Bank Reconciliation

advertisement

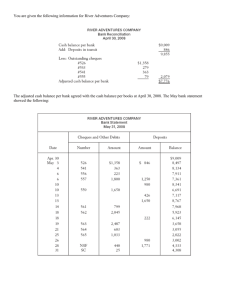

Bank reconciliation statement is a report which compares the bank balance as per company's accounting records with the balance stated in the bank statement The term reconciliation simply means to bring together One reason may due to ERRORs made by the company or by bank. But there are many other reasons that cause the difference. BANK STATEMENT CASHBOOK Cheques Outstanding/Unpresented cheques (Cr.): cheques which have been issued by the company but were not presented or cleared before the issuance of bank statement. Deposits in Transit (Cr.): Deposits which have been sent by the company to the bank but have not been received by the bank at proper time before the issuance of bank statement. (bank lodgement not yet credited) Dishonoured cheques (Dr.): These are the cheques deposited by the company in bank account but the bank has failed to ‘honour’ the cheque. May due to : ◦ NSF cheque = not sufficient funds ◦ Stale cheque = cheque presented at the paying bank after a certain period (typically six months) of its payment date ◦ Signature does not match, error in wordings of amount etc. Service Charges (Cr.): Service charges may have been deducted by the bank. Such charges are usually not known to the company before the issuance of bank statement. Interest Income (Dr.): If any interest income has been earned by the company on its bank account, it is not usually entered in company's cash account before the issuance of bank statement. Standing Orders (Cr.): an instruction a firm gives to the bank to pay a set amount at regular intervals to another's account. Direct Debit (Cr.): an authorization to the creditors, typically used for recurring payments, such as utility bills, where the payment amounts vary from one payment to another Credit transfers (Dr.): amounts being paid directly into our bank account. They are normally from other customers, or other people who owe the firm money Company A Bank Reconciliation December 31, 2011 Balance as per cash book Add: Interest Income Credit Transfer 19,000.00 234.00 134.00 Less: Dishonoured Cheque Service Charge Direct Debit Standing Order 543.00 254.00 321.00 987.00 Balance in statement of financial position Less: Deposit in Transit Add: Outstanding Cheque Balance as per bank statement Confirm this figure by referring to Bank Statement 368.00 19,368.00 (2,105.00) 17,263.00 (865.00) 654.00 17,052.00 OTHER FORMAT: Company A Bank Reconciliation December 31, 2011 Balance as per cash book Add: Interest Income Credit Transfer 19,000.00 234.00 134.00 Less: Dishonoured Cheque Service Charge Direct Debit Standing Order 543.00 254.00 321.00 987.00 368.00 19,368.00 Adjusted balance as per cash book (2,105.00) 17,263.00 Balance as per bank statement 17,052.00 Add: Deposit in Transit Less: Outstanding Cheque Adjusted Balance as per bank statement 865.00 (654.00) 17,263.00 This format is to prepare the adjustment of both cashbook and bank statement. So there will be a balancing figure. Whereas, the first format is to show the agreement btw the balance of cashbook and bank statement.