INTERNATIONAL INDIAN SCHOOL, RIYADH GRADE – XII

advertisement

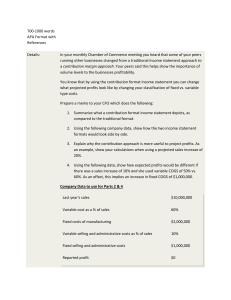

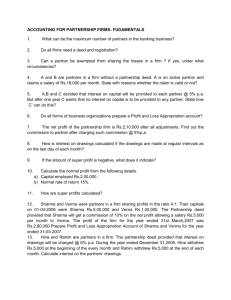

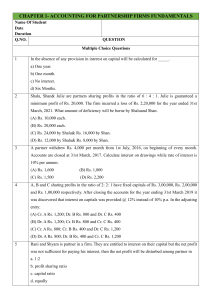

INTERNATIONAL INDIAN SCHOOL, RIYADH GRADE – XII ACCOUNTANCY FIRST TERM WORSHEET – 2013 – 14 Unit I Accounting for partnership firms – Fundamentals 1. What is meant by unlimited liability of a partner? 2. State one difference between fixed capital account and fluctuating capital account of partners. 3. What is meant by partnership deed? 4. List any four essential features / elements of partnership. 5. State any four contents of partnership deed. 6. J and K are partners in a firm. Their capitals are J Rs 300000 and K Rs 20000. During the year ended 30 – 03 – 2010 the firm earned a profit of Rs 150000. Assuming that the normal rate of return is 20%. Calculate the value of goodwill of the firm. i. By capitalization method and ii. By super profit method if the goodwill is valued at 2 years purchase of super profits. 7. How does the factor ‘location’ affect the goodwill of the firm? 8. Define goodwill. 9. What are super profits? 10. The total capital employed by a partnership firm is Rs 100000 and its super profit is Rs. 5000. Normal rate of return is 20 % in similar forms working under similar conditions. Calculate the average profit of the firm. 11. D, E and F were partners in a firm sharing profits in the ratio of 5: 7: 8. Their fixed capitals were D Rs 500000, E Rs700000 and F Rs 800000. Their partnership deed provided for the following: i. Interest on capital @ 10 % p.a. ii. Salary of Rs10000 per month of F iii. Interest on drawings @ 12% p.a. D withdrew Rs 40000 on 31st January 2009; E withdrew Rs 50000 on 31st March 2009 and F withdrew Rs30000 on 31st December. During the year ended on 31st December 2009 the firm earned a profit of Rs 350000. Prepare a profit and loss Appropriation Account for the year ended 31st December 2009. 12. K and R were partners in a firm sharing profits in the ratio of 7:3. Their fixed capitals ware K Rs 900000 and R Rs 400000. The partnership deed provided for the following but the profit for the year was distributed without providing for i. Interest on capital @9% p.a. ii. K’s salary is Rs50000 per year R’s salary Rs 3000 per month. The profit for the year ended 31-3-2007 was Rs 278000. Pass the Adjustment entry. Unit – 2 Accounting for partnership firms – Reconstitution and Disolution 1. List any two situations which may result the reconstitution of a partnership firm. 2. State the meaning of sacrificing ratio. 3. What are accumulated losses? 4. Give the meaning of gaining ratio. 5. Why are assets revalued at the time of admission of a partner? 6. L and M are partners in a firm sharing profits and losses in the ratio of 7:3. They admit N on 3/7 shares which he takes 2/7 from L and 1/7 from M. Calculate new profit sharing ratio. 7. A and B are partners which capitals of Rs 26000 and Rs 22000 respectively. They admit C as a partner with ¼ the share in the profit of the firm. C brings Rs 26000 as his share of capital. Give journal entry to record goodwill on C’s admission. 8. Ali and Arib were partners in a firm sharing profits in 4:1 ratio. They had insured their lives jointly for Rs Rs 500000. Ali died three months after the date of last balance sheet. According to the partnership deed, legal representatives of deceased partner were entitled to the following payments. i. This capital Rs 150000 as per the last balance sheet. ii. Interest on capital @ 12 % p.a. up to the date of death. iii. His share of profits to the date of death calculated on the basis of average profits for the last three years were Rs 100000 Rs 180000 and Rs200000. Prepare Ali’s capital Account to be rendered to his representative and the Executors Account. 9. P, Q and R are partners in a firm in the ratio of 5:3:2. On 31st December 2010 the form was dissolved. On dissolution the following particulars are available. i. Assets realized Rs 170000 after a loss of Rs 20000. ii. Liabilities were paid Rs 27000 including an unrecorded liability of Rs1000. iii. Realization expenses paid Rs 700. iv. On the date of dissolution, partner’s capital was in the ratio of 2:2:1. Prepare realization A/c, partner’s capital A/c and cash Account. 10. Given below is the Balance sheet of K and S who are partners in a firm sharing profits in the ratio of 3:2 Liabilities Assets Creditors 15000 Reserves 5000 Plant 30000 Patents 5000 Capital A/c :- Furniture 3000 K – 30000 Stock 16000 50000 Destors 15000 70000 Cash S – 20000 1000 70000 On the date M is admitted as a partner for 1/5th share on the following terms. a) He is to contribute Rs 14000 as share of capital which includes his share of premium for goodwill. b) Goodwill is valued at 2 years purchase the average profits of the last 4 years, which were Rs 10000, Rs9000, Rs 8000 and Rs 13000 respectively. c) Plant to written down to Rs 25000 and patents written by Rs 8000 d) Un recorded investments Rs 7000. Prepare the Revaluation A/c , partners capital A/c and Balance sheet of the new firm. 11. X, Y and Z were partners in a firm sharing profits in 5:3:2 ratio. On 31st March 2006 Z retired from the firm on the date of Z’s retirement, the Balance sheet of the firm was as follows. Balance sheet of X , Y and Z as on 31 – 3 – 2006 Liabilities Rs Assets Rs Creditors 27000 Bank 80000 Bills payable 13000 Outstanding rent 22500 (-) provision for doubtful debts(500) 19500 Provision for legal claim 57500 Stock 21000 Capitals :X 127000 Y 91000 Z 71000_____ 20000 Furniture Land and Building 87500 200000 288000 408000 408000 On Z’s retirement it was agreed that 1. Land and Building will be appreciated by 5 % and Furniture will be depreciated by 20 %. 2. Provision for doubtful debts will be made at 5% on debtors and provision for legal claims will be made at Rs 60000. 3. Goodwill of the firm was valued at Rs. 60000. 4. Rs 70000 from Z’s capital A/c will be transferred to his loan A/c and the balance will be paid to him by a cheque. Prepare revaluation A/c, partners capital A/c and Balance sheet of X and Y after Z,s retirement. Prepared by R.V. Ashok Mehta