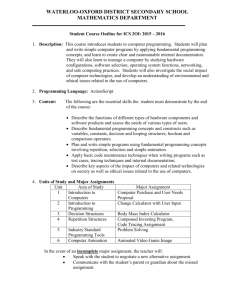

2015Finance Internship Assignments

advertisement

Finance Internship Assignments for Students Periods 7 or 8 Students who have the Finance Internship Assignments OUTSIDE OF SCHOOL OR AFTER SCHOOL can complete these assignments for EXTRA CREDIT During NON Credit Union or Cavalier Corner Days- You will have assignments to complete. Every week you will be assigned a Marketing Activity to complete. The form must be approved by Natasha or Becky, signed by them and turned in to me for a grade. You must also keep up with your Internship Handbook Assignments & due dates. You must also complete the EVERFI-Financial Literacy Course. To Register go to www.everfi.com/register Add your name to my class-Finance Internship Code: 3013bd33 You will need to work on these assignments by: completing the online simulation/lesson with the pre/post assessments (these will be graded by Everfi & I will receive your grade on a report), Type out the Discussion Questions & Responses and Choose ONE of the Interactive Activities to complete & turn in (TYPED too) and observe the due dates. EVERFI Modules a. Savings DUE DATE: 10/1 or 10/2 Discussion Questions: a. What is interest? How is interest different from compound interest? b. Why is it important for young people to start saving as early as possible given the principles of interest? c. What is the purpose of a budget? d. How can people make sure their budgets remain balanced? Interactive Activity (CHOOSE ONE) a. Saving Goal Examples: Explore how both small & large savings goals can be reached with consistent savings over time. b. Computer Interest Exploration: Compare the interest earned with different compounding frequencies. c. Savings Vehicle Practice: Identify the appropriate savings vehicle in specific real life scenarios. b. Banking DUE DATE: 10/15 or 10/16 Discussion Questions: a. What are the different types of banking institutions? b. How is a checking account different than a savings account? c. How can you monitor your checking account balance and what are the risks of spending more than you have? Interactive Activity (CHOOSE ONE) a. Banking Options: Compare & Contract key characteristics of retail banks, credit unions and online banks b. Comparing Account Types: Categorize account types according to their liquidity, interest rates & required minimum balances. c. Real life Account Fees: Learn about common account fees and how to avoid them. c. Payment Types DUE DATE: 11/2 or 11/3 Discussion Questions: a. What is credit and how can it be useful to consumers? b. What features of credit cards do you need to research when considering a credit card? c. How can people make sure they are using credit cards responsibly? d. What is the difference between a debit card and a credit card? Interactive Activity (CHOOSE ONE) a. Credit Offer Comparison: Compare aspects of credit card offers by examining fee structures, rewards & other card features. b. Understanding a Credit Card Bill: Use a credit card statement to answer questions about your credit card usage, payment schedule and accrued interest rate (you may google an example) d. Credit Scores DUE DATE: 11/12 or 11/13 Discussion Questions: a. What information goes into a credit score and what information does not? b. Why would you want a good credit score? How are credit scores used? c. What can you do to help make your credit score strong? d. What can you do if you have a low credit score to help increase it? Interactive Activity (CHOOSE ONE) a. Explore a Credit Report: Examine the components of a typical credit report b. Helping & Hurting your Credit: Determine the effect of a range of financial decisions on your credit score and select appropriate options to improve credit. e. Higher Education DUE DATE: 12/3 or 12/4 Discussion Questions: a. How is education an investment in yourself? b. Explain why it might be a good idea to borrow money for college if you might now otherwise afford to go. c. What are the steps in the student loan process? d. Why is it important to repay your student loans on time? Interactive Activity (CHOOSE ONE) a. Federal Loan Comparison: Examine the key differences between subsidized & unsubsidized federal loans. b. Filling out FAFSA: Explore components of the FAFSA application; answer questions about the FAFSA application process & common misconceptions f. Rent vs. Own DUE DATE: 12/17 or 12/18 Discussion Questions: a. What is a mortgage? b. What causes a mortgage foreclosure? c. What are the advantages of renting vs owning a home? What are the advantages of owning vs. renting a home: d. Is buying a house always a solid investment? Interactive Activity (CHOOSE ONE) a. Lease Agreement Exploration: Examine the common terms, regulations, fees & deposits found in a typical housing leasing agreement. b. Buying a Car Simulation: Go through the decision making process of buying a car, calculate your available monthly budget to select an appropriate car loan agreement. g. Insurance & Taxes DUE DATE: 1/14 or 1/15 Discussion Questions: a. What is tax revenue used for? b. What is the difference between sales tax & property tax? c. What type of insurance do people use and what are the benefits to having insurance? d. How does one pay for insurance? Interactive Activity (CHOOSE ONE) a. Insurance Policy Terms Practice: Apply knowledge of common insurance policy terms and explain them. b. Paystub Practice: Examine the components of a typical paystub and discuss taxes, insurance & other deductions. h. Consumer Protection DUE DATE: 1/28 or 1/29 Discussion Questions: a. What is identity theft, and what can people do to protect themselves from it? b. Why should people check their credit report once a year? c. What are some examples of consumer fraud? Interactive Activity (CHOOSE ONE) a. Ways Identity Theft Can Happen: Discuss how passwords for online accounts and sensitive information can lead to identity theft. Describe how someone should create a password and protect themselves. b. Resolving Identity Theft: Prioritize the actions and steps an individual should take to resolve identify theft once t has occurred. i. Investing DUE DATE: 2/11 or 2/12 Discussion Questions: a. Why do people take financial risks? b. What is a stock, and why might stocks be a good investment? c. What is a mutual fund and how is it different than a stock? d. How are bonds different from stocks? How does their risk profile differ? e. How can you lower risks when it comes to investing? NO INTERACTIVE ACTIVITY j. GAME DUE DATE: 2/25 or 2/26