An Introduction to Basic Investments

advertisement

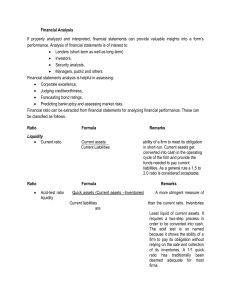

An Introduction to Basic Finance Herbert B. Mayo The College of New Jersey The 3 Divisions of the Finance Discipline Finance – the study of money and its management. – Financial Institutions – Investments – Corporate (business) finance Sources of Finance Balance Sheet – Financial statement that enumerates what an economic unit owns or owes and its net worth. A firms financial position Assets = Liabilities + Equity Assets - Items of property owned by a firm, household, or government and valued in monetary terms. An economic resource. Liabilities - What an economic unit owes expressed in monetary terms Equity - Owners investment in a firm (claim to the assets); a firms net worth or book value Risk, Return, and Financial Leverage Return - What is earned on an investment; the sum of income and capital gains generated by an investment Risk - Possibility of a loss; the uncertainty that the anticipated return will not be achieved Financial Leverage - Use of borrowed funds in return for agreeing to pay a fixed return; use of debt financing Risk and Return Valuation - Process of determining what an asset is currently worth Goal of management: maximize shareholder value Over time, the price of a company’s stock is indicative of management performance.