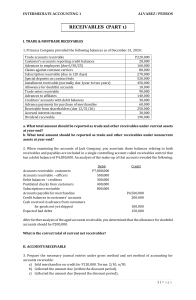

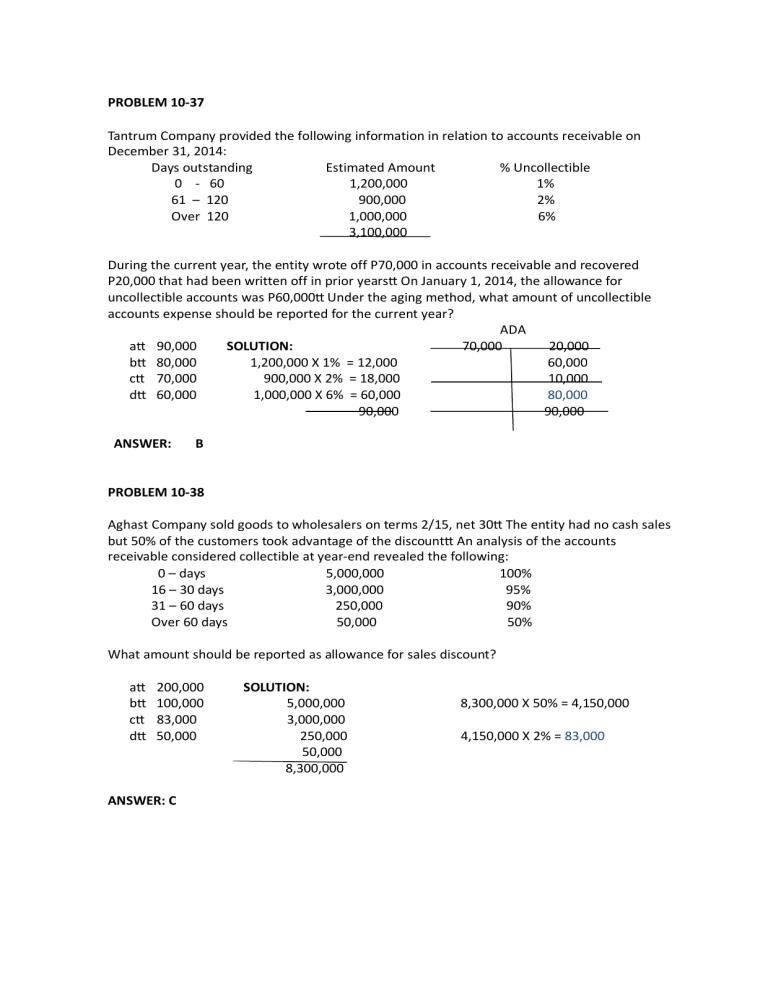

PROBLEM 10-37 Tantrum Company provided the following information in relation to accounts receivable on December 31, 2014: Days outstanding Estimated Amount % Uncollectible 0 - 60 1,200,000 1% 61 – 120 900,000 2% Over 120 1,000,000 6% 3,100,000 During the current year, the entity wrote off P70,000 in accounts receivable and recovered P20,000 that had been written off in prior years. On January 1, 2014, the allowance for uncollectible accounts was P60,000. Under the aging method, what amount of uncollectible accounts expense should be reported for the current year? ADA a. 90,000 SOLUTION: 70,000 20,000 b. 80,000 1,200,000 X 1% = 12,000 60,000 c. 70,000 900,000 X 2% = 18,000 10,000 d. 60,000 1,000,000 X 6% = 60,000 80,000 90,000 90,000 ANSWER: B PROBLEM 10-38 Aghast Company sold goods to wholesalers on terms 2/15, net 30. The entity had no cash sales but 50% of the customers took advantage of the discount. An analysis of the accounts receivable considered collectible at year-end revealed the following: 0 – days 5,000,000 100% 16 – 30 days 3,000,000 95% 31 – 60 days 250,000 90% Over 60 days 50,000 50% What amount should be reported as allowance for sales discount? a. b. c. d. 200,000 100,000 83,000 50,000 ANSWER: C SOLUTION: 5,000,000 3,000,000 250,000 50,000 8,300,000 8,300,000 X 50% = 4,150,000 4,150,000 X 2% = 83,000 PROBLEM 10-39 On December 31, 2014, Ludicrous Company reported accounts receivable of P6,000,000 and allowance for doubtful accounts of P300,000 before year-end adjustment: Outstanding Accounts receivable Probability of collection Under 15 days 3,000,000 .96 16 – 30 days 2,000,000 .90 31 – 45 days 400,000 .80 46 – 60 days 300,000 .70 61 – 75 days 200,000 .65 Over 75 days 100,000 .00 The accounts which have been outstanding over 75 days and have zero probability of collection would be written off immediately. What is the appropriate balance for the allowance for doubtful accounts on December 31, 2014? 560,00 0 660,000 260,000 360,00 a. b. c. d. SOLUTION: 3,000,000 X .96 = 2,880,000 2,000,000 X .90 = 1,800,000 400,000 X .80 = 320,000 300,000 X .70 = 210,000 200,000 X .65 = 130,000 100,000 X .00 = 0 5,340,000 ADA 6,000,000 300,000 5,700,000 360,000 5,340,000 ANSWER: D PROBLEM 10-40 Namesake Company reported the following unadjusted balances on December 31, 2014. DEBIT CREDIT Accounts receivable 3,000,000 Allowance for doubtful accounts 10,000 Net credit sales 8,000,000 The entity estimated that 3% of the gross accounts receivable would become uncollectible. What amount should be reported as doubtful accounts expense for the current year? a. b. c. d. 240,000 100,000 90,000 80,000 SOLUTION: ADA 100,000 10,000 90,000 ANSWER: B