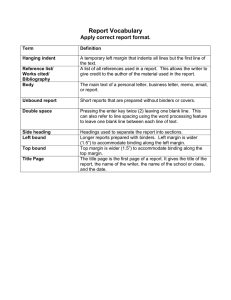

Chapter 3

advertisement

FINA 2802: Investments and Portfolio Analysis Securities Markets Dragon Yongjun Tang January 21 & 23, 2010 Lecture 4 & 5: Securities Markets Reading: Chapter 3 Practice Problem Sets: 1,2,3,4,6,7,8,9,10,12,13,14,18,20,21 2 Learning Objectives Role of investment bankers in primary issues Identify the various security markets Describe the role of brokers Compare trading practices in exchanges vs dealer markets Buy Stock on Margin and Sell Stock Short 3 Life Cycle of a Company Private (Entrepreneur + VC) Primary Secondary Commission Investment Bank Public (NYSE/Nasdaq) Dealer Market Maker Buy on Margin Buy Sell Short Bid-ask Spread Commission Broker Commission Sell 4 How Firms Issue Securities Primary Market: •Initial Public Offering (IPO) •Seasoned Equity Offering (SEO) Investment Bankers: •Assist firms in issuing securities •Firm Commitment (Take a risk in underwriting) •Best efforts (issuer bears the risk of not placement) 5 Figure 3.1 Relationship Among a Firm Issuing Securities, the Underwriters and the Public 6 Figure 3.2 A Tombstone Advertisement 7 Shelf Registration SEC Rule 415 Allows firms to register securities and sell them gradually to the public for two years. 8 Private Placements Firms sell shares directly to a small group of institutional or wealthy investors Cheaper: No need to register to SEC (Rule 144A) Smaller offerings 9 Initial Public Offering (IPO) Road shows, bookbuilding Cost: commissions (7%) + underpricing Investment bankers tend to underprice new issues IPO prices tend to rise after IPO (“Money left on the table”) IPO are usually poor long-term investments Internet Auction 10 IPO Underpricing: A dramatic example (VA Linux) IPO price: $30 First day closing price: $239.25 Today’s price: $1.00 Replicate this picture using finance.yahoo.com (LNUX) Day's Range: 1.00 - 1.04 52wk Range: 0.32 – 2.18 Volume: Avg Vol (3m): 28,795 270,871 Market Cap: P/E (ttm): EPS (ttm): Div & Yield: 64.31M N/A -0.055 N/A (N/A) Last Trade: 1y Target Est: 1.0025 1.59 11 Figure 3.3 Average Initial Returns for IPOs in Various Countries 12 Figure 3.4 Long-term Relative Performance of Initial Public Offerings 13 Where Securities Are Traded Secondary Market Organized exchanges – NYSE (or the Big Board); AMEX; regional exchanges Over the counter (OTC) – Nasdaq: market makers; three levels – Bond trading Directly between the two parties – Electronic Communication Networks (ECN) 14 National Market System •Established by Exchange Act of 1975 •Intent was to link firms electronically •Resulted in Consolidated Tape 15 Bond Trading Major concern: Liquidity Automated Bond System (ABS) OTC market 16 Trading on Exchanges The participants: Investors Brokerage firms (owns a “seat” on the exchange) Commission brokers Floor brokers 17 Trading on Exchanges The specialist (or market maker): •Makes a market •The brokers’ broker •Maintains the limit order book •Maintains a fair and orderly market NYSE is an example 18 New York Stock Exchange (NYSE) 19 Trading on Exchanges Types of orders: Market Limit Day Good-till-canceled Stop-loss orders; stop-buy orders 20 Figure 3.5 Limit Order Book for Intel on Archipelago 21 Figure 3.6 Price-Contingent Orders 22 Trading on Exchanges Block orders - at least 10,000 shares DOT & SuperDOT - direct to specialist Settlement – three business days Shares “In Street Name”. Shares kept by the broker after a transaction 23 Trading on OTC Markets •Negotiated market •No specialist •NASDAQ computer system 24 Nasdaq 25 Market Structures in Other Countries London - predominately electronic trading Euronext – market formed by combination of the Paris, Amsterdam and Brussels exchanges Tokyo Stock Exchange Hong Kong Stock Exchange Shanghai Stock Exchange 26 Cost of Trading Broker’s commissions: Explicit “Hidden” costs: Bid-Ask Spread Price Concession 27 Cost of Trading Impact of trading costs on returns Return = capital gains + current income - all broker ' s fees initial investment + initial broker ' s fees Cost of Trading Example: You bought a stock for $70 and later sold it for $80 You received $8 in dividends, paid an initial broker’s fee of $1% of purchase price, and paid another $1% of selling price when you sold the stock. What is your return on this investment (ignoring taxes)? 29 Placing an Order • Should you use a full-service or a discount broker? • What is the value of the full-service broker’s advice? 30 Student Loan You think your value will go up You want to make the most out of it So you borrow money to finance education 31 Buying on Margin Borrow to buy securities (make use of the Broker call’s loan) Securities stay with the broker as collateral 32 Buying on Margin Investor’s account: Assets Liabilities Value of stocks purchased Loan from Broker Equity Cost of setting up a margin strategy 33 Buying on Margin At time 0: Initial investor' s equity 0 Initial Margin 0 Market val ue of securities At 0 any future time Actual investor' s equity t Actual Margin t Market val ue of securities t Buying on Margin • The Federal Reserve System sets minimum initial margin requirements currently 50% • All exchanges set a minimum maintenance margin requirement currently around 30% 35 Buying on Margin Example: What is the initial margin if the investor purchases 100 shares of stock at $100 per share using $6,000 of her own money and borrows the rest? 36 Buying on Margin Example (continued): If the value of the above stock fell to $70 per share, what is now the actual margin? 37 Buying on Margin Example (continued): If the value of the above stock fell to $50 per share, what is now the actual margin? 38 Buying on Margin Margin Call Pmin= the lowest price a share can fall to without a call L = the loan value M = the margin requirement N = the number of shares Buying on Margin Margin Call Example: An investor purchases 100 shares of stock at $100 per share using $6,000 of her own money and borrows the rest. If the maintenance margin is 30%, what is the lowest price a share can fall without a call? 40 Margin Trading - Initial Conditions X Corp 50% 40% 1000 Initial Position Stock $70,000 $70 Initial Margin Maintenance Margin Shares Purchased Borrowed $35,000 Equity 35,000 41 Margin Trading - Maintenance Margin Stock price falls to $60 per share New Position Stock $60,000 Borrowed $35,000 Equity 25,000 Margin% = $25,000/$60,000 = 41.67% 42 Margin Trading - Margin Call How far can the stock price fall before a margin call? (1000P - $35,000)* / 1000P = 40% P = $58.33 * 1000P - Amt Borrowed = Equity 43 Problem 3, Chapter 3 (p. 93) Dee Trader opens a brokerage account, and purchases 300 shares of Internet Dreams at $40 per share. She borrows $4,000 from her broker to help pay for the purchase. The interest rate on the loan is 8%. a. What is the margin in Dee’s account when she first purchases the stock? b. If the share price falls to $30 per share by the end of the year, what is the remaining margin in her account? If the maintenance margin requirement is 30%, will she receive a margin call? c. What is the rate of return on her investment 44 Problem 7, Chapter 3 (p. 94) You are bullish on Telecom stock. The current market price is $50 per share, and you have $5,000 of your own to invest. You borrow an additional $5,000 from your broker at an interest rate of 8% per year and invest $10,000 in the stock. a. What will be your rate of return if the price of Telecom stock goes up by 10% during the next year? (Ignore the expected dividend.) b. How far does the price of Telecom stock have to fall for you to get a margin call if the maintenance margin is 30% of the value of the short position? Assume the price all happens immediately. 45 Why buy on margin? Borrowing magnifies ROE (risky strategy) Return on Equity ( ROE income ) equity income Return on Total Investment ( ROA ) total investment Leverage and ROE ROE RS RL RS L E RS RL 47 Short Sales Borrow Securities to sell them Sell first -- then buy! Margin is required (cost of short selling) Short position must be covered Investor expects price to decline 48 Short Selling Original Stock Holder 100 Shares Broker 100 Shares Short Seller 100 Shares New Stock Holder 49 Short Sales Return on Short Sale Price Buy Back Price Per Share Investment ( margin ) Short Sale Short Sales Example: An investor sells short 100 shares of stock at $100 per share. The margin requirement is 50% of the short sale. a. If the investor covers her short sale when the stock price declines to $70 per share, what is the return on the short sale? b. What is the return if there is no margin requirement? 51 Short Sales Example: An investor sells short 100 shares of stock at $100 per share. The margin requirement is 50% of the short sale. c. If the investor covers her short sale when the stock price increases to $130 per share, what is the return on the short sale? 52 Short Sales-Initial Margin Investor’s account at time 0: Assets Value of stocks sold ( P0 N ) Initial Margin (E0) Liabilities Value of Stocks owed ( P0 N ) Equity (Current Margin) Equity Percentage Initial Margin= Value of Stocks owed As time elapses, the value of stocks owed changes, affecting the %Margin! Short Sales-Margin Investor’s account at time t: Assets Liabilities Value of stocks sold( P0 N ) Value of Stocks owed ( Pt N ) Initial Margin (E0) DIVIDENDS DUE Equity (Et=Current Margin) Percentage Margin= Equity ( current margin) Value of Stocks owed As time elapses, the value of stocks owed changes, affecting the %Margin! Short Sales -Margin How high can the price of stock go before a margin call is issued? Actual margin= Equity t P N E0 Pt N 0 Value of stock owed t Pt N We want actual margin > required margin. Solve for Pt Short Sales Margin call price: Pmax NP0 E0 N M 1 Pmax maximumprice per share without margin call P0 price per share at time of short sale E0 initial margin N number of shares sold short M margin requiremen t Short Sales Example: An investor sells short 100 shares of stock at $100 per share. The initial margin requirement is 50% of the short sale. If the maintenance margin is 30%, what is the maximum stock price without a margin call on the short sale? 57 Short Sale - Initial Conditions Z Corp 50% 30% $100 100 Shares Initial Margin Maintenance Margin Initial Price Sale Proceeds $10,000 Margin & Equity 5,000 Stock Owed 10,000 58 Short Sale - Maintenance Margin Stock Price Rises to $110 Sale Proceeds $10,000 Initial Margin 5,000 Stock Owed 11,000 Net Equity 4,000 Margin % (4000/11000) 36% 59 Short Sale - Margin Call How much can the stock price rise before a margin call? ($15,000* - 100P) / (100P) = 30% P = $115.38 * Initial margin plus sale proceeds 60 Problem 4, Chapter 3 (p. 93) Old Economy Traders opened an account to short sell 1,000 shares of Internet Dreams from Question 3. The initial margin requirement was 50%. (The margin account pays no interest.) A year later, the price of Internet Dreams has risen from $40 to $50, and the stock has paid a dividend of $2 per share. a. What is the remaining margin in the account? b. If the maintenance margin requirement is 30%, will Old Economy receive a margin call? c. What is the rate of return on the investment? 61 Problem 8, Chapter 3 (p. 94) You are bearish on Telecom and decide to sell short 100 shares at the current market price of $50 per share. a. How much in cash or securities must you put into your brokerage account if the broker’s initial margin requirement is 50% of the value of the short position? b. How high can the price of the stock go before you get a margin call if the maintenance margin is 30% of the value of the short position? 62 Regulations of Securities Markets Securities Act of 1933 Securities Exchange Act of 1934 Securities Investor Protection Act of 1970 Blue Sky Laws Circuit Breakers Main Concern: Insider Trading Trading scandals and reactions: Sarbanes-Oxley Act 63 Summary Issuing securities Trading Buying on margin and short sales Next class: Mutual Funds 64