. Assets Rs.

Creditors A/c

Amal’s Capital A/c

4,800

750

Plant & Machinery

Furniture

Debtors

Stock

2,500

500

1,000

800

Cash

Bimal’s Drawings

200

550

5,550 5,550

3 AVINASH JAIN

Success Coaching Centre

Sec-4 & sec-14

Ph.9782016302, 9672269750, 9784094650

The assets realized as under:

Plant and Machinery

Furniture

Debtors

Stock

Rs.

1,250

150

400

500

The expenses of realisation amounted to Rs. 175. Amal’s private estate is not sufficient even to pay his private debts; whereas Bimal’s private estate has a surplus of Rs. 200 only.

Show necessary ledger accounts to close the books of the firm.

Q.No.-9. A,B,C and D sharing profits in the ratio of 4:3:2:1 decided to dissolve their partnership on 31 st March 2012 when their balance sheet was as under:

Liabilities

Creditors

Employees Provident fund

Capital Accounts:-

A 40,000

B 20,000

Rs.

15,700

6,300

60,000

Assets

Bank

Debtors

Stock

Prepaid Expenses

Plant & machinery

Rs.

535

15,850

25,200

800

20,000

Patents

C’s Capital A/c

D’s Capital A/c

8,000

3,200

8,415

82,000 82,000

Following information is given to you:-

1. One of the creditors took some of the patents whose book value was Rs. 5,000 at a valuation of Rs. 3,200. Balance of the creditors was paid at a discount of Rs. 400.

2. There was a joint life policy of Rs. 20,000 (not mentioned in the balance sheet) and this was surrendered for Rs.

4,500.

3. The remaining assets were realized at the following values:- Debtors Rs. 10,800; Stock Rs. 15,600; Plant and

Machinery Rs. 12,000; and Patents at 60% of their book-values. Expenses of realisation amounted Rs. 1,500.

D became insolvent and a dividend of 25 paise in a rupee was received in respect of the firms claim against his estate.

Prepare necessary ledger accounts.

Q.No.- 10. M/s X, Y and Z who were in partnership sharing profits and losses in the ratio of 2:2:1 respectively, had the following Balance Sheet as at December 31, 2011:

Liabilities Rs. Assets Rs.

Capital : X 29,200

Y 10,800

Z 10,000

Z’s Loan

Loan from Mrs. X

Sundry Trade Creditors

50,000

5,000

10,000

25,000

Fixed Assets

Stock

Book Debts 25,000

Less: Provision (5000)

Cash

Advance to Y

40,000

25,000

20,000

1,000

4,000

90,000 90,000

The firm was dissolved on the date mentioned above due to continued losses. After drawing up the balance sheet given above, it was discovered that goods amounting to Rs. 4,000 have been purchased in November, 2011 and received but the purchase was not recorded in books.

Fixed assets realized Rs. 20,000; Stock Rs. 21,000 and Book Debt Rs. 20,500. Similarly, the creditors allowed a discount of

2% on the average. The expenses of realisation come to Rs. 1,080. X agreed to take over the loan of Mrs. X. Y is insolvent, and his estate is unable to contribute anything.

4 AVINASH JAIN

Success Coaching Centre

Sec-4 & sec-14

Ph.9782016302, 9672269750, 9784094650

Give accounts to close the books: work according to the decision in Garner vs. Murray.

Q.No.-11. ‘Thin’, ‘Short’ and ‘Fat’ were in partnership sharing profits and losses in the ratio of 2:2:1.

On 30 th September, 2012 their Balance Sheet was as follows:

Liabilities Rs. Assets Rs.

Capital Accounts:

Thin 80,000

Short 50,000

Fat 20,000

Current Accounts:

Thin 29,700

Short 11,300

Fat (Dr.) 14,500

Sundry Creditors

Bank Overdraft

1,50,000

26,500

84,650

44,330

Premises

Fixtures

Plant

Stock

Debtors

50,000

1,25,000

32,500

43,200

54,780

3,05,480 3,05,480

‘Thin’ decides to retire on 30 th September, 2012 and as ‘Fat’ appears to be short of private assets, ‘Short’ decides that he does not wish to take over Thin’s share of partnership, so all three partners decide to dissolve the partnership, so all three partners decide to dissolve the partnership with effect from 30h September, 2012. It then transpires that ‘Fat’ has no private assts whatsoever.

The premises are sold for Rs. 60,000 and the plant for Rs. 1, 07,500. The fixtures realize Rs. 20,000 and the stock is acquired by another firm at book value less 5%. Debtors realize Rs. 45,900. Realization expenses amount to Rs. 4,500.

The bank overdraft is discharged and the creditors are also paid in full.

You are required to write up the following ledger accounts in the partnership books following the rules in Garner vs.

Murray:

(i) Realisation Account;

(ii) Partner’ Current Accounts;

(iii) Partners’ Capital Accounts showing the closing of the firm’s books.

Q.No.-12. A,B,C and D were partners sharing profits in the ratio of 3:3:2:2 . Following was their balance sheet as on

31.12.2011:

Liabilities Rs. Assets Rs.

Capital A/c

A 60,000

B 45,000

Creditors

A’s Loan

1,05,000

46,500

30,000

Capital A/c

C 48,000

D 18,000

Furniture

Trademarks

Stock

Debtors 48,000

Less: provision for (1,500)

Doubtful debts

Bank

66,000

12,000

21,000

30,000

46,500

6,000

1,81,500 1,81,500

On 31.12.2011, the firm was dissolved and B was appointed to realize the assets and pay off the liabilities. He was entitled to receive 5% commission on the amount finally paid to other partners as capital. He agreed to bear the expenses of realisation. The assets were realized as follows: Debtors Rs. 33,000; Stock Rs. 24,000; Furniture Rs. 3,00;

Trademarks Rs. 12,000.

Creditors was paid in full, in addition, a contingent liability for Bills Receivable discounted materialized to the extent of

Rs. 7,500. Also, there was a joint life policy for Rs. 90,000. This was surrender for Rs. 9,000. Expenses of realisation amounted to Rs. 1,500. C was insolvent but Rs. 11,100 was recovered from his estate.

Prepare Realisation Account, Bank Account and Capital Accounts of the partners.

5 AVINASH JAIN

Success Coaching Centre

Sec-4 & sec-14

Ph.9782016302, 9672269750, 9784094650

Q.No.-13. The following is the Balance Sheet of A,B,C on 31 st December, 2011 when they decide to dissolve the partnership:

Liabilities Rs. Assets Rs.

Creditors

A’s Loan

Capital A/c

A

2,000

5,000

15,000

Sundry Assets

Cash

48,500

500

B

C

18,000

9,000

49,000 49,000

The assets realized the following sums in instalments:

I 1,000

II

III

3,000

3,900

IV

V

6,000

20,100

34,000

The expenses of realisation were expected to be Rs. 500 but ultimately amounted to Rs. 400 only.

Show how at each stage the cash received should be distributed between partners. They share profits in the ratio of

2:2:1.

Q.No.-14. The partners A, B and C have called you to assist them in winding up the affairs of their partnership on 30 th

June, 2012. Their Balance sheet as on that date is given below:

Liabilities Rs. Assets Rs.

Sundry Creditors

Capital Accounts:

A

B

C

17,500

67,000

45,000

31,500

Cash at Bank

Sundry Debtors

Stock in trade

Plant and Equipment

Loan-A

Loan-B

1,60,500

(1) The partners share profit and losses in the ratio of 5:3:2

(2) Cash is distributed to the partners at the end of each month

(3) A summary of liquidation transactions are as follows:

July 2012

Rs. 16,500 - collected from Debtors; balance is uncollectable

Rs. 10,000 –received from sale of entire stock.

6,000

22,000

14,000

99,000

12,000

7,500

1,60,500

Rs. 1,000 – liquidation expenses paid.

Rs. 8,000 – cash retained in the business at the end of the month.

August 2012

Rs. 1,500 – liquidation expenses paid. As part payment of his Capital, C accepted a piece of equipment for Rs.

10,000 (book value Rs. 4,000).

Rs. 2,500 – cash retained in the business at the end of the month.

September 2012

Rs. 75,000 – received on sale of remaining plant and equipment.

Rs. 1,000 – liquidation expenses paid. No cash retained in the business.

Required: Prepare a schedule of cash payments as of September 30, showing how the cash was distributed.

Q.No.-15. B and S partners of S and & Co. sharing profits and losses in the ratio of 3:1. S and T are partners of T & Co.

Sharing profit and losses in the ratio of 2:1.

6 AVINASH JAIN

Success Coaching Centre

Sec-4 & sec-14

Ph.9782016302, 9672269750, 9784094650

On 31 st October, 2011, they decided to amalgamate and form a new firm M/s. BST & Co. wherein B, S and T would be partners sharing profits and losses in the ratio of 3:2:1.

Their balance sheets on that date were as under:

Liabilities

Due to X & Co.

Due to S & Co.

Other Creditors

Reserves

Capitals

B

S

T

S &Co. T & Co.

Rs. Rs.

40,000

-

60,000

25,000

1,20,000

80,000

-

-

50,000

58,000

50,000

-

1,00,000

50,000

Assets

Cash in hand

Cash at bank

Due from T & Co.

Due from X & Co.

Other Debtors

Stock

Furniture

Vehicles

Machinery

Building

S & Co.

Rs.

10,000

15,000

50,000

-

80,000

60,000

10,000

-

75,000

25,000

3,25,000 3,08,000 3,25,000 3,08,000

The amalgamated firm took over the business on the following terms:

(a) Goodwill of S & Co. was worth Rs. 60,000 and that of T & Co. Rs. 50,000. Goodwill account was not to be opened in

T & Co.

Rs.

5,000

20,000

-

30,000

1,00,000

70,000

3,000

80,000

- the books of the new firm, the adjustments being recorded through capital accounts of the partners.

(b) Building, machinery and vehicles were taken over at Rs. 50,000, Rs. 90,000 and Rs. 1,00,000 respectively.

(c) provision for doubtful debts has to be carried forward at Rs. 4,000 in respect of debtors of S & Co. and Rs. 5,000 in respect of debtors of T & Co.

You are required to:

(i) Compute the adjustments necessary for goodwill.

(ii) Pass the journal entries in the books of BST & Co. assuming that excess/deficit capital (taking T’s Capital as base) with reference to share in profits are to be transferred to current accounts.

Q.No.-16. On 31 st March 2012, shri Raman acquires on payment of Rs. 80,000 the business of M/s Gupta and Singh taking over at book value the following assets and liabilities:

Debtors 35,000

Furniture 3,000

Stock 46,000

Creditors 10,000

There was no change between 1 st January, 2012 and 31 st March, 2012 in the book value of the assets and liabilities not taken over.

The same set of books has been continued after the acquisition and no entries of the acquisition have been passed except for the payment of Rs. 80,000 made by Shri Raman.

From the following balance sheet and trial balance prepare Business Purchase Account, Profit and Loss Account for the year ended 31 st December, 2012 and Balance Sheet at that date.

Balance Sheet as at December, 2011

Liabilities Rs. Assets Rs.

Capital Accounts

Shri Gupta

Shri Singh

Bank Loan

Creditors

30,000

20,000

18,000

12,000

80,000

Furniture

Investments

Insurance Policy

Stock

Debtors

3,000

5,000

2,000

40,000

30,000

80,000

On 31 st December 2012 the trial balance is:

7 AVINASH JAIN

Success Coaching Centre

Sec-4 & sec-14

Ph.9782016302, 9672269750, 9784094650

Rs. Rs.

Stock

Furniture

Investment

Insurance policy

Business Purchase Account

Bank Loan

Capital:

Gupta

Singh

Raman

Bank

Debtors

Creditors

Purchases

40,000

3,000

5,000

2,000

80,000

3,000

48,000

3,20,000

18,000

30,000

20,000

30,000

15,000

Expenses

Sales

12,000

4,00,000

Closing Stock Rs. 50,000

5,13,000 5,13,000

Q.No.-17.Firm X & Co. consists of partners A and B sharing Profits and Losses in the ratio of 3:2. The firm Y & Co. consists of partners B and C sharing profits and losses in the ratio of 5:3.

On 31 st March, 2012 it was decided to amalgamated both the firms and form a new firm XY & Co., wherein A,B and C would be partners sharing Profits and losses in the ratio of 4:5:1.

Balance Sheet as at 31.3.2012

Liabilities X &Co. Y & Co. Assets X & Co. Y &Co.

Capital:

A

B

C

1,50,000

1,00,000

---

---

75,000

50,000

Cash in hand/bank

Debtors

Stock

Vehicles

40,000

60,000

50,000

---

30,000

80,000

20,000

90,000

Reserve

Creditors

50,000

1,20,000

40,000

55,000

Machinery

Building

1,20,000

1,50,000

---

---

4,20,000 2,20,000 4,20,000 2,20,000

The following were the terms of amalgamation:

(i) Goodwill of X & Co., was valued at Rs. 75,000. Goodwill of Y & Co. was valued at Rs. 40,000. Goodwill account not to be opened in the books of the new firm but adjusted through the capital accounts of the partners.

(ii) Building, Machinery and Vehicles are to be taken over at Rs. 2, 00,000 Rs. 1, 00,000 and Rs. 74,000 respectively.

(iii) Provision for doubtful debts at Rs. 5,000 in respect of X & Co. and 4,000 in respect of Y & Co. are to be provided.

You are required to:

(i) Show, how the Goodwill value is adjusted amongst the partners.

(ii) Prepare the Balance Sheet of XY & Co. as at 31.3.2012 by keeping partners capital in their profit sharing ratio by taking capital of ‘B’ as the basis. The excess or deficiency to be kept in the respective Partners’ Current accounts.

Q.No.-18. The following is the Balance Sheet of Messers A and B as on 31 st March 2011:

Liabilities

A’s Capital 40,000

B’s Capital 50,000

A’s Loan

General Reserve

Liabilities

Rs.

90,000

10,000

10,000

20,000

1,30,000

Assets

Land and Buildings

Stock

Debtors

Investment

6% Debentures in X Ltd.

Cash

Rs.

50,000

30,000

20,000

20,000

10,000

1,30,000

8 AVINASH JAIN

Success Coaching Centre

Sec-4 & sec-14

Ph.9782016302, 9672269750, 9784094650

It was agreed that Mr. C is to be admitted for a fifth share in the future profits from 1 st April 2011. He is required to contribute cash towards goodwill and Rs. 10,000 towards capital.

The following further information is furnished:

(i) The partners A and B shared the profit in the ratio 3:2.’

(ii) Mr. A was receiving a salary of Rs. 500 p.m. from the very inception of the firm in 1998 in addition to share of profit.

(iii) The future profit ratio between A, B and C will be 3:1:1. Mr. A will not get any salary after the admission of Mr. C.

(iv) (a) The goodwill of the firm shall be determined on the basis of 2 years’ purchases of the average profits from business of the last 56 years. The partnerships of the profits are as under:

Rs.

Year ended 31-3-07 Profit 20,000

Year ended 31-3-08 Loss 10,000

Year ended 31-3-09 Profit 20,000

Year ended 31-3-10 Profit 25,000

Year ended 31-3-11 Profit 30,000

The above profits and losses are after charging the salary of Mr. A. The profit of the year ended 31 st March 2007 included an extraneous profit of Rs. 30,000 and the loss of the year 31 st March 2008 was on account of loss by strike to the extent of Rs. 20,000.

(b) It was agreed that the value of the goodwill of the firm shall appear in the books of the firm.

(v) The trading profit for the year ended 31 st March, 2012 was Rs. 40,000 before depreciation.

(vi) The partners had drawn each Rs. 1,000 p.m. as drawings.

(vii) The value of the other assets and liabilities as on 31 st March 2012 were as under:

Building (before depreciation) 60,000

Stock 40,000

Debtors Nil

Investment 20,000

Liabilities Nil

(viii) Provide depreciation at 5% on land and buildings on the closing Balance and interest at 6% on A’s Loan.

(ix) They applied for conversion of the firm into a Private Limited Company. Certificate received on 1-4-2012. They decided to convert Capitals A/cs of the partners into share capital in the ratio of 3:1:1 on the basis of total Capital as on

31-3-2012. If necessary, partners have to subscribe to fresh capital or withdraw.

Prepare the profit and loss account for the year ended 31 st March, 2012 and the Balance Sheet of the company.

Q.No.-19. A and B were carrying on business sharing profits and losses equally. The firm’s Balance Sheet as at

31.12.2011 was:

Liabilities Rs. Assets Rs.

Sundry Creditors

Bank Overdraft

Capital Accounts

A 1,40,000

B 1,30,000

60,000

35,000

2,70,000

Stock

Machinery

Debtors

Joint Life Policy

Leasehold Premises

Profit & Loss a/c

60,000

1,50,000

70,000

9,000

34,000

26,000

Drawing Accounts:

A 10,000

B 6,000 16,000

3,65,000 3,65,000

The business was carried on till 30.6.2012. The partners withdrew in equal amounts half the amount of profits made during the period of six months after charging depreciation at 10% p.a. on machinery and after writing off 5% on leasehold premises. In the half year, sundry creditors were reduced by Rs. 10,000 and bank overdraft by Rs. 15,000.

On 30.6.2012, stock was valued at Rs. 75,000 and Debtors at Rs. 60,000; the joint life policy had been surrendered for

Rs. 9,000 before 30.602012 and other items remained the same as at 31.12.2011.

9 AVINASH JAIN

Success Coaching Centre

Sec-4 & sec-14

Ph.9782016302, 9672269750, 9784094650

On 30.6.2012, the firm sold the business to a Limited Company. 30.6.2012.The Company paid the purchase consideration in Equity Shares of Rs. 10 each.

You are required to prepare: (a) Balance sheet of the firm as at 30.6.2012; (b) The Realisation Account ;(c) Partners’

Capital Accounts showing the final settlement between them.

Q.No.-20. A, B and C were in partnership sharing profits and losses 3:2:1. There was no provision in the agreement for interest on capitals or drawings.

A died on 31.12.2012 and on that date, the partners’ balance were as under:

Capital Account: A – Rs. 60,000; B – Rs. 40,000; C- Rs. 20,000

Capital Account: A – Rs. 29,000; B – Rs. 20,000; C- Rs. 5,000 (Dr.)

By the partnership agreement, the sum due to A’s required to be paid within a period of 3 years, and minimum installation of Rs. 20,000 each were to be paid, the first such instalment falling due immediately after death and the subsequent instalments at half-yearly intervals. Interest @ 5% p.a. was to be credited half-yearly.

In ascertaining his share, goodwill (not recorded in the books) was to be valued at Rs. 60,000 and the assets, excluding the joint Endowment Policy (mentioned below), were valued at Rs. 36,000 in the excess of the book values.

No Goodwill account was raised and no alteration was made to the book values of fixed assets. The Joint Assurance

Policy shown in the books at Rs. 20,000 matured on 1.1.2011, realizing Rs. 26,000; Payments of Rs. 20,000 each were made to A’s Executors on 1.1.2011, 30.6.2011 and 31.12.2011(before charging the interest due to A’s estate) amounted to Rs. 32,000. During that period, the partners drawings were; B- 15,000; and C- Rs. 8,000.

On 1.1.2012, the partnership was dissolved and an offer to purchase the business as a going concern for Rs. 1,40,000 was accepted on that day. A cheque for that sum received on 30.6.2012.

The balance due to A’s estate, including interest, was paid on 30.6.2012 and on that day, B and C received the sums due to them.

You are required to write-up the partners’ capital and Current Accounts from 1.1.2011 to 30.6.2012. Show also the account of the executors of A.

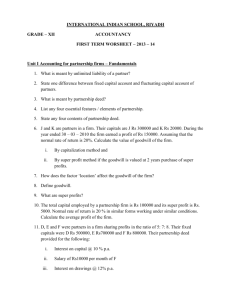

Q.No.-21. P, Q and R partners in a registered firm. Their balances of capital on 1 st April, 2004 were Rs. 25,000 Rs. 15,000 and Rs. 5,000 respectively. The partnership deed provides that:

(i) R shall be credited with a salary @ Rs. 300 per month.

(ii) Interest on capital is to be allowed at 10% per annum and on drawings to be charged at 15% per annum.

(iii) After providing for (i) and (ii) as mentioned above and extra remuneration to R as provided in this paragraph (iii), R shall be entitled to 5% of all the profits in excess of Rs. 7,000 per annum.

(iv) Q has to be credited one-fifth of the balance of profits, after making all adjustments mentioned under (i) to (iii) and

(iv),

(v) The balance of profit is to be distributed between P & R in the ratio of 7:1

On 1 st October, 2004 R introduce Rs. 5,000 as additional capital. P had withdrawn Rs. 2,000 on 1 st August, 2004 and Rs.

1,600 on 31 st December, 2004 while R had not withdrawn any amount. Q withdrew Rs. 400 at the end of each quarter.

The net profit for the year ended 31 st March, 2005 before providing for the above adjustment amounted to Rs. 40,500.

You are required to prepare Profit and Loss Account and Partner’s Capital Account for the accounting year 2004-05.

Q.No.-22. The following information relates of the business of a firm: (a) Average capital employed in the firm: 7, 20,000

(b) Net profit of the firm for the past three years were: Rs. 1, 07,600; 90,700 & 1, 12,500. (c) Reasonable return expected in the same type of business is 10% (d) Fair remuneration of the partners for their services is 12,000 per annum.

Calculate the value of Goodwill.

(1) On the basis of 5 years purchases of annual average super profits.

(2) On the basis of annuity of super profits, taking the present value of annuity of Re. 1 for five years at 10% interest being 3.78.

(3) On the basis of capitalizing the annual average super profits at the reasonable return of 10%.

Q.No.-23. Ram, Shyam Rahim are partners in a firm sharing profits and losses in the ratio of 2:2:1. It is agreed that interest on Capital will be allowed @ 10% per annum and interest on drawings will be charged @ 8% per annum. No interest will be charged/allowed on Current Accounts. The followings are the particulars of the capitals, currents and drawings accounts of the partners:

Ram Shyam Rahim

Rs. Rs. Rs.

10 AVINASH JAIN

Success Coaching Centre

Sec-4 & sec-14

Ph.9782016302, 9672269750, 9784094650

Balance in Capital Accounts on 1-1-2002 75,000 40,000 30,000

Balance in Current Accounts 1-1-2002 10,000 5,000 5,000(Dr.)

Drawings 15,000 10,000 10,000

The draft accounts for 2002 showed a net profit of Rs. 60,000 before taking into account interest on capitals and drawings and subject to the following rectification of error:

(i) Life insurance Premium of Ram accounting to Rs. 750 paid by the firm on 31 st December, 2002 has been charged to

Miscellaneous Expenditure Account.

(ii) Repairs on Machinery amounting to Rs. 10,000 has been debited to Plant and Machinery Account and depreciation thereon charged @ 20%

(iii) Travelling expenses Account of Rs. 3,000 of Shyam for a pleasure trip to paid by the firm on 30 th June, 2002 Have been debited to Travelling expenses Account.

You are required to prepare the profit and loss Appropriation Account for the year ended 31 st December, 2002 and partner’s current accounts for the year.

Q.No.24. The following was Balance Sheet of two partners “A” and “B” who were sharing profits 2:1 on 31 st March 2005.

Liabilities Rs. Assets Rs.

Creditors

Capitals:

A

B

65,900

30,000

20,000

Cash at Bank

Sundry Debtors

Stock

Plant & Machinery

Buildings

1,200

9,700

20,000

35,000

50,000

1,15,900 1,15,900

They agreed to admit M into Partnership on the following terms: (i) M was to be given one-third share in profits, and was to bring Rs. 15,000 as his capital and Rs. 6,000 as his share of goodwill;(ii) That the value of stock and Plant were to be reduced by 10 percent. (iii) That a provision of 5% was to be created for doubtful debts. (iv) That the building account was to be appreciated by Rs. 9,600. (v) That the goodwill amount was to be withdrawn by the old partners; and (vi)

Investment worth Rs. 400 (not mentioned in the balance sheet) were taken into account.

Draft journal entries to give effect to the above arrangement, show the Memorandum Revaluation Account, Capital

Accounts and prepare the opening Balance Sheet of the new firm.

Q.No.-25. ‘A’,’B’ and B’s son ‘C’ are partners in a firm. On 1 April, 2002 firms manager ‘D’ was admitted. In the new firm profit and loss will be distributed A: 4/10 th ,B: 3/10th C: 2/10 th and salary Rs. 600 p.a., and D: 1/10 th . D was getting salary of Rs. 1000 p.a. and 3% commission on profit before charging salary of partner but after charging salary of ‘D’ and commission. It was decided that in the first year of partnership excess of ‘D’ share over the amount which he was getting as manager increased by Rs. 700 be charged to A’s share. While closing books on 31 March 2003 partners agreed for following adjustment: (i) provide for staff bonus Rs. 5500. (ii) A’s son ‘K’ who is a employee be given extra bonus of Rs.

250, which will be charged to his father’s share. (iii) B’s share of Rs. 500 be transferred to his son C’s a/c. The profit for the year was Rs. 32000 before above adjustment and C’s salary. Prepare P&L Appropriation a/c.

Q.No.-26. P and Q were carrying on business in partnership sharing profits and losses equally. It was agreed that Q should retire from the firm from 1 st April, 2003 and that his son R should join from 1 st April, 2003 and should be entitled to one third of the profits. The balance Sheet of P and Q on 31 st March, 2003 was as follows:

Liabilities Amount Assets Amount sundry Creditors

Capital Accounts:

P 84,500

Q 1,02,000

29,500

1,86,500

Cash-at-bank

Debtors

Stock

Furniture

Building

Goodwill

33,000

48,000

33,000

12,000

60,000

30,000

2,16,000 2,16,000

On 1 st April, 2003 Goodwill was valued at Rs. 60,000, Building at Rs. 1,00,000 and Stock at Rs. 30,000. It was agreed that enough money should be introduce to enable Q to be paid out and leave Rs. 30,000 cash by way of Working Capital. P and R were to provide such sum as would make their capital proportionate to their share of profits. Q also agreed to make a loan to his son R by transfer from his capital account of half the amount which R had to provide. P and R paid in

11 AVINASH JAIN

Success Coaching Centre

Sec-4 & sec-14

Ph.9782016302, 9672269750, 9784094650 cash due from them on 10 th April, 2003 and the amount due to Q was paid out on that day. Give Journal entries to record the above transactions and capital accounts.

Q.No.-27. Anand, Bihari and Chandan are partner’s sharing profits and losses in the ratio 4:3:3. Their Balance Sheet as on 31 st March, 2004 was as under:

Liabilities Amount Assets Amount

Creditors

General reserves

24,500

4,500

Cash in hand

Debtors

9,600

15,400

Loan from X

Capital Accounts:

Anand

Bihari

Chandan

3,000

25,000

15,000

10,000

Joint Life Policy

(surrender value)

Investments

Plant and Machinery

10,500

25,000

21,500

82,000 82,000

Anand died on a1st August, 2004. He was entitled to receive salary of Rs. 9,000 p.a. and interest on Capital @ 15% p.a.

During this period his drawings were Rs. 3,000. For calculation of profit of this period, past four year’s average profit should be taken as base. As per partnership deed, in the event of death of any partner goodwill is to be calculated at

20% of past four year’s total profit. Past four year’s profits and loss was-

First year’s profits Rs. 24,000, Second year’s profits Rs. 216,000, Third year’s profits Rs. 3,000 and Forth year’s profits was Rs. 5,000. An investment to be reduced by 10% and a provision of Rs. 1,500 is to be made for claims.

Firm has taken Joint Life Policy of Rs. 60,500 of which full payment is received by firm.

Prepare necessary Account to calculate amount payable to the heir of Anand.

Q.No.-28. N, M and D were working into partnership sharing profits equally. On 1 st April 2008, N decided to retire from the firm. The Balance Sheet of the firm as on 31 st March, 2008 was as follows:

Liabilities sundry Creditors bills Payable

Amount Assets

50,000

16,000

Cash in hand

Sundry Debtors

Amount

26,000

32,000

General fund

Capital Accounts:

N 20,000

M 20,000

D 20,000

10,800

60,000

1,36,800

Stock

Furniture

Plant and Machinery

Motor car

34,000

10,000

24,000

10,800

1,36,800

The following decisions were taken at the time ‘N’ retirement:

(i) That the value of Plant and Machinery be reduced by Rs. 4,800.

(ii) That the Motor Car was to re-valued by Rs. 4,800.

(iii) That a provision of Rs. 2,800 be made in respect of outstanding trade expenses.

(iv) That the goodwill of the firm be valued at Rs. 42,000 and N’s share in the same be adjusted into the accounts of ‘M’ and “d” who decide to share the future profits and losses in the ratio of 3:2 respectively.

(v) That the entire Capital of the newly constituted firm be firm at Rs. 80,000 and re-adjusted between ‘M and ‘D in their new profit-sharing ratio by bringing in or paying out cash.

From the above particulars give journal entries on the date of retirement and prepare Balance Sheet of the new firm showing N’s balance as loan.

Q.No.-29. Ram, Lakhan and Bharat commenced business on 1 st January, 2000. They agreed to share the profits and losses in the ratio of 5:4:1. Their capitals were Rs. 60,000. Rs. 45,000 and Rs. 30,000 respectively. The partnership deed provided for interest on capital at 5% per annum. During year 2000 the firm earned a profit of Rs. 30,000 (Before provide interest on capital). During the year, partner’s drawings were: Ram- Rs. 9,000. Lakhan Rs. 12,000 and Bharat Rs.

6,000.Dispute arises among partners, so they decided to dissolve the firm on 31 st Dec. 2000. The assets were sold which realized Rs. 1, 50,000 and cash in hand was Rs. 15,000. There were creditors to the extent of Rs. 42,000 which were paid off a discount of 10%.

Prepare necessary accounts to close the books of firm.

12 AVINASH JAIN

Success Coaching Centre

Sec-4 & sec-14

Ph.9782016302, 9672269750, 9784094650

Q.No.-30. A,B and C are partners sharing profits in the ratio of 3:1:1. On 31 st March, 2002 they decided to dissolve their firm. On that date their B/S was as under:

Liabilities sundry Creditors loan

Capital Accounts:

A 27,500

Amount Assets

6,000

1,500

Cash

Debtors 24,200

Less: provision for B/D 1,200

Stock

Amount

3,200

23,000

7,800

B 10,000

C 7,000 44,500

Furniture

Sundry Assets

1,000

17,000

52,000 52,000

It is agreed that (i) A is to takeover furniture at Rs. 800 and Debtors amounting to Rs. 20,000 at Rs. 17,200. The Creditors

Rs. 6,000 to be assumed by him at that figure.

(ii) B is to take over all the stock at Rs. 7,000 and some of the sundry assets at Rs. 7,200 (being book value, less 10%).

(iii) C is to take over the remaining sundry assets at 90% book value less Rs. 100 as discount and assume the responsibility for the discharge of the loan together with accruing interest Rs. 30 which has not been recovered in the books.

(iv) The expenses of dissolution were Rs. 270. The remaining debtors were sold to a debts collecting agency for 50% of the book value.

Prepare necessary accounts to close the book of the figures.

Q.No.-31. Ram, Shyam and Mohan are partners in a firm, sharing profits and losses in the ratio of 4:3:3. Mohan is minor partner. Their Balance Sheet on 31 st March, 2003 is as follows:

Liabilities

Creditors

Bank loan

Amount Assets

2,00,000

50,000

Cash

Stock

Amount

10,000

60,000

Capital Accounts:

Ram 1,00,000

Debtors

Machinery

1,00,000

2,80,000

Shyam 60,000

Mohan 40,000 2,00,000

4,50,000 4,50,000

They decided to dissolve the firm on 1 st April, 2003. Bank loan is secured by a pledge of stock. Debtors realize Rs. 70,000,

Stock Rs. 30,000 and Machinery Rs. 1, 00,000. Realisation Expenses amounted to Rs. 10,000. ‘Shyam’ is insolvent and nothing can be recovered from him. The private assets of ‘Ram’ amounted to Rs. 46,000 and his private creditors amounted Rs. 40,000. The personal assets of ‘Mohan’ amounted to Rs. 80,000. He did not have any private liability.

Prepare necessary accounts to close the books of the firm.

Q.No.-32. Ram and Shyam are partners in the ratio of 2:1 respectively. As on 1 st Jan. 2005, they sold their business to a joint stock company named Ram Shyam & Co. Their Balance Sheet as on that date was as follows:

Liabilities

Creditors

Amount Assets

10,000

10,000

50,000

30,000

Plant

Furniture

Investment

Stock

Debtors cash at Bank

Amount

15,000

8,000

15,000

20,000

35,000

7,000

Bills payable

Capital

Ram

Shyam

1,00,000 1,00,000

Company did not agree to take investments, which were distributed among partners in the profit sharing ratio. Cash of the firm was also not taken by the company.

Assets and Liabilities of the firm were taken at the following values by the company:

13 AVINASH JAIN

Success Coaching Centre

Sec-4 & sec-14

Ph.9782016302, 9672269750, 9784094650

Goodwill 20,000 Debtors 27,000

Plant 13,000 Creditors 10,000

Furniture 6,000 Bills payable 8,000

Stock 25,000

Company paid Rs. 2,500 for expenses. Make journal entries and close the books of firm by preparing ledger accounts.

Q.No.-33. On March 31, 2000 M/s A and B and M/s X and Y, two firms have following Balance Sheets.

Balance sheet of M/s A & B

Liabilities

Sundry Creditors

Mrs. A’s loan

Capital

A

B

Amount Assets

20,000

5,000

40,000

20,000

85,000

Cash at Bank

Stock

Sundry Debtors

Office furniture

Premises

Amount

5,600

20,400

15,000

4,000

40,000

85,000

Balance sheet of M/s X & Y

Liabilities

Sundry Creditors

Capital

X

Amount Assets

25,000

24,000

Cash at Bank

Stock

Sundry Debtors

Amount

6,700

18,300

20,000

Y 16,000 Office furniture investment

5,000

15,000

65,000 65,000

On April 1, 2000 both firms have decided to amalgamate. For this Mrs. A’s loan was paid and investments of M/s. X and

Y were not accepted by the new firm. The goodwill of M/s. A & B and M/s X and Y was valued at Rs. 8,000 and Rs. 10,000 respectively. Premises of M/s. A & B was revalued at Rs. 50,000 and Stock was found overvalued by Rs. 4,000. Stock of

M/s. X & Y was valued Rs. 2,000 over. Provision for bad debts on the debtors of both firms was made at 5%. The total capital of the new firm was agreed to be Rs. 80,000, which should be in the profit sharing ratio of the partners being

3:2:3:2, respectively. Goodwill account of new firm is closed. Close the books of both the firms and give entries in the book of the new firm M/s. A, B, X, and Y. Also prepare Balance Sheet of the newly constituted firm.

Q.No.-34. The Balance Sheet of A and B stood as follows on 31 st March 2008.

Liabilities Rs. Assets Rs.

Creditors

Bills payable

Capital accounts:

A

B

17,000

1,200

25,000

25,000

Cash

Sundry Debtors 20,000

Less Reserve 1,000

Stock

Machinery

Fixtures

Goodwill

6,200

19,000

22,000

15,000

1,500

4,500

68,200 68,200

It was decided to sell the business to X, Y and Co., Ltd. on the company agreeing to allot 6,000 fully paid shares of Rs. 10 each in full satisfaction of the purchase consideration. The company assumed the liabilities except the bills payable and took over the assets excepting the cash balance. The partners shared profits and losses equally. Pass the journal entries and prepare accounts showing the final settlement as regards the partners, assuming that the shares were duly allotted.

Q.No.-35. X, Y Ltd. and Z Ltd. are partners of X & Co. The partnership deed provided that:

14 AVINASH JAIN

Success Coaching Centre

Sec-4 & sec-14

Ph.9782016302, 9672269750, 9784094650

(a) The working partner Mr. X is to be remunerated at 15% of the net profits after charging his remuneration, but before charging interest on capital and provision for taxation;

(b) Interest is to be provided on capital at 15% per annum;

(c) Balance profits after marking provision for taxation, is to be shared in the ratio of 1:2:2 by the three partners.

During the year ended 31 st March, 1997:

(i) The net profit before tax and before making payment to partners amounted to Rs. 6,90,000;

(ii) Interest on capitals at 15% per annum amounted to:

Rs. 60,000 for X; Rs. 1,50,000 for Y Ltd. and Rs. 1,80,000 for Z Ltd. The capitals have remained unchanged during the year;

(iii) Provision for tax is to be at 40% of “total income” of the firm. The total income has been computed at Rs. 1,95,000.

You are asked by:

(a) The firm to pass closing entries in relation to the above;

(b) Y ltd. to pass journal entries in its books pertaining to its income from the firm and show the investment in partnership account as it would appear in its ledger;

(c) Z Ltd. to show, how the above information will appear in its financial statements for the year;

(d) Shri X to show the working, if any, in relation to the above.

Q.No.-36. Alpha Manufacturing P. Ltd. is a company manufacturing articles. Beeta Marketing P. Ltd. is a company engaged in marketing activities.

The two companies enter into a partnership on the following terms:

(a) Alpha Manufacturing P. Ltd. is to supply goods on credit of two months to the partnership firm. The partnership is to discharge the dues to Alpha manufacturing P. Ltd. along with interest at 12%per annum regularly on due dates.

(b) Beeta Marketing P. Ltd. is to sell the goods.

(c) Expenses of sales are to be met out of the partnership funds. Alpha Manufacturing P. Ltd. and Beeta Marketing P. Ltd. are to introduce capital of Rs. five Lakhs each for meeting the above expenses and as working capital. Interest at 15% per annum is payable on partner’s capital- Payment being made every month. Accordingly the capitals are introduced on

1 st April, 1999.

(d) Profits and losses are to be dealt with as follows:

(i) 10% of the profits, if any, are to be credited to reserves for strengthening the working capital base;

(ii) Balance profits are to be shared equally by credited to current accounts;

(iii) Losses, if any, are to be borne equally by debit to capital accounts.

(e) The firm name is to be AB Traders.

During the year ended 31 st March, 2000 the following were the transactions:

(a) Purchases Rs. 150 Lakhs of which Rs. 30 Lakhs were in the first quarter; Rs. 90 Lakhs were in the next six months; the balance Rs. 30 Lakhs were in the last quarter. The purchases are evenly spread through the respective periods.

(b) Sales were Rs. 200 Lakhs.

(c) Sales expenses where Rs. 10 Lakhs and were paid in full.

(d) Discount allowed to customers amounted to Rs. 4 Lakhs. On 31 st March, 2000, amounts due You are required to prepare final accounts of the firm.

Q.No.-37. M/S NEPTUNE & Co.’s Balance Sheet as 31 st March 2001:

Liabilities Rs. Assets Rs.

Bank overdraft (State bank)

Sundry creditors

Capital Accounts:

Mr. A

Balance as per Last B/S 4,02,000

Add: profit for the year 95,400

4,97,400

Less: Drawings 40,000

Mr. B

Balance as per Last B/S 2,00,000

54,000

1,56,000

4,57,000

Cash at Bank of India

Sundry debtors

Stock

Motor car cost

As per past B/S 1,60,000

Less: depreciation till date 54,000

Machinery:

Cash as per last B/S 3,00,000

Less: Depreciation till date 1,40,000

Land & buildings

800

2,80,000

1,00,000

1,06,000

1,60,000

2,40,000

15 AVINASH JAIN

Success Coaching Centre

Sec-4 & sec-14

Ph.9782016302, 9672269750, 9784094650

Add: profit for the year 95,400

2,95,400

Less: Drawings 76,000 2,19,400

8,86,800 8,86,800

You have examined the foregoing Draft of the Balance Sheet and have ascertained that the following adjustments are required to be carried out:

(i) Land and Building are shown at cost less Rs. 60,000 being the proceeds of the sale during the year of premises costing

Rs. 70,000.

(ii) Machinery having a net book value of Rs. 4,300 had been scraped during the year. The original cost was Rs. 12,300.

(iii) Rs. 2,000 paid for the License fees for the year ending 30 th September, 2001 had been written off.

(iv) Debts amounting to Rs. 10,420 were considered to be bad and further debts amounting to Rs. 5,400 were considered doubtful and required 100% provision. Provision for doubtful debts had previously been made for Rs. 10,000.

(v) An item in the inventory was valued at Rs. 37,400, but had realizable value of Rs. 26,000 only. Scrape material, having a value of Rs. 6,600 had been omitted from the stock valuation.

(vi) The cashier had misappropriated Rs. 700.

(vii) The cash- book for the year ending 31 st March, 2001 included payments amounting to Rs. 6, 924, the cheques having been made out but not dispatched to suppliers until April, 2001.

(viii) Interest is to be allowed on the partners’ opening Capital Account balances less drawings during the year at 9%. You are required to prepare:

(a) Profit & loss adjustment Account for the year (b) Capital & loss of the partners.

Q.No.-38. Avinash, Basuda Ltd. and Chinmoy Ltd. were in partnership sharing profits and losses in the ratio of 9:4:2.

Basuda Ltd. retired from the partnership on 31 st March, 1998, when the firm’s balance sheet was as under:

Liabilities Rs. Assets Rs.

Sundry creditors

Capital accounts:

Avinash 2,700

Basuda Ltd. 1,200

Chinmoy Ltd. 600

600

4,500 cash at bank sundry debtors stock furniture plant land & building

284

400

800

266

850

2,500

5,100 5,100

Basuda Ltd.’s share in goodwill and capital was acquired by Avinash and Chinmoy Ltd. in the ratio of 1:3, the continuing partners bringing in the necessary finance to pay off Basuda Ltd. The partnership deed provides that on retirement or admission of a partner, the goodwill of the firm is to be values at three times the average annual profits of he firm during the four years ended 31 st March, 1998 in thousands of rupees were:

1994-95 450

1995-96 250

1996-97 600

1997-98 700

The deed further provided that goodwill account is not to appear in the books of accounts at all. The continuing partners agreed that with effect from 1 st April, 1998 Ghanshyam, son Avinash is to be admitted as a partner with 25% share of profits.

Avinash gifts to Ghanshyam, by transfer from his capital account, an amount sufficient to cover up 12.5% of capital and goodwill requirement is purchased by Ghanshyam from Avinash and Chinmoy Ltd. in the 2:1.

The firm asks to you:

(i) Prepare a statement showing the continuing partner’s shares;

(ii) Pass journal entries including for bank transactions; and

16 AVINASH JAIN

Success Coaching Centre

Sec-4 & sec-14

Ph.9782016302, 9672269750, 9784094650

(iii) prepare the balance sheet of the firm after Ghanshyam admission.

Q.No.-39. Ram, Rahim and Robert are partners, sharing profits and Losses in the ratio of 5:3:2.

It was decided that Robert would retire on 31-3-2005 and in his place Richard would be admitted as a partner with new profit sharing ratio between Ram, Rahim and Richard are 3:2:1.

Balance Sheet of Ram, Rahim and Robert as at 31-3-2005:

Liabilities Rs. Assets Rs.

Capital Accounts: cash in hand

Ram

Rahim

Robert

Gen. Reserve

Sundry Creditors

Loan from Richard

1,00,000

1,50,000

2,00,000

2,00,000

8,00,000

2,00,000 cash at bank

Sundry Debtors

Stock in Trade

Plant & Machinery

Land & Building

16,50,000

Retirement of Robert and admission Richard is on the following terms:

(a) Plant & Machinery to be depreciated by Rs. 30,000

(b) Land & Building to be valued at Rs. 6, 00,000.

(c) Stock to be valued at 95% of book value.

20,000

1,00,000

5,00,000

2,00,000

3,00,00

5,30,000

16,50,000

(d) Provision for doubtful debts @ 10% to be provided on debtors.

(e) General Reserve to be apportioned amongst Ram, Shyam and Robert.

(f) The firm’s goodwill to be valued at 2 years purchase of the average profits of the last 3 years. The relevant figures are:

Year ended 31.3.2002 - profit Rs. 50,000

Year ended 31.3.2003 - profit Rs. 60,000

Year ended 31.3.2004 - Profit Rs. 55,000

(g) Out of the amount due to Robert Rs. 2, 00,000 would be retained as loan by the firm and the balance will be settled immediately.

(h) Richard’s capital should be equal to 50% of the combined capital of Ram and Rahim.

(i) Capital Accounts of the partners; and (ii) Balance Sheet of the reconstituted firm.

Q.No.-40. X and Y are partners sharing profits and losses in the ratio of 3:2. On 30 th September, 2007 they admitted Z as a partner. The new profit sharing ratio agreed was 2:2:1. At the time of admission Z brought in a fixture valued at Rs.

6,000 and machinery worth Rs. 24,000. No accounting entry was passed for the fixture brought in by partner Z in the books of the firm.

Also at the time of admission the valuation of goodwill was made. The value of goodwill of X and Y was decided at Rs.

40,000 and value of goodwill of partner Z was fixed at Rs. 20,000. No effect was given to the books of the firm.

On 31.3.2007, it was decided that partner X would retire and the other partners viz., Y and Z would continue the business of the firm by converting it into a company called YZ Ltd., with equal shareholding in the company.

The partners agreed as below:

(i) The goodwill of the firm shall be fixed at Rs. 80,000. Necessary effect for goodwill value not recorded earlier shall be given. The present goodwill value being Rs. 80,000 shall be reflected in the company.

(ii) All the assets and liabilities of the firm shall be taken over by the company.

(iii) Partner X would take motor car of the firm at a value of Rs. 7,400.

(iv) A plant owned by the firm is sold for Rs. 6,000.

(v) The profit of the firm Upto 30.9.2006 was 44,000.

(vi) Partner X agreed to leave Rs. 90,000 as loan with the firm in return for 12%interest per annum.

Following is the Trial Balance of the firm as on 31.3.2007:

Particulars Debit Credit

17 AVINASH JAIN

Success Coaching Centre

Sec-4 & sec-14

Ph.9782016302, 9672269750, 9784094650

Capital Accounts:

X

Y

Z

Drawings Account:

X

Y

-

-

-

22,000

80,000

50,000

24,000

-

-

Z

Sundry debtors

Sundry creditors

Plant (Book value of plant sold Rs. 8,000)

Fixtures

Stock

Motor car

20,000

9,600

70,000

-

46,000

14,000

24,000

-

-

32,000

-

-

-

-

Cash at bank

Profit and loss A/c(for the year)

5,400

34,600

-

2,45,600

-

59,600

2,45,600

You are required to prepare:

(i) Goodwill Adjustment Account

(ii) Profit & Loss appropriation Account

(iii) Partner’s Capital Accounts

(iv) Balance Sheet of YZ Ltd. after conversion.

Q.No.-41. A,B and C are partners sharing profits and losses in the ratio of 3:2:1. B retired from the firm. Partners A and C decided to take his share 3:1 ratio. What is the new ratio of the partners A and C?

Q.No.-42. Laurel and Hardy are partners of the firm LH & Co., from 1.4.2003. Initially both of them contributed Rs.

1,00,000 each as capital. They did not contribute any capital thereafter. They maintain accounts of the firm on mercantile basis. They were sharing profits and losses in the ratio of 5:4. After the accounts for the year ended

31.3.2007 were finalized, the partners decided to share profits and losses equally with effect from 1.4.2003.

It was also discovered that in ascertaining the results in the earlier years certain adjustments details of which are given below, had not been noted.

Year ended 31 st March 2004

Rs.

2005

Rs.

2006

Rs.

2007

Rs.

Profit as per accounts prepared and finalized

Expenses not provided for (as at 31 st March)

Income not taken into account (as at 31 st March)

1,40,000

30,000

18,000

2,60,000

20,000

15,000

3,20,000

36,000

12,000

3,60,000

24,000

21,000

The partners decided to admit Chaplin as a partner with effect from 1.4.2007. It was decided that Chaplin would be allotted 20% share in the firm and he must bring 20% of the combined capital of Laurel and Hardy.

Following is the balance sheet of the firm as on 31.3.2007 before admission of Chaplin and before adjustment of revised profits between Laurel and Hardy.

Liabilities Amount Assets Amount

Capital Accounts: Plant and machinery 60,000

Laurel

Hardy

Sundry creditors

2,11,500

1,51,500

2,27,000

5,90,000

Cash on Hand

Cash at bank

Stock in trade

Sundry debtors

10,000

5,000

3,10,000

2,05,000

5,90,000

You are required to prepare:

18 AVINASH JAIN

Success Coaching Centre

Sec-4 & sec-14

Ph.9782016302, 9672269750, 9784094650

(i) Profit and Loss Adjustment account;

(ii) Capital accounts of the partners; and

(iii) Balance Sheet of the firm after the admission of Chaplin.

Q.No.-43. A,B and C are partners of the firm ABC & Co., sharing profits and losses in the ratio of 5:3:2.Following is the

Balance Sheet of the firm as at 31.3.2008:

Balance Sheet of the firm as at 31.3.2008

Liabilities Amount Assets Amount

Partner Capital A/cs:

A 4,50,000

Goodwill

Building

1,00,000

10,50,000

B

C

1,30,000

1,70,000

Machinery

Furniture

6,50,000

2,15,000

Investment fluctuation reserve

Contingency reserve

1,00,000

75,000

Investments (Market value Rs. 75,000)

Stock

60,000

Long-term loan 15,00,000 Sundry debtors 6,50,000

Bank overdraft

Sundry creditors

2,20,000

8,00,000

Advertisement suspense 6,95,000

25,000

34,45,000 34,45,000

It was decided that B would retire from the partnership on 1.4.2008 and D would be admitted as a partner on the same date. Following adjustments are agreed amongst the partners for the retirement/admission:

(i) Goodwill is to be valued at Rs. 5, 00,000, but the same will not appear as an Asset in the ‘books of the firm.

(ii) Building and machinery are to be revalued at Rs. 10, 00,000 and Rs. 5, 20,000 respectively.

(iii) Investments are to be taken over by B at the market value.

(iv) Provision for doubtful debts to be maintained at 20% on sundry debtors.

(v) The capital of the reconstituted firm will be Rs. 10, 00,000 to be contributed by the partners A, C and D in their new profit sharing ratio of 2:2:1.

(vi) Surplus funds if any will be used to pay the bank overdraft.

(vii) Amount due to retiring partner B will be transferred to his loan account.

Prepare:

(i) Revaluation Account;

(ii) Capital Accounts of the partners; and

(iii) Balance Sheet of the firm after reconstitution.

Q.No.-44. P, Q and R share Profit and losses in the ratio of 4:3:2 respectively. Q retires and P and R decide to share future profit and losses in the ratio of 5:3. Then immediately H is admitted of 3/10 shares of profits half of which was gifted by P and the remaining share was taken by H equally from P and R. Calculate the new Profit sharing ratio after H’s admission and Gain ratio of P and R.

Q.No.-45. E, F and G were partners sharing profit and losses in the ratio of 5:3:2 respectively. On 31 st March, 2009

Balance Sheet of the firm stood as follows:

Liabilities

Capital A/cs

E 50,000

F 40,000

G 28,000

Creditors

Outstanding Expenses

Amount Assets

Buildings

Furniture

1,18,000

33,500

1,700

Stock

Debtors

Cash at Bank

Amount

55,000

25,000

42,000

20,000

11,200

1,53,200 1,53,200

On 31 st March, 2009, E decided to retire and F and G decided to continue as equal partners. Other terms of retirement were as follows:

(i) Building be appreciated by 20%.

(ii) Furniture be depreciated by 10%.

(iii) A provision of %% be created for bad debts on debtors.

19 AVINASH JAIN

Success Coaching Centre

Sec-4 & sec-14

Ph.9782016302, 9672269750, 9784094650

(iv) Goodwill be valued at two years’ purchase of profit for the latest accounting year. The firm’s profit for the year ended 31 st March, 2009 was Rs. 25,000. No goodwill account is to be raised in the books of accounts.

(v) Fresh capital be introduced by F and G to the extent of Rs. 10,000 and Rs. 35,000 respectively.

(vi) Out of sum payable to retiring partner E, a sum of Rs. 45,000 be paid immediately and the balance be transferred to his loan account bearing interest @ 12% per annum. The loan to be paid off by 31 st March, 2011.

One month after E’s retirement, F and G agreed to admit E’s son H as a partner with one-forth share in profit/losses. E agreed that the balance in his loan account be converted into H’s Capital. E also agreed to forgo one month’s interest on his loan.

It was also agreed that H will bring in his share of goodwill through book adjustment, valued at the price on the date of

E’s retirement. No goodwill account is to be raised in the books.

You are requested to pass necessary Journal Entries to give effect to above transactions and prepare Partner’s Capital

Accounts.

Q.No.-46. A, B and C were partners of a firm sharing profit and losses in the ratio of 3:4:3.The Balance sheet of the firm, as at 31 st March, 1998 was as under:

Liabilities

Capital A/cs

Amount Assets

Fixed Assets

Amount

1,00,000

A 48,000

B 64,000

C 48,000

Reserve

Creditors

1,60,000

20,000

40,000

Current Assets:

Stock 30,000

Debtors 60,000

Cash at Bank 30,000 1,20,000

2,20,000 2,20,000

The firm had taken a Joint Life Policy for Rs. 1,00,000; the premium periodically paid was charged to profit and loss

Account. Partner C died on 30 th September, 1998. It was agreed between the surviving partners and legal representative of C that:

(i) Goodwill of the firm will be taken a Rs. 60,000.

(ii) Fixed Assets will be written down by Rs. 20,000.

(iii) In lieu of Profit, C should be paid at the rate of 25% per annum on his capital as on 31 st March, 1999, after charging depreciation of Rs. 10,000 (depreciation Upto 30 th September was agreed to be Rs. 6,000) were Rs. 48,000.

Partners’ Drawing Accounts showed balance as under:

A Rs. 18,000 (drawn evenly over the year)

B Rs. 24,000 (drawn evenly over the year)

C Rs. (up-to-date of death) Rs. 20,000

On the basis of the above figures, please indicate the entitlement of the legal heirs of C, assuming that they had not been paid anything other than the sharer in the Joint Life Policy.

Q.No.-47. A, B and C were partners, sharing profit and losses in the ratio of 5:3:2. On 31 st March, 2000 Balance Sheet stood as follows:

Liabilities

Capital A/cs

A

B

C

Creditors

Amount Assets

7,79,000

7,07,800

6,86,200

4,91,000

Plant and Machinery

Furniture and Fittings

Stock

Debtors

Cash at Bank

Amount

13,62,000

2,36,000

7,02,000

1,91,000

1,73,000

26,64,000 26,64,000

On 31 st July, 2000 A died. According to partnership deed, on the death of a partner, the capital account of the deceased partner was to be credited with:

(i) His share of profit for the relevant part of the year of death calculated on the basis of earned during the immediately preceding accounting year, and

(ii) His share of goodwill.

20 AVINASH JAIN

Success Coaching Centre

Sec-4 & sec-14

Ph.9782016302, 9672269750, 9784094650

Goodwill was to be valued at two years’ purchase of the average profits of immediately preceding three accounting years. The profits, as per books of account, were as follows:

Rs.

For accounting year ended 31 st March, 1998 3, 29,000

For accounting year ended 31 st March, 1999 3, 46,000

For accounting year ended 31 st March, 2000 3, 78,000

However, while going through the books of account on A’s death, it came to light that Rs. 30,000 worth of wages were spent on installation of a new machinery, but the sum was not capitalized; the machinery was put into operation on 1 st

October, 1999. Depreciation was provided on the machinery @ 20% per annum. On 1 st October, 2000 A’s Son D was admitted into partnership with immediate effect on the following terms:

(a) D would get one-forth share in the profits of the firm, while the relative profit sharing ratio between B and C would remain unchanged.

(b) The final balance of A’s Capital Account would be credited to D’s capital Account.

(c) An adjustment would be made in the Capital Accounts for D’s share of goodwill. The basis of valuation of firm’s goodwill would be the same as was adopted at the time of the death of his father.

On 31 st March 2001 the profit and loss account of the firm showed that the firm earned a profit of Rs. 4, 16,000 for the year. The respective drawings accounts showed that while B and C had withdrawn Rs. 60,000 each during the year, D’s drawings totaled to respective capital accounts.

You are required to:

(i) Prepare a statement showing distribution of profits for the accounting year ended 31 st March, 2001; and

(ii) Pass journal entries for all the transactions relating to death of the partner, D’s admission into partnership, and at the end of the year relating to transfer of Drawings Accounts and distribution of profit for the year.

Q.No.-48. A and M are partners, sharing profit and losses in the ratio of 3:2. G is admitted for 1/4 th share. Thereafter, N enters the partnership for 20 paise in a Rupee. Compute new profit sharing ratio.

21 AVINASH JAIN