American Political Economy

advertisement

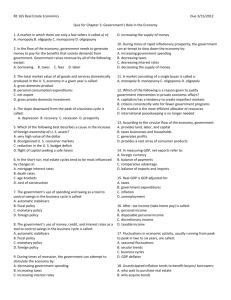

Public Policy 0 Results from battles among citizens, groups, and public officials 0 Determines who gets what, where, and how 0 Shapes future outcomes 0 Creates arrangements that confer advantages to some political actors and disadvantages to others 0 Occurs in context of tension between capitalism and democracy 0 Policies debated openly and determined within democratic institutions 0 Outcomes responsive (at least in part) to public opinion and what mobilized groups demand 0 Democratic features of policy making constrained and distorted by 0 Advantages capitalism confers 0 Patterns of inequality 0 Uneven access to political institutions Economic Policy 0 Gross Domestic Product (GDP) = total goods and services produced 0 Government has grown since 1950s (Table 9.1) 0 increasing activities of government (social welfare and defense) 0 Size of government small in comparison 0 0 0 0 Tax burden light: lower % of GDP in form of taxes (Figure 9.1) Spends less as % of GDP (Figure 9.2) Leaner benefits and fewer public services Small public sector employment 0 Government lacks power to manage economy and significantly influence behavior of private firms 0 Corporate managers enjoy greater autonomy 0 Firms subject to fewer government regulations 0 Modes and institutional constraints: Fiscal (budget) and monetary policy (interest rates) 0 Fiscal policy divided between Congress and President 0 Monetary policy controlled by “independent” Federal Reserve Board (FED) Fiscal Policy 0 Manipulates total amount of government revenue and spending to manage overall demand 0 Budget deficits stimulate economy (unemployment) 0 Budget surpluses restrain economy (inflation) 0 Budget more than fiscal tool – establishes priorities and values of government 0 Determines winners and losers; distributes costs and benefits 0 Reveals relationships of power 0 Budget process involves partisan, institutional, and interest group conflict 0 Starts with President and goes to Congress (budget committees) 0 Appropriations bills emerge and are sent to President Taxes 0 Highly contentious – level, types, shares 0 Receipts rose from 1983-2000 (20% GDP) 0 Bush’s tax cuts reversed trend (16.5% by 2003) 0 Decline in revenue, rising federal deficits => debt payments strain government’s ability to provide services 0 Federal government (Table 9.2) 0 Corporate income taxes declined (loopholes, credits, accounting gimmicks, shelters); supposed to be 35% (not 20%) 0 Excise taxes (alcohol, cigarettes, gas) down 0 Social Security payroll taxes up 0 Progressive (rich pay larger proportion of income) or Regressive (tax rates same regardless of income)? 0 Regressive (Figure 9.3): tax burden roughly same for all income groups 0 Incentives through exemptions, rebates, deductions (mortgage interest; depreciation for equipment; IRAs) 0 Tax expenditures = public subsidies through favored tax treatment; not as visible; less likely to arouse conflict 0 “subterranean politics” results in very complex tax code Spending 0 Groups struggle over how much should be spent; what it should be spent on 0 Government expenditures have increased (1950, 15.6% of GDP; 2008, 21%) 0 Government does more (Social Security; Medicare/Medicaid; EPA; other functions) 0 Federal outlays for defense and welfare (Table 9.3) 0 Welfare state expenses account for 63.6% of all spending (2008) 0 Welfare and warfare account for 93% of all outlays 0 All other tasks get remaining 7% 0 2/3 of all government spending mandatory (debt, entitlement programs (e.g., Social Security, food stamps, Medicare)) 0 1/3 discretionary spending (jurisdiction of Appropriations Committees) 0 Largest is defense (1/2 of all discretionary spending) Monetary Policy 0 Manipulation of interest rates, cost of money 0 High rates slow economy; low rates encourage borrowing, spending 0 Differential impact on groups 0 Controlled by Federal Reserve Board (FED) 0 Determines interest rate banks pay to borrow money (low rates increase money supply) 0 Buys and sells government bonds (puts more money into circulation) 0 Sets reserve rate banks must hold on deposits (higher rates decrease money supply) 0 FED (created in 1913) substantial autonomy (independence from Congress and President) insulates monetary policy from democratic control 0 Subject to capture by banks => representatives in policymaking bodies; mobilization of bias (what is good for banks is good for economy) 0 Changes under Bernanke (took over from Greenspan, 2008) 0 Support for regulation of financial sector; FED lender of last resort 0 Purchases and guarantees (over $5 trillion) dwarfs bailout money 0 More active, more regulatory oversight, more investments (make it more target of lobbying, jeopardizes independence) 0 Remains very cozy with financial sector (What’s good for Wall Street is good for America) Regulation 0 Authorized by Congress, bureaucracy sets rules firms must follow 0 U.S. has comparatively low level of government regulation 0 Government regulation necessary because markets are not self-regulating, will not protect public interest and social values 0 Progressive and New Deal Eras (first wave) popular pressure prompted government to create economic regulation for specific industries (prices, standards, competition, licenses) 0 Interstate Commerce Commission (1887) – regulate railroad rates and routes 0 Federal Trade Commission (1914) – protect consumers from unfair business practices 0 Food and Drug Administration (1931) – protect consumers from tainted foods, harmful drugs 0 Securities and Exchange Commission (1934) – protect investors from fraud 0 Agencies often captured by industry; “revolving door”; serve interests of industry rather than public 0 Second wave (1960s) demanded social regulation, across industries (antidiscrimination, environmental regulations, workplace safety) 0 Civil rights agencies – protect against discrimination 0 Environmental Protection Agency (1970) – develop/enforce environmental standards 0 Occupational Safety and Health Administration (1970) – establish/monitor workplace safety and health standards 0 Consumer Products Safety Commission (1972) – ensure product safety 0 Prompted counteroffensive by business community calling for “regulatory reform” 0 Ongoing conflict over standards, enforcement, and industry capture