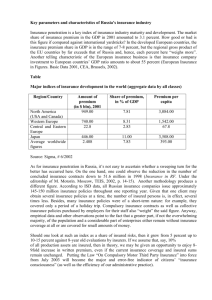

Whole Life Insurance

advertisement

Chapter 2 Life Insurance Policies “Whole Life Insurance” Whole Life Insurance Policies The Nature of Whole Life Insurance: Often, called straight or ordinary Life insurance, it provides life time protection & pays the face amount if insured dies or reaches specific age(100). It is viewed as endowment insurance (it pays if he dies before age 100 or if he reaches it). Also, whole life insurance is viewed as a term insurance up to age 100 & pays the amount as if he had died. Whole Life Insurance Policies Because of level premium, he has the right of cash value. Also, he can borrow this cash value under loan provision. Finally, he can surrender it at 100 & gets the cash value that equals the face amount. Whole Life Insurance Policies Par & Non-Par Whole Life Ins.: In participating (par) policy insured receives dividends in good years (if actual interest > expected) & can use it to buy a paid-up extra amount & surrender this amount only & Keep the original policy. Dividends are not guaranteed, i.e., depend on experience & vary) but insurer pay it in some policies as a frozen value, i.e., it is treated as a series of nonguaranteed pure endowments (annuities). Whole Life Insurance Policies Types of whole life insurance policies: 1-Ordinary Life Insurance Premium: It is called straight & Continuous premium whole life insurance or regular policy with level premium & cash value. Future expected dividends & cash value of any extra amount you can surrender can be used to pay the future premiums & the original policy became paid up. Under premium deposit rider, insured can deposit an amount with insurer to pay part or all future premiums automatically. Whole Life Insurance Policies Uses of Ordinary Life Insurance: a) If life protection is needed at least 10 yrs & you need saving, so buy whole life policy & surrender it or borrow the cash value at later age. b) In case of huge estate so, you need large amount if you dies to clear your estate. Whole Life Insurance Policies Limitation of Ordinary Life Insurance: - If you need large amount in early age & small amount at later age, buy a yearly renewable term not whole life insurance & you get 10 times the amount. Whole Life Insurance Policies 2-Limited Payment life (paid up)Ins.: As ordinary life insurance but with premium for specific period. Ex.: Ali 30 yr bought 20 yr payment policy paid at 50. So, policy matures when he dies but premium paid for 20 yr. Rarely, whole life insurance sold with single premium. (Single prem. > limited > Level). The smaller the period of limited payment, the larger the premium & the CV & vise versa. Whole Life Insurance Policies 3-Current Assumption Whole Life Insurance: [CAWLI] Called interest sensitive policy, a non-par or unbundled policy i.e. it explicit actual premium paid, interest earned, mortality, expenses & CV. Re-determination provision states: insurance company re-determine the premium under the new assumption of future interest (min. guaranteed) & mortality (max. guaranteed) Based on their new values to maintain the stated amount of insurance. Whole Life Insurance Policies - If new premium is lower, insured elect to pay it, pay the old & get high CV or increase the benefits. Types of CAWLI: a) Low premium product at initial period (5yrs) then recalculate it & insured pays new premium (if higher) & get the same amount or pay old premium & get lower amount. b)Higher premium products at initial period (10 yrs) & premiums stop if actual interest & mortality rate are better than expected. Whole Life Insurance Policies 4-Variable Life Insurance: It is called unit-linked life insurance. That depends on the actual interest on a specific investment (mutual fund or a trust), with guaranteed minimum amount. It offset the adverse effects of inflation on insurance. Whole Life Insurance Policies Characteristics: a) Whole life with fixed premium & variable benefits & cash value. b) Reserve is invested in separate account in any type of investment at insured's option. c) Actual CV is not guaranteed, insurer bears mortality & insured bear interest. Whole Life Insurance Policies Other Forms of Whole Life Insurance 5- Modified Life Insurance: Low premium at 3-5 yrs & higher thereafter & has many versions: a) Increased one time at end of 3-5 yrs. b) Increased each yr for 5 yrs then, level. c) Term insurance for 3-5 yrs & converted to whole life with level premium. Advantage: Insured with low income can buy whole life insurance now even though he can't afford its premium & increase it when his income increases. Whole Life Insurance Policies 6- Enhanced Ordinary Life Insurance: The amount of insurance is reduced after few yrs & use dividends to buy paid up amount for the difference. 7- Graded Premium Life Insurance: low premium (50%) at 1st yr & increase each yr for 5-20 yr & level thereafter. 8- Single Premium Whole Life Insurance 9- Indexed Whole Life Insurance: Insurance amount is tied to inflation (any price index). Whole Life Insurance Policies 10- Special purpose Life Insurance: 1/10- Industrial (or Debit) Life Insurance : sold in small amount with weekly or monthly premium collected at home. 2/10- Juvenile Insurance: insured is a child from 1 day to 14 or 15 yrs & parents pay premium. Advantage: small premium (but for long period) & guaranteed insurability to child in old age. Disadvantage: premium paid for long period, no need for money in case of child death. 3/10- Funeral Insurance: to cover funeral expenses. Whole Life Insurance Policies 11- Insurance covering Multiple Lives: 1/11- Second -to- Die(or Survivorship)Life Insurance: - More than 1 insured & pay benefits at last one death (term & whole) & prem. Lower than 2 separate policy. - May include split option to split the policy into two half in case of divorce. 2/11- First -t0- Die (or joint) Life Insurance: - More than 1 insured & pay benefits at first death, premium lower than 2 separate policy. Whole Life Insurance Policies 12-Universal Life Insurance (ULI): - Whole life Insurance with variable (unbundled) premium - Insured determine number & values of premium. (monthly, quarterly,……., single). -Premium added to an account & deduct: Mortality & charge expenses & add a variable interest. Characteristics of ULI: -Unbundling of component part: separate premium to 3 parts: protection, saving & expenses. Whole Life Insurance Policies Each year insured informed about: premium paid, mortality charge, cash surrender value & interest credited to CV where: 1) Mortality charge = Amount at R x monthly rate. 2) Expenses charge = loading to meet commission, administration front-end load, back-end load or both. 3) Interest rate: minimum rate guaranteed or actual if higher. Whole Life Insurance Policies Two Form of ULI: a) Level Death Benefits at Early Yrs: CV increase & protection decrease (amount at R). b) Increasing Death Benefits: death benefits equal to a specific amount of insurance + accumulated CV. Whole Life Insurance Policies Considerable Flexibility of ULI: a- Premium values & number are flexible. b- Insurance amount can be increased or decreased with insurability. c- Policy can be changed from level death benefits to increasing. d- Partial cash withdrawal (not loan) available. e- Loan is available. f- Additional insured is available. Whole Life Insurance Policies 13- Group Life Insurance: Many insureds in 1 contract (master policy) w/out physical examination & each insured gets certificate (not policy). 14- Savings Bank Life Insurance (SBLI): Bank over the phone & internet. Advantage: cheap because of low operating cost & commission. 15- Preferred Risks: Whole life with low premium & large amount for insured with better health, weight, occupation & habits (non smokers).