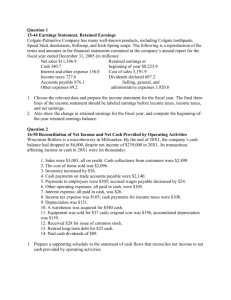

Lat21 Parch Corporation acquired a 90% ... common stock on January 1, 20X1 for $630,000 cash. The...

advertisement

Lat21 Parch Corporation acquired a 90% interest in Sarg Corporation’s outstanding voting common stock on January 1, 20X1 for $630,000 cash. The stockholder’s equity of Sarg on this date consisted of $500,000 capital stock and $200,000 retained earnings. The separate financial statement of Parch and Sarg corporations at and for the year ended December 31, 20X1 are summarized as follows: Parch Sarg $ 700,000 $ 500,000 Combined Income and Retained Earnings Statements for the Year Ended December 31, 20X1 Sales Income from Sarg 70,000 Gain on land - Gain on equipment 10,000 20,000 Cost of sales Depreciation expense Other expenses Net income Beginning retained earnings Dividends Retained earnings December 31, 20X1 - - (300,000) (300,000) (90,000) (35,000) (200,000) (65,000) 200,000 110,000 600,000 200,000 (100,000) (50,000) $ 700,000 $ 260,000 $ $ Balance Sheet at December 31, 20X1 Cash Accounts receivable-net 35,000 30,000 90,000 110,000 100,000 80,000 Other current items 70,000 40,000 Land 50,000 70,000 Buildings-net 200,000 150,000 Equipment-net 500,000 400,000 Investment in Sarg 655,000 Inventories $1,700,000 $ 880,000 Accounts payable $ 85,000 Other liabilities - $ 50,000 70,000 Capital stock, $10 par 500,000 500,000 Retained earnings 200,000 260,000 790,000 $ 880,000 $ During 20X1 Parch made sales of $50,000 to Sarg at a gross profit of $15,000. One-third of these sales were inventoried by Sarg at year-end. Sarg owed Parch $10,000 on open account at December 31, 20X1. Sarg sold land that cost $20,000 to Parch for $30,000 on July 1,20X1. Parch still owns the land. On January 1, 20X1 Parch sold equipment with a book value of $20,000 and a remaining useful life of four years to Sarg for $40,000. Sarg uses straight-line depreciation and assumes no salvage value on this equipment. Required : Prepare consolidation working papers for Parch Corporation and Subsidiary for the year ended December 31, 20X1.