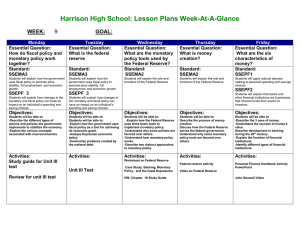

(2008) Fiscal policy and monetary policy are two tools used by the

advertisement

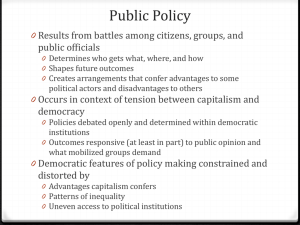

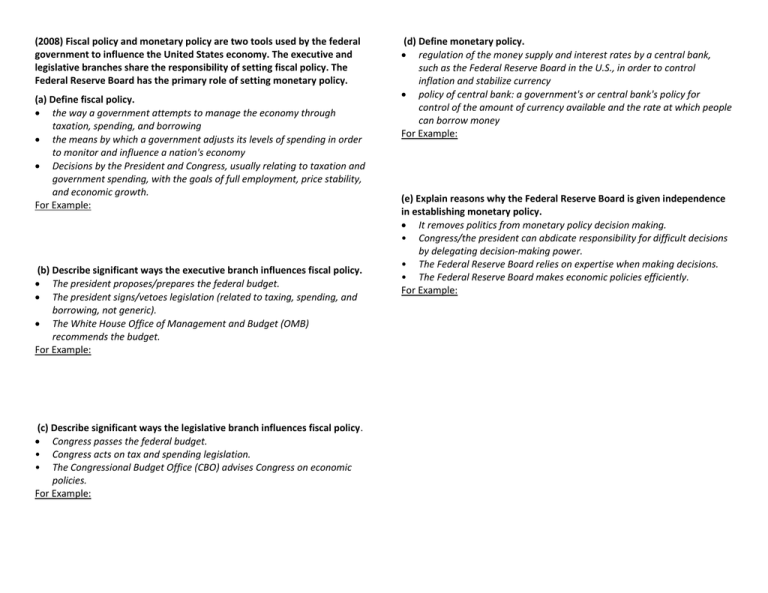

(2008) Fiscal policy and monetary policy are two tools used by the federal government to influence the United States economy. The executive and legislative branches share the responsibility of setting fiscal policy. The Federal Reserve Board has the primary role of setting monetary policy. (a) Define fiscal policy. the way a government attempts to manage the economy through taxation, spending, and borrowing the means by which a government adjusts its levels of spending in order to monitor and influence a nation's economy Decisions by the President and Congress, usually relating to taxation and government spending, with the goals of full employment, price stability, and economic growth. For Example: (b) Describe significant ways the executive branch influences fiscal policy. The president proposes/prepares the federal budget. The president signs/vetoes legislation (related to taxing, spending, and borrowing, not generic). The White House Office of Management and Budget (OMB) recommends the budget. For Example: (c) Describe significant ways the legislative branch influences fiscal policy. Congress passes the federal budget. • Congress acts on tax and spending legislation. • The Congressional Budget Office (CBO) advises Congress on economic policies. For Example: (d) Define monetary policy. regulation of the money supply and interest rates by a central bank, such as the Federal Reserve Board in the U.S., in order to control inflation and stabilize currency policy of central bank: a government's or central bank's policy for control of the amount of currency available and the rate at which people can borrow money For Example: (e) Explain reasons why the Federal Reserve Board is given independence in establishing monetary policy. It removes politics from monetary policy decision making. • Congress/the president can abdicate responsibility for difficult decisions by delegating decision-making power. • The Federal Reserve Board relies on expertise when making decisions. • The Federal Reserve Board makes economic policies efficiently. For Example: