Chapter 17 and 18 AP

advertisement

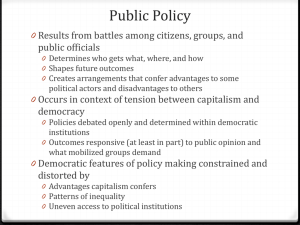

Chapter Seventeen The Policy-Making Process The Policy Making Process Political agenda~ Issues that people believe require governmental action Legitimate scope of government action is generally determined by public opinion. What do you see as the issues that require governmental action? What is the legitimate scope of the government? Costs, Benefits, and Policy Cost: any burden, monetary or non-monetary, that some people must, or expect, to bear from the policy Benefit: any satisfaction, monetary or non-monetary, that some people must, or expect, to receive from the policy Politics is a process of settling disputes over who benefits/pays and who ought to benefit/pay. Types of Politics: Majoritarian politics: distributed benefits, distributed costs (Antitrust legislation) Interest group politics: concentrated benefits, concentrated costs (Union labor) Client politics: concentrated benefits, distributed costs (Milk industry) Entrepreneurial politics: distributed benefits, concentrated costs (Sinclair, Nader) Figure 17.1: A Way of Classifying and Explaining the Politics of Different Policy Issues Economic Policymaking Chapter 18 Managing the Economy Types of Economic Policies Fiscal Policy: taxing and spending (budget). Handled by Congress and the President Monetary policy: regulation of the money supply by the Federal Reserve Board (the Fed). Economic Theories: 1. Keynesian economics: Government can manipulate the health of an economy through spending 2. Supply-side economics: Cuts in taxes will produce business investment that will offset loss of $ due to lower taxes. 3. Monetarism: Money supply is the most important factor for determining the health of the economy 4. Economic planning: The free market is unstable and therefore the government must plan parts of the country’s economic activity. Funding the Government We authorize the government, through the Constitution and elected officials, to raise money through taxes. Taxation is the primary way that the government collects money. Without revenue, or income from taxes, government would not be able to provide goods and services. The Power to Tax Article 1, Section 8, Clause 1 of the Constitution grants Congress the power to tax. The Sixteenth Amendment gives Congress the power to levy an income tax. Limits on the Power to Tax 1. The purpose of the tax must be for “the common defense and general welfare.” 2. Federal taxes must be the same in every state. 3. The government may not tax exports. Tax Structures Proportional Taxes (PA State Tax) A proportional tax is a tax for which the percentage of income paid in taxes remains the same for all income levels. Progressive Taxes (Federal Income Tax) A progressive tax is a tax for which the percent of income paid in taxes increases as income increases. Regressive Taxes (Sales Tax) A regressive tax is a tax for which the percentage of income paid in taxes decreases as income increases. Spending Categories Mandatory Spending Money that lawmakers are required by law to spend Interest payments on the national debt “Entitlement” programs (Social Security, Medicare and Medicaid) Discretionary Spending Money that government planners can choose how to spend. Defense Education Training Environmental cleanup National parks and monuments Scientific research Land management Farm subsidies Foreign aid Source of Federal Revenue Social Security and Medicare Taxes (21%) Unemployment Taxes (12%) Federal Income Taxes (49%) Corporate Taxes (10%) Excise Taxes (3%) Other (4%) Estate Taxes Gift Taxes Import Taxes The President’s Message on the 2010 budget Taxing and Spending Entitlements: Programs where money is automatically spent without annual review of programs. 1. Social Security 2. Medicare 3. Federal Pensions 4. Interest on National Debt Makes up almost 2/3 of federal budget Problem because Congress and the President cannot control much of spending Budget Process 1. Agencies prepare their budget needs and submit to President’s Office of Management and Budget (OMB) 2. OMB makes recommendations to President 3. President submits budget to Congress 4. Congressional Budget Office (CBO) checks President’s budget 5. Ways and Means committee in House review taxes and revenues. 6. Appropriations committee review spending 7. Agencies lobby for money 8. Majority vote in both houses passes budget 9. President signs or vetoes bill (no line-item veto) The Federal Budget Debate Social Welfare Policy Trade Policy Trade deficits (US imports more goods from other nations than it exports) have led to calls for protectionism. Recent push for free trade GATT WTO NAFTA The Federal Reserve The Federal Reserve (“Fed”) serves as the nation’s central bank, which is designed to oversee the banking system and regulate the quantity of money in the economy. The “Fed” is a privately owned institution, authorized in 1914 by Congress to ensure the health of the nation’s banking system. The Fed is run by its Board of Governors. Seven members appointed by the President of the United States. The Chairman of the Board is the most important position: presiding, directing, and testifying about Fed policy. He is appointed by the President and confirmed by the Senate. The Federal Reserve System is made up of the Federal Reserve Board in Washington, D.C. and twelve regional Federal Reserve Banks. Three Primary Functions of the Fed ¬ Regulate the private banking industry to make sure banks follow federal laws intended to promote safe and sound banking practices. - Act as a banker’s bank, making loans to other banks and as a lender of last resort. ® Control of the supply of money i.e. Monetary Policy. Tools of Monetary Control The Fed has three instruments of monetary control: Open-Market Operations: Buying and selling bonds. Changing the Reserve Ratio: Increasing or decreasing the ratio. Changing the Discount Rate: The interest rate the Fed charges other banks for loans. Problems with controlling the monetary system: The Fed does not control the amount of money that households choose to hold as deposits in banks. The Fed does not control the amount of money that bankers choose to lend.