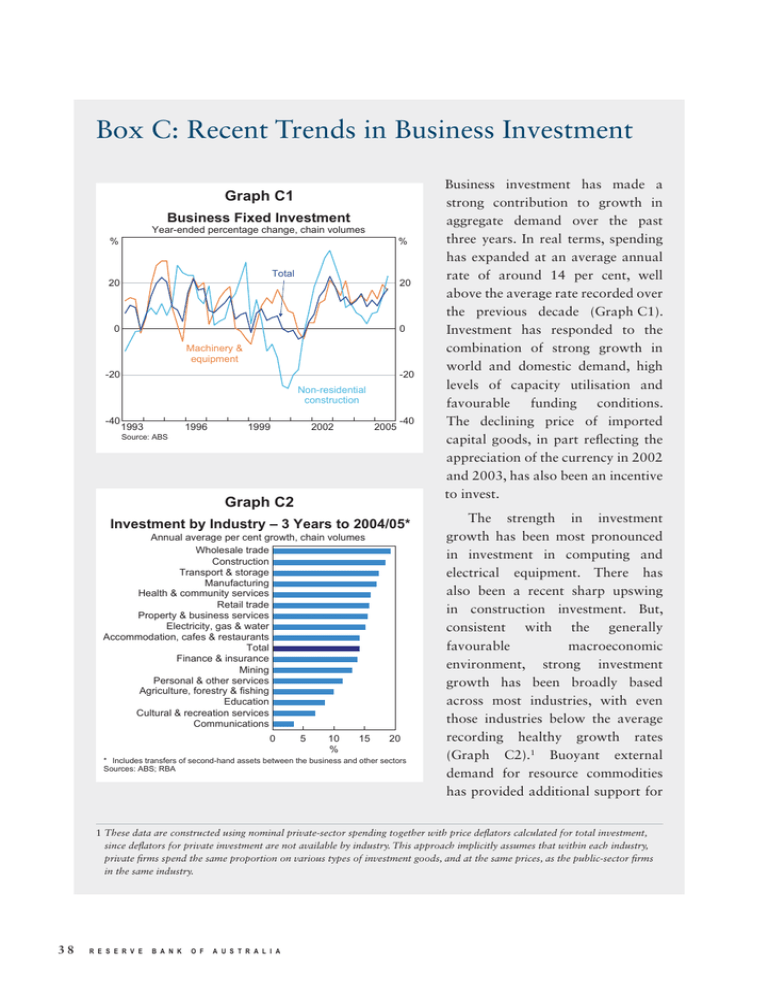

Box C: Recent Trends in Business Investment Graph C1

advertisement

Box C: Recent Trends in Business Investment Graph C1 Business Fixed Investment Year-ended percentage change, chain volumes % % Total 20 20 0 0 Machinery & equipment -20 -20 Non-residential construction -40 1993 1996 1999 2005 2002 -40 Source: ABS Graph C2 Investment by Industry – 3 Years to 2004/05* Annual average per cent growth, chain volumes Wholesale trade Construction Transport & storage Manufacturing Health & community services Retail trade Property & business services Electricity, gas & water Accommodation, cafes & restaurants Total Finance & insurance Mining Personal & other services Agriculture, forestry & fishing Education Cultural & recreation services Communications 0 5 10 % 15 20 * Includes transfers of second-hand assets between the business and other sectors Sources: ABS; RBA Business investment has made a strong contribution to growth in aggregate demand over the past three years. In real terms, spending has expanded at an average annual rate of around 14 per cent, well above the average rate recorded over the previous decade (Graph C1). Investment has responded to the combination of strong growth in world and domestic demand, high levels of capacity utilisation and favourable funding conditions. The declining price of imported capital goods, in part reflecting the appreciation of the currency in 2002 and 2003, has also been an incentive to invest. The strength in investment growth has been most pronounced in investment in computing and electrical equipment. There has also been a recent sharp upswing in construction investment. But, consistent with the generally favourable macroeconomic environment, strong investment growth has been broadly based across most industries, with even those industries below the average recording healthy growth rates (Graph C2).1 Buoyant external demand for resource commodities has provided additional support for 1 These data are constructed using nominal private-sector spending together with price deflators calculated for total investment, since deflators for private investment are not available by industry. This approach implicitly assumes that within each industry, private firms spend the same proportion on various types of investment goods, and at the same prices, as the public-sector firms in the same industry. 38 R E S E R V E B A N K O F A U S T R A L I A investment spending by the mining industry, as well as by resourcerelated firms in other industries. Perhaps surprisingly, investment in the manufacturing sector has been very strong, though this mostly reflects the resource-related areas of metals, petroleum, coal and chemical products, with investment growth relatively muted elsewhere. Graph C3 Investment and Funding* Share of nominal GDP % 15 % n Internal funding n Net equity** n Debt 15 Investment 10 10 5 5 The recent strength in overall 0 0 investment has also been facilitated by favourable conditions for both -5 -5 1993 1997 2001 2005 internal and external funding. * Funding measures – three-quarter moving average ** Issued equity less equity buybacks Corporate profitability has been high, Sources: ABS; ASX; RBA although the resulting pick-up in retained earnings has been outstripped by the expansion in investment spending. Consequently, firms’ demand for external funds has also increased, with the larger and generally more cyclical debt component picking up by more than net equity raisings (Graph C3). The strength in debt financing in recent quarters has been encouraged by relatively low corporate bond yields and interest rates on business loans. R S T A T E M E N T O N M O N E T A R Y P O L I C Y | F E B R U A R Y 2 0 0 6 39 40 R E S E R V E B A N K O F A U S T R A L I A