Chapter_4

advertisement

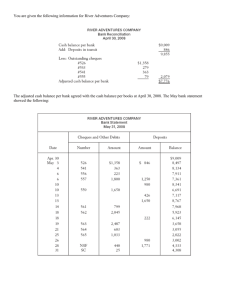

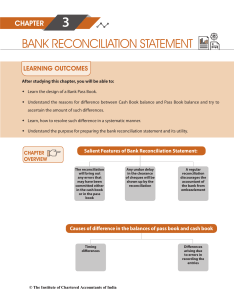

BSAD 221 Introductory Financial Accounting Donna Gunn, CA Types of Fraud • Misappropriation of Assets • Essentially theft of assets • Fraudulent Financial Reporting • False or misleading financial statements • Earnings management is the most common The Fraud Triangle Motive Opportunity Rationalization Internal Controls Plans designed by management and the Board of Directors to deal with risks related to: • Reliability of financial records and reporting • Ability to operate effectively and efficiently • Compliance with legal requirements Control Activities • Competent People • Separation of duties • Monitor Employees • Limit Access to Assets/Records • Proper Approval/Authorization • Proper Safeguard Controls • Adequate Records Competent People The most important feature of control is the people who make the system work. High turnover in the business means inexperienced people Incompetent people make mistakes! Separation of Duties The duties that should be segregated are: authorization to execute transactions, recording of transactions, custody of assets Monitor Employees All employees should be monitored • Compliance with policies • Compare to budget If feasible, use internal audit Limited Access Assets and records should not be available to persons who have no need to handle them. Proper Approval/Authorization • Ensures unauthorized transactions are not occurring, which could result in inefficiencies and/or fraud Proper Safeguard Controls Examples • Mandatory vacation/job rotation • Use security cameras • Backup files / store documents in fireproof vault Adequate Records • Supporting documentation so transactions can be retraced if necessary • E.g. PO’s, Invoices, Receiving Report, Cheque, etc. Internal Control of Cash Internal control refers to policies and procedures that are designed to: Properly account for assets. Safeguard assets. Ensure the accuracy of financial records. Cash is the asset most susceptible to theft and fraud. Bank Reconciliation Explains the difference between cash reported on bank statement and cash balance on company’s books. Provides information for reconciling journal entries. Bank Reconciliation Balance per Bank Balance per Book + Deposits in Transit + Deposits by Bank (credit memos) - Outstanding Cheques - Service Charge - NSF Cheques ± Bank Errors ± Book Errors = Correct Balance = Correct Balance Bank Reconciliation Balance per Bank + Deposits in Transit All reconciling items on the book side require an - Outstanding Checks adjusting entry to the cash account. Balance per Book + Deposits by Bank (credit memos) - Service Charge - NSF Cheques ± Bank Errors ± Book Errors = Adjusted Balance = Correct Balance Bank Reconciliation Prepare a July 31 bank reconciliation statement and the resulting journal entries for the Simmons Company. The July 31 bank statement indicated a cash balance of $9,610, while the cash ledger account on that date shows a balance of $7,430. Additional information necessary for the reconciliation is shown on the next page. Bank Reconciliation 1) Outstanding cheques totaled $2,417. 2) A $500 cheque mailed to the bank for deposit had not reached the bank at the statement date. 3) The bank returned a customer’s NSF cheque for $225 received as payment of an account receivable. 4) The bank statement showed $30 interest earned on the bank balance for the month of July. 5) Cheque 781 for supplies cleared the bank for $268 but was erroneously recorded in our books as $240. 6) A $486 deposit by Acme Company was erroneously credited to our account by the bank. Bank Reconciliation Bank Reconciliation Ending bank balance, July 31 Additions: Deposit in transit Deductions: Bank error $ Outstanding cheques Correct cash balance Ending book balance, July 31 Additions: Interest Deductions: Recording error $ NSF cheque Correct cash balance $ 9,610 500 486 2,417 $ 2,903 7,207 $ 7,430 30 28 225 $ 253 7,207 Bank Reconciliation GENERAL JOURNAL Date Description Jul 31 Cash (A) Post. Ref. Page 56 Debit 30 Interest Revenue (R) 31 Supplies Inventory (A) Accounts Receivable (A) Cash (A) Credit 30 28 225 253