Quiz for Chapter 3 - the Home Page for Voyager2.DVC.edu.

advertisement

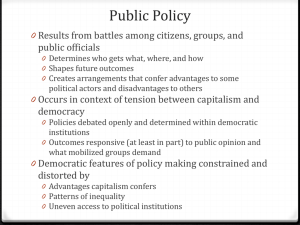

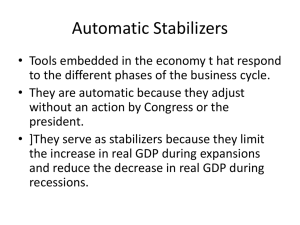

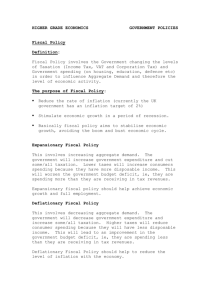

RE 165 Real Estate Economics Due 3/15/2012 Quiz for Chapter 3: Government’s Role in the Economy 1. A market in which there are only a few sellers is called a( n): A. monopoly B. oligopoly C. monopsony D. oligopsony 2. In the flow of the economy, government needs to generate money to pay for the benefits that society demands from government. Government raises revenue by all of the following except: A. borrowing B. taxes C. fees D. labor 3. The total market value of all goods and services domestically produced in the U. S. economy in a given year is called: A. gross domestic product B. personal consumption expenditures C. net export D. gross private domestic investment 4. The slope downward from the peak of a business cycle is called: A. depression B. recovery C. recession D. prosperity 5. Which of the following best describes a cause in the increase of foreign ownership of U. S. assets? A. very high value of the dollar B. disorganized U. S. consumer markets C. reduction in the U. S. budget deficit D. flight of capital seeking a safe haven 6. In the short run, real estate cycles tend to be most influenced by changes in: A. mortgage interest rates B. death rates C. age brackets D. cost of construction 7. The government’s use of spending and taxing as a tool to control swings in the business cycle is called: A. automatic stabilizers B. fiscal policy C. monetary policy D. foreign policy 8. The government’s use of money, credit, and interest rates as a tool to control swings in the business cycle is called: A. automatic stabilizers B. fiscal policy C. monetary policy D. foreign policy 9. During times of recession, the government can attempt to stimulate the economy by: A. decreasing government spending B. increasing taxes C. increasing interest rates D. increasing the supply of money 10. During times of rapid inflationary prosperity, the government can at-tempt to slow down the economy by: A. increasing government spending B. decreasing taxes C. decreasing interest rates D. decreasing the supply of money 11. A market consisting of a single buyer is called a: A. monopoly B. monopsony C. oligopsony D. oligopoly 12. Which of the following is a reason given to justify government intervention in private economic affairs? A. capitalism has a tendency to create imperfect markets B. citizens consistently vote for fewer government programs C. the market is the most efficient allocator of resources D. international peacekeeping is no longer needed 13. According to the circular flow of the economy, government: A. provides land, labor, and capital B. taxes businesses and households C. generates profits D. provides a vast array of consumer products 14. In measuring GDP, net exports refer to: A. foreign currency B. balance of payments C. comparative advantage D. balance of exports and imports 15. Real GDP is GDP adjusted for: A. taxes B. government expenditures C. inflation D. unemployment 16. After- tax income (take-home pay) is called: A. personal income B. disposable personal income C. discretionary income D. taxable income 17. Fluctuations in economic activity, usually running from peak to peak in two to six years, are called: A. seasonal fluctuations B. secular trends C. business cycles D. GDP deflator 18. Unanticipated inflation tends to benefit buyers/ borrowers: A. who wait to purchase real estate B. who acquire bonds RE 165 Real Estate Economics Due 3/15/2012 Quiz for Chapter 3: Government’s Role in the Economy C. with fixed interest rate loans D. with adjustable rate loans 19. According to fiscal theory, a tax decrease should: A. increase private spending B. decrease private savings C. fight inflation D. create unemployment 20. A famous economist, considered to be the founder of ‘‘new economics,’’ who advocated using government fiscal policy to offset unemployment: A. Adam Smith B. Milton Friedman C. John Stuart Mill D. John Maynard Keynes 21. In the short run, a reduction in the supply of money should increase: A. taxes B. government spending C. interest rates D. real estate construction rates 22. When government revenues exceed government spending, there should be a budget: A. deficit B. balance C. decline D. surplus 23. The type of unemployment that recovers as the economy recovers is called: A. cyclical B. structural C. chronic D. stifled 24. Progressive income taxes and unemployment benefits are examples of the use of: A. monetary policy B. pure capitalistic theory C. automatic stabilizers D. Federal Reserve policies 25. Fiscal and monetary policies run into problems because of structural difficulties, measurement problems, and: A. uniform applications B. political difficulties C. computer difficulties D. contractual applications