Mr. Gene Collins

advertisement

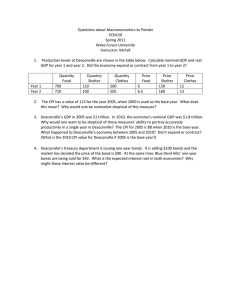

Mr. Gene Collins John B. and Lillian E. Neff Department of Finance College of Business and Innovation The University of Toledo The Immediate Global Banking Liquidity Crisis has been resolved – Slow Liquidity removal remains. Coordinated Global Credit management efforts are working unevenly - Europe Slow growth will likely continue through the first quarter of 2013 The increase in taxes to pay for the prior excesses has already begun Dollar stability some strength until 2011 More consistent but relatively slow growth continues through 2012. Bank Liquidity withdraw may need to wait until 2013 as Bank Lending improves. Manufacturing continues to grow - small inventory rebuild – Euro jeopardizes dollar competitiveness Housing continues to be a drag on the economy into 2012. Government Deficits will continue to be a drag through 2012 as State and Local Governments reduce spending and Federal reduction perception improves Relatively slow growth (1.5-3.1) continues through Q2 2013 with real unemployment slightly higher. Bank Liquidity withdraw may need to wait until 2013 as improved Bank Lending continues. Manufacturing continues to expand – dollar competitiveness-some setbacks from Euro Housing continues to be a drag on the economy into 2013. Government Deficits will continue to be a drag through 2012 stabilizing in 2013 as State and Local Governments reduce spending and Federal reduction perception improves. Draconian measures of deficit reduction will be softened by both parties (after the November elections). The Euro Zone will hold together as the decline in the Euro improves their exports at the expense of the US. Germany fights a rear guard action but funds the Euro. 2012 2011 Y/Y % Q1 Q2 Q3 Real GDP Consumer Spending 0.4 1.3 2.0 2.1 0.7 Business Investment 2.1 Government Spending Net Exports GDP Addition 2011 2012 (E)Q4 (E)Q1 (E)Q2 (E)Q3 (E)Q4 Annual Average 2.6 1.9 2.1 2.9 2.8 1.6 2.4 2.3 2.4 2.2 2.3 2.5 2.6 1.9 2.4 10.3 14.8 5.1 4.4 5.3 6.8 6.1 8.1 5.7 -5.9 -0.9 -0.1 0.0 -2.1 -1.8 -1.0 -0.6 -1.7 -1.4 -0.3 0.2 0.5 -0.2 0.1 0.2 0.6 0.0 0.0 0.2 2012 Y/Y % 2013 (E)Q1 (E)Q2 (E)Q3 1.9 2.1 2.9 2.8 2.4 2.2 2.3 2.5 2.6 Business Investment 4.4 5.3 6.8 Government Spending -2.1 -1.8 0.1 0.2 Real GDP Consumer Spending Net Exports GDP Addition (E)Q4 (E)Q1 (E)Q2 2012 2013 (E)Q3 (E)Q4 Annual Average 2.7 3.0 3.3 2.4 2.8 2.3 2.6 2.9 3.2 2.4 2.7 6.1 5.1 5.8 6.5 6.9 5.7 6.0 -1.0 -0.6 -2.0 -1.8 -1.6 -0.8 -1.4 -1.6 0.6 0.0 0.1 0.2 0.2 0.1 0.2 0.1 2011 Actual 2012 2011 2012 Q1 Q2 Q3 Headline CPI (Y/Y) 5.2 4.1 3.1 2.1 2.8 2.7 2.5 2.0 3.6 2.5 Core CPI (Y/Y) 2.5 2.7 1.8 2.1 2.5 2.3 1.3 2.2 2.0 1.7 (E)Q4 (E)Q1 (E)Q2 (E)Q3 (E)Q4 Annual Average 2013 2013 (E)Q1 (E)Q2 (E)Q3 (E)Q4 Average Headline CPI (Y/Y) 2.3 2.6 2.9 3.1 2.7 Core CPI (Y/Y) 1.6 2.2 2.1 2.3 2.1 Domestic CPI will rise gradually reaching an actionable target range for the FED by Q4 2013. Core CPI will remain under control and show a stable to upward bias. Unemployment Rate will not be a reliable economic indicator because of participation rate variation. The percent of the population employed will continue to decline in 2012– While employment increases. Housing price increases remain flat to weak in most areas as knock-on foreclosures from continued unemployment and underemployment increase with no further tax subsidies and established tighter underwriting. The over built and weak economic areas will continue to see some further housing price depreciation into 2012 from foreclosure pressure. Fed Funds rate will remain well below the Fed 0.5% target into 2013. Fed bond purchases will continue through 2012 at decreasing levels after Q3 2012 Year end Fed Funds still below ¼ %. Direct Fed stress sector lending has ended. No major liquefying of the Fed balance sheet until Q4 2012 or 2013 The term structure of interest rates indicates low inflationary economic growth continues. Stimulating Federal Payroll Tax Holiday o Extension of Tax reductions for another year o Modest Spending Federal Increases o Some further Public Works Infrastructure o Deficit “Reduction” cuts will be moderated by economic performance after November 2012 State fiscal problems a major economic negative o Reductions in employment continues more slowly o More Municipal Bankruptcies o Capital projects reduction slows to maintenance o Continued tax and user fee increases continues Annual Average Expected GDP Growth 2010 (A) 2.7 % 2011 1.6 % 2012 2.4 % 2013 2.8% Carpe Diem BMO Capital Markets Economics, November 25,2011 Barclays Capital Markets Research Bloomberg News, Bloomberg LLC St. Louis Federal Reserve Bank of Canada Monetary Policy Report October 2011Quarterly Report Cleveland Federal Reserve