C2P2 Assignment – 10K Analysis – Financial Statements

advertisement

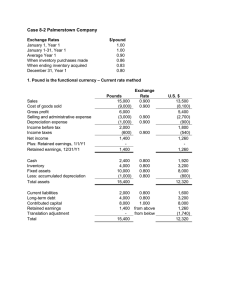

Running Head: FINANCIAL STATEMENTS 1 Financial Statements: Balance Sheets and Income Statements Amanda Baker Bellevue University FINANCIAL STATEMENTS 2 Abstract Financial statements are critical to the health of a business. They provide a glance into the intricacies of both the day-to-day operations and future endeavors of a business and are designed to help leaders make thoughtful and strategic decisions well before financial problems arise. The following highlights the balance sheet and income statement and provides answers to questions posed in this component’s lesson. FINANCIAL STATEMENTS 3 Financial Statements: Balance Sheets and Income Statements What is the total dollar amount of assets and where did you find this information? Identify some of the assets listed and explain what these assets represent. Current assets are assets that will likely be will be exchanged for cash in the near future. An example of a current asset is accounts receivable which means goods have been provided to the customer, however the company has not yet received payment. Because the company expects to receive payment in for those goods within a year, this asset is reported as current. Fixed assets include items that are intended for business operations and will not be sold at least for a year. Because fixed assets such as buildings, equipment, and furniture will depreciate over time, the depreciation amount must be accounted for on the balance sheet and its value is reported as net book value (value after depreciation). For instance, if the printer is used in the accounting department for multiple print runs daily, over time the printer will wear out and need to be replaced. When this asset is recorded on the balance sheet, the depreciation value over time must be taken into consideration. Other assets include miscellaneous assets that cannot otherwise be categorized with current and fixed assets such as other leases or other assets that have been paid in advance, but have not yet expired. What is the total dollar amount of liabilities and where did you find this information? Identify some of the liabilities listed and explain what these liabilities represent. FINANCIAL STATEMENTS 4 The total dollar amount of liabilities is $3,127. This information is also found on the balance sheet. The liabilities represented on the balance sheet are current liabilities – debt that is payable within one year and long-term debt which is money owed by the company and paid over a specific longer termed period. What is the ending retained earnings balance and where did you find this information? What does this retained earnings represent? The retained earnings of $375, a part of stockholder’s equity, is found on the balance. Retained earnings represent income that has accumulated but has not been redistributed. It is used to reinvest in the company or pay debt. (Investopedia). What stockholders' equity accounts are included and on the balance sheet? Preferred Stock – a less risky stock that is paid out to preferred shareholders before ordinary shareholders are paid. Common Stock ($10.00 par, 100,000 shares outstanding) – shares entitled to profits once all other costs have been incurred. Paid-in capital in excess of par on common stock – the amount a company receives when it issues shares of stock. Retained Earnings – accumulated undistributed income What is the total dollar amount of revenue and where did you find this information? Explain what is included in the revenue of this company. FINANCIAL STATEMENTS 5 The income statement shows the total operating revenue for XYZ Company as $2,575 and consists of money that the company has made before the cost of goods sold have been deducted. What is the total dollar amount of expenses and where did you find this information? Explain what is included in the expenses of this company. The total operating expenses of $675 and total interest expense is $60. This total of $735 in expenses is located on the income statement. Expenses include operating expenses such as selling, general and administrative, depreciation, and fixed while interest expenses refer to interest paid on short-term and long-term notes. Which financial statement do you personally feel gives you the most information? Why? Your response to this specific question should be at least 100 words. Both the balance sheet and income statement play an integral part in providing a snapshot of the financial health of a company. In determining which of the two statements provide the most information, it is important to first discuss the purpose of each statement and provide an overview of what each statement offers. Balance Sheet The balance sheet highlights assets, liabilities and investments of a company and it focuses on long-term benefits for the business such as equity payment received by the company or money paid out for equipment that will yield future returns. Income Statement The income statement focuses on revenue and costs currently being incurred and shows whether a company has profited or taken a loss. This statement provides an FINANCIAL STATEMENTS 6 operational glance and can be used to help company leaders identify and address possible issues early on. From a strategic point of view, the balance sheet provides the most information. Leaders are tasked with forming a long-term strategy and because the balance sheet focuses on future benefits, this would be an ideal report for strategic planning. However, a company’s success is dependent on its profitability. Leaders, shareholders, and stakeholders alike want to ensure that a company is profiting rather than taking a loss. The income statement provides a straightforward snapshot of money going in and money going out. All financial statements including the balance sheet, income statement, and cash flow statement, must be used in tandem to provide an overall picture of the company’s health while providing the necessary warnings for leadership to address problems before they start, or at least, before they become too large to resolve. FINANCIAL STATEMENTS References Libguides. (nd). Articulation of financial statements. Retrieved from http://libguides.bellevue.edu.ezproxy.bellevue.edu/c.php?g=148579&p=976032 Tennent, J. (2008). Guide to financial management. Retrieved from https://flexxive.bellevue.edu/bbcswebdav/pid-197847-dt-content-rid293687_1/courses/FBUS335XL02_2157_M01/Guide%20to%20Financial%20Management%20C2P1.pdf 7