AMERICAN GOVERNMENT

advertisement

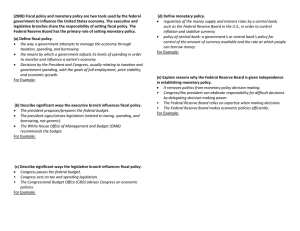

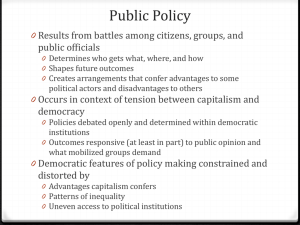

AMERICAN GOVERNMENT Red Flag Questions Pages 206-213 CHAPTER 7: THE EXECUTIVE BRANCH AT WORK SECTION 3: Financing Government By the end of this section, you will be able to answer these questions: 1. How does the federal government pay for its operations? 2. What are the two types of government spending? 3. How does the federal budget process work? 4. How do fiscal and monetary policy affect the nations economy? PAYING FOR THE GOVERNMENT Income taxes What is an income tax and what amendment gave government the power to levy this tax? What share of revenue does the income tax bring in for the government? progressive tax (give example) What percentages are paid by low-income and high-income earners? Payroll Taxes payroll tax regressive tax (give example) How is the payroll tax different from the income tax? proportional tax (give example) Other sources of Revenues What are tariffs? estate tax gift tax Why does the gift tax exist? What other sources of nontax revenue does the government collect? Borrowing Money bond When does a deficit occur? federal debt What is the current federal debt of the U.S.? GOVERNMENT SPENDING Mandatory Spending mandatory spending (give example) What percentage of the annual budget is spent on mandatory spending? Discretionary Spending discretionary spending What percentage of the annual budget is spent on discretionary spending? Why can approving the budget become a long and laborious process? THE BUDGET PROCESS What does fiscal mean? What will be the starting and stopping dates for FY2012? The President’s Budget Where does the creation of the federal budget begin and what does it reflect? How does the Office of Management and Budget assist the president in preparing his budget? When is the president’s budget complete? The Budget in Congress What is the purpose of the Congressional Budget Office? What two-step process does congress follow when working on the budget? How are Budget Committees different from Appropriations Committees? What may happen if Congress does not complete the budget by the beginning of the fiscal year? FISCAL AND MONETARY POLICY fiscal policy monetary policy Fiscal Policy What is the goal of fiscal policy? How might the government stimulate the economy if it is growing slowly or shrinking? What are the risks of increasing government spending or cutting taxes to boost the economy? What is inflation? How might government combat inflation? Monetary Policy How does the government influence the economy through monetary policy? What is the Federal Reserve System? In what three ways does the Fed carry out monetary policy? Why is creating a successful monetary policy a balancing act?