Chapter 12 - Capital Structure and Leverage

advertisement

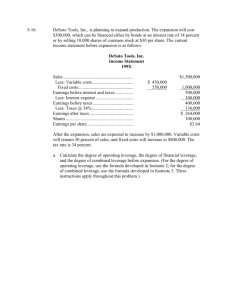

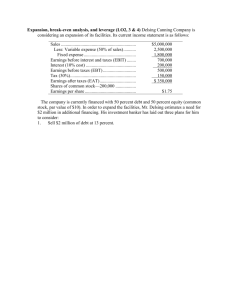

Operating and Financial Leverage (Chapter 5) Business and Financial Risk Employing Leverage Leverage and the Income Statement Operating Leverage and Business Risk Breakeven Analysis Degree of Operating Leverage Degree of Financial Leverage Degree of Combined Leverage Illustration of Leverage Effects Business and Financial Risk Business Risk - Uncertainty inherent in the firm’s operations if it used no debt. Major Factors Affecting Business Risk: – Total sales variability – Total fixed operating expenses Financial Risk – Additional risk incurred through the use of debt financing. Employing Leverage Leverage: – Use of “fixed cost” items in the process of magnifying earnings. Operating Leverage: – Use of “fixed operating costs” in the process of magnifying operating income (EBIT) Financial Leverage: – Use of “fixed financial costs” (e.g., debt and preferred stock financing) in the process of magnifying earnings per share EPS. Our discussion focuses on the use of debt financing. Leverage and the Income Statement - Sales Fixed costs Variable costs EBIT Interest EBT Taxes EAT Operating Leverage Total Leverage Financial Leverage Note: EPS = EAT/(# shares) [assuming no pfd. stock] Leverage Analysis: An Example Webb’s Incorporated Income Statement (Year Ended December 31, 2002) - Sales (30,000 units @ $25) Variable costs ($7 per unit) Fixed costs EBIT Interest expenses EBT Taxes EAT Given 20,000 shares outstanding: EPS = $66,000/20,000 = $3.30 $ 750,000 (210,000) (270,000) $ 270,000 (170,000) $ 100,000 ( 34,000) $ 66,000 Key to Symbols Used in the Following Analyses Note: The symbols used in the notes differ somewhat from the symbols used in the text. P = price per unit Q = sales in units V = variable cost per unit F = fixed costs VC = total variable costs TC = F + VC = total costs S = PQ = sales dollars EBIT = S - TC Operating Leverage and Business Risk Calculating Breakeven Point in Units: – (1) S - TC = 0 – (2) S - F - VC = 0 – (3) PQ - F - VQ = 0 – (4) PQ - VQ = F F Q (P V ) Webb’s Breakeven Point in Units: F $270,000 Q 15,000 units ( P V ) $25 $7 Calculating Breakeven Point in Dollars: F (multiply both sides by P) P V PF PQ (divide numerator & denominator by P) P V F S= (multiply V / P by Q / Q) V 1P F F Result: S VQ VC 1 1 PQ S F $270,000 S $375,000 VC $210,000 1 1 S $750,000 Q Breakeven Chart Thousands of Dollars 1200 S 1000 800 TC 600 400 200 0 0 15 30 Thousands of Units 45 EBIT Chart Thousands of Dollars 600 EBIT 500 400 300 200 100 0 -100 -200 -300 -400 15 30 45 Thousands of Units Degree of Operating Leverage % in EBIT DOL % in Sales Q( P V ) S VC = Q( P V ) F S VC F S VC = EBIT Note: If F = 0, DOL = 1 (i.e., without any F, the % change in EBIT would be equal to the % change in sales). By employing F, the firm’s % change in EBIT will be greater than the % change in sales. Webb’s DOL When Q = 30,000 Units 30,000($25 $7) DOL 2.0 30,000($25 $7) $270,000 For every 1% change in sales, EBIT will change 2%. Operating Leverage is Risky: If sales increase 5%, a DOL of 2.0 indicates that EBIT would increase 10%. On the other hand, if sales decline 7%, a DOL of 2.0 indicates that EBIT would decline 14%. Degree of Financial Leverage % in EPS DFL % in EBIT EBIT = EBIT - I Note: If interest expense = 0, DFL = 1.0 (i.e., without any debt financing, the % change in EPS would be equal to the % change in EBIT). By incurring interest expense (debt financing) the firm’s % change in EPS will be greater than the % change in EBIT. Webb’s DFL When Q = 30,000 Units $270,000 DFL 2.7 $270,000 $170,000 For every 1% change in EBIT, EPS will change 2.7% Financial Leverage is Risky: If EBIT increases 2%, a DFL of 2.7 indicates that EPS would increase 5.4%. On the other hand, if EBIT declines 4%, a DFL of 2.7 indicates that EPS would decline 10.8%. Degree of Combined Leverage % in EPS % in Sales Q( P V ) = Q( P V ) F I S VC S VC = S VC F I EBT % in EBIT % in EPS = % in Sales % in EBIT = (DOL)(DFL) DCL Note: If F = 0, and I = 0, DCL = 1.0 (i.e., without F or I the % change in EPS would be equal to the % change in sales). By employing F or I (or both), the firm’s % change in EPS will be greater than the % change in sales. Webb’s DCL When Q = 30,000 Units 30,000(25 7) DCL 30,000(25 7) 270,000 170,000 = (DOL)(DFL) = (2)(2.7) = 5.4 Illustration of Leverage Effects (A 10% Increase in Sales for Webb’s Inc.) Bef. Sales Inc. - - Sales (33,000 units @ $25) Variable costs ($7 per unit) Fixed costs EBIT Interest expense EBT Taxes EAT $ 825,000 $ 750,000 (231,000) (210,000) (270,000) (270,000) $ 324,000 $ 270,000 (170,000) (170,000) $ 154,000 $ 100,000 ( 52,360) (34,000) $ 101,640 $ 66,000 EPS = $101,640/20,000 = $5.08 EPS = $3.30 DOL = 2.0 324,000 270,000 % in EBIT = .2 270,000 = 2(% in sales) = 20% DFL = 2.7 5.08 - 3.30 % in EPS = = .54 3.30 = 2.7(% in EBIT) = 54% DCL = 5.4 % in EPS = 5.4(% in sales) = 54%