File - Business Studies at Coláiste na Mí

advertisement

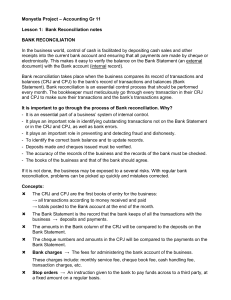

BANK RECONCILIATION STATEMENTS Point of Note This chapter will be a combination of Accounts and Theory Important Refresher • We already know how to complete cash accounts and that bank statements include items such as: • • • • • • • Bank Charges Bank Interest Charged Standing Orders (S/0) Direct Debit Paypath Credit Transfers Dishonoured Cheques It is important that you remember how to do a basic cash account and understand these definitions when working in this chapter You will be concerned with three accounts • Your Bank A/C • Adjusted Bank Statement • Bank Reconciliation Statements- Here we add lodgements not yet credited, and subtract cheques not yet presented for payment. Bank Reconciliation Statements • The bank Account (or The Analysed Cash Book) is the account holders own record of money received and spent • The Bank Statement is the banks record of money received and spent by the account holder. This is viewed from the banks perspective • The Bank Reconciliation Statement is then prepared to reconcile (or fix) the two records and check for any errors that have occurred Why complete a bank reconciliation statement • Ideally, the banks statement should match your own one, but what if a cheque written has been delayed or the standing order has not yet been paid or you have forgotten a direct debit? You would have obviously made changes to your account but the bank may not have done the same • So we have to adjust the records and make a bank reconciliation statement which will: 1. Identify the true balance of the bank account 2. Update your own records with unknown items-those which appear on the bank statement that you don’t know about Comparing a Bank Statement and Personal account • Entries on the debit side of the bank statement are on the credit side of the personal account and entries on the credit side of the personal account are on the debit side of the bank account. This is because every debit has a credit, and if I debit my own bank account, the bank view this money as money they owe me which is a credit. (This will make sense with practice) • The balance on the bank statement may be different from the balance in the personal account because there is usually a time difference between transactions Reasons for differences between Bank Statements and Your Bank Account 1. Cheques written but not yet been cashed- you have given a cheque to someone but because they have not cashed it yet it does not show up in the banks accounts 2. Lodgements made but not yet shown in bank accounts 3. You are unaware of certain transactions, e.g. interest 4. Human error can happen-putting in €30 instead of €300 5. Direct Debits and Standing orders that you forgot about- e.g. a particular phone bill being €125 and not the usual €40 (Máistir Murtagh) I know what you’re thinking…… Don’t worry- we will be doing a lot of practice For Help Please use the additional links to practice questions and solutions as part of your study for this chapter that are on the website. When we have finished this topic, use the questions we have done in class to also help you