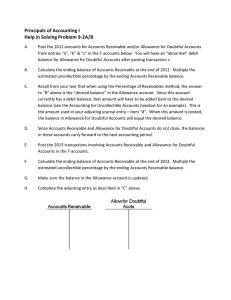

Accounts Receivable 1. Does the Finance department have written policies and procedures defining responsibilities for preparing invoices, recording accounts receivables, recording payments, collecting the accounts, and follow-up of overdue accounts? 2. Are the responsibilities for billing, collections, and posting to the general ledger adequately segregated within Sage X3? 3. Does the Finance department maintain and record all accounts receivable in Sage X3? 4. Does the Finance department have a written policy regarding write-offs of outstanding resident and commercial tenant rent? 5. Does the Finance department have written policies and procedures concerning resident and commercial tenant refunds as well as any billing adjustments? 6. Are charges for residents and commercial tenants based on authorized rates? 7. Does the Finance department periodically provide accurate statements of account balances to residents and commercial tenants? 8. Is an aging schedule for residents and commercial tenants prepared monthly and, if so, is it reviewed by the Financial Controller? 9. Does the Accounts Receivable Accountant take appropriate action and document efforts to follow up with the Property Managers to collect on account balances that are past due from residents and commercial tenants? 10. Does the Finance department use an allowance account for doubtful or uncollectible accounts? If so, does the department have a written methodology for calculating the allowance for doubtful or uncollectible accounts?