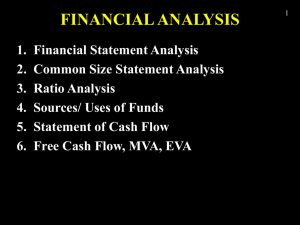

Chapter 9 Power Point Presentation 1

advertisement

Chapter 9 Analysis of Financial Statements 1 I. General Accounting Principles A. Reliability B. Understandability C. Comparability 2 II. The Balance Sheet A. Financial statement that enumerates what an economic unit owns and owes and its net worth B. Enumerates 1. Assets 2. Liabilities 3. Stockholders’ Equity C. Consolidated Balance Sheet 1. Parent company’s balance sheet, which summarizes and combines the balance sheets of the firms various subsidiaries 3 II. The Balance Sheet A. Assets 1. Items or property owned by a firm, household, or government and valued in monetary terms a) Current: cash and cash equivalents, accounts receivable, and inventory (1) Converted to cash within a year b) Long-term: land, buildings, machinery, and equipment (1) Held for more than one year 4 II. The Balance Sheet 1. Inventory a) Raw materials, work in process, and finished goods; what a firm has available to sell 2. Accounts Receivable a) Account rising from a credit sale that has not been collected 3. Hidden Assets a) Assets that have appreciated in value but are carried on the balance sheet at a lower value 5 II. The Balance Sheet A. Liabilities 1. What an economic unit owes a) Current (Accounts Payable, Accruals, Notes Payable) (1) Debt that must be paid during the fiscal year b) Long Term (1) Debt that becomes due after one year 6 II. The Balance Sheet A. Equity 1. Stock Holders Equity a) Stockholders investment in the firm (1) Preferred stock (2) Common stock 2. Additional paid-in capital 7 II. The Balance Sheet 1. Retained earnings a) The portion of net income which is retained by the corporation rather than distributed to its owners as dividends 2. Book value a) Firms total assets minus total liabilities; equity; net worth 3. Book value per share a) Book value divided by the number of shares outstanding 8 III. Income Statement A. Financial statement that summarizes revenues and expenses for a period of time to determine profit or loss B. Enumerates 1. Revenues 2. Expenses C. To determine 1. Income (earnings) 2. Earnings per share 9 IV. Statement of Cash Flows A. Financial statement summarizing cash inflows and cash outflows B. Enumerates 1. Sources of funds (cash inflows) 2. Uses of funds (cash outflows) 3. Determines change in the cash position 4. Emphasis on the firm’s ability to generate cash 10 IV. Statement of Cash Flows A. Cash Inflows 1. A decrease in an asset’s value 2. An increase in a liability Determines change in the cash position 3. An increase in equity B. Cash Outflows 1. An increase in an Asset’s Value 2. A decrease in a liability 3. A decrease in an Equity 11 V. Limitations of Accounting Data A. Non-measureable items are excluded B. Aggregations C. Biased estimates of data D. Insufficient challenges by auditors 12 VI. Depreciation A. Allocates cost of plant and equipment over time B. Non-cash expense C. Impact on taxes and cash flow 13 VI. Depreciation A. Straight-line depreciation 1. Equal allocation each year B. Accelerated depreciation 1. Larger proportion during early years 2. Recoups most of the cost quicker 3. Initially reduces income taxes 14