Chapter 18 Capital Structure and the Cost of Capital

advertisement

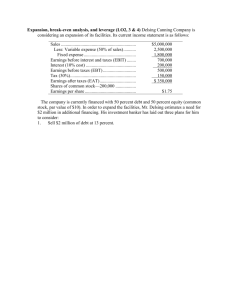

Chapter 18 Capital Structure and the Cost of Capital © 2011 John Wiley and Sons Chapter Outcomes Explain how capital structure affects a firm’s capital budgeting discount rate. Explain how a firm can determine its cost of debt financing and cost of equity financing. Explain how a firm can estimate its cost of capital. Describe how a firm’s growth potential, dividend policy, and capital structure are related. 2 Chapter Outcomes, continued Explain how EBIT/eps analysis can assist management in choosing a capital structure. Describe how a firm’s business risk and operating leverage may affect its capital structure. Describe how a firm’s degree of financial leverage and degree of combined leverage can be computed and explain how to interpret their values. Describe the factors that affect a firm’s capital structure. 3 What is Capital Structure? Capital structure is the mix of debt and equity An optimal debt/equity mix will minimize the firm’s cost of capital A lower cost of capital means a higher firm value 4 Corporate Debt as a Percentage of GDP 60.0% 50.0% Percent 40.0% 30.0% 20.0% 10.0% 0.0% 5 Required Rate of Return and the Cost of Capital Project cost = $1000 Financed by: $600 debt at 9% interest (pre-tax) $400 equity with a 15% return requirement 6 Minimum Required Returns Annual pre-tax cash flow = $600 (0.09) + $400 (0.15) = $114 Minimum pre-tax return = 114/$1000 = 11.4% or: = $600/$1000 (9%) + $400/$1000(15%) =11.4% 7 Three Names, Same Concept Required rate of return—investor Cost of capital (or weighted average cost of capital)—firm Discount rate—NPV calculation 8 Why a Weighted Average? In most cases, the weighted average cost of capital should be used in project evaluation, NOT projectspecific financing costs This month: accept project with IRR of 9% and is debt-financed at 8% Later this year: reject project with IRR of 12% that was to be equity financed at 15% This is not a value-maximizing strategy! 9 Computing Capital Costs After-tax cash flows require the use of after-tax financing costs Incremental cash flows require incremental, or marginal, financing costs 10 Cost of Capital Cost of debt Cost of preferred stock Cost of common equity – Retained earnings – New common stock 11 Cost of Debt Yield to maturity (YTM) of new debt Sources: – current interest rates for rated bonds – investment bank advice – current YTM on firm’s outstanding bonds – long-term bank financing rate 12 Cost of debt calculation Interest is tax-deductible to the firm kd = YTM ( 1 - T) Example: 40 percent marginal tax rate New debt can be issued with a 10 percent YTM kd = 10% (1 - .4) = 6% 13 Cost of Preferred Stock Recall: Price of preferred stock = Dp / rp rp = Dp / Pps taking flotation costs into account, cost of preferred stock = kp = Dp / (Pps - Fps) 14 Cost of Preferred Stock Example Dividend = $5 per share Price of preferred stock = $55 Flotation cost = $3 per share kp = Dp / (Pps - Fps) kp = $5 / ($55 - $3) = 9.62% 15 Cost of Common Equity Two sources of common equity: – Retained earnings – New common stock 16 Cost of Retained Earnings Is cost of retained earnings = zero? No, because of opportunity cost to shareholders Two methods to find cost of retained earnings – security market line approach – constant dividend growth model 17 Cost of Retained Earnings: Security Market Line Approach Recall: E (Ri) = RFR + i ( RMKT - RFR) This represents the opportunity cost to shareholders of the firm’s use of retained earnings to finance projects so: kRE = E (Ri) = RFR + i ( RMKT - RFR) 18 Cost of Retained Earnings: Constant Dividend Growth Model Recall: Price of common stock = D1 / (rcs - g) Since shareholder required return = opportunity cost if firm uses retained earnings as a financing source, kRE = rcs = (D1 / P) + g 19 Cost of New Common Stock Adapt the constant dividend growth model to reflect flotation costs since when new shares are sold, the firm receives (Price - flotation costs) per share. kn = [D1 / (P - Fcs)] + g 20 Weighted Average Cost of Capital WACC = wd kd + wp kp + we ke where wd + wp + we = 1.0 Weights should reflect management’s belief of a target capital structure which minimizes financing costs Measuring whether the firm is moving toward the target capital structure: – book value weights (balance sheet) – market value weights (market prices) 21 WACC and Project Analysis WACC represents the discount rate to be used in capital budget project analysis – Use the project’s WACC, not necessarily the firm’s WACC, because of risk differences – Higher risk projects will have higher WACC 22 Difficulty of Making Capital Structure Decisions Interrelationships –Firm’s growth rate –Profitability –Dividend policy 23 LTD Divided by Total Assets, various firms 1997-2008 Long-term Debt Divided by Total Assets 70.0% 60.0% Apple AT&T 50.0% Consolidated Edison Dell 40.0% Percent ExxonMobil Google 30.0% McDonald's Microsoft 20.0% Sears Walgreens Wal-Mart 10.0% 0.0% 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 24 Planning Growth Rates Internal Growth Rate – How quickly assets can grow without raising external funds IGR = (RR x ROA)/(1 – RR x ROA) Sustainable Growth Rate – How quickly assets can grow if debt/equity ratio remains constant SGR = (RR x ROE)/(1 – RR x ROE) 25 Effects of Unexpectedly Higher (or Lower) Growth Dividend policy Profitability Capital Structure 26 EBIT/eps analysis Examine how different capital structures affect earnings and risk EBIT - interest Net income (ignore taxes) eps = Net income / # of shares 27 Current and Proposed Capital Structures CURRENT PROPOSED Total assets $100 million $100 million Debt 0 million 50 million Equity 100 million 50 million Common stock price $25 $25 Number of shares 4,000,000 2,000,000 Interest rate 10% 10% 28 CURRENT—No Debt, 4 Million Shares (Millions Omitted) EBIT 50% BELOW EXPECTED EBIT $6.00 – Int 0.00 NI $6.00 eps $ 1.50 EXPECTED $12.00 0.00 $12.00 $ 3.00 EBIT 50% ABOVE EXPECTED $18.00 0.00 $18.00 $ 4.50 29 PROPOSED—50% Debt (10% Coupon), 2 Million Shares (Millions Omitted) EBIT 50% BELOW EXPECTED EBIT $6.00 – Int 5.00 NI $1.00 eps $ 0.50 EXPECTED $12.00 5.00 $ 7.00 $ 3.50 EBIT 50% ABOVE EXPECTED $18.00 5.00 $13.00 $ 6.50 30 EBIT/eps analysis Current versus Proposed 8 eps Proposed 6 4 Current 2 0 -2 -4 3 6 9 10 12 15 18 EBIT 31 Indifference Level Occurs where the lines cross; at that level of EBIT both capital structures have the same eps Occurs where EBIT = interest cost (%) x total assets or, in other words, where EBIT/TA = interest cost (%) 32 Indifference Level EBIT/TA = interest cost (%) If EBIT/TA > interest cost, higher leverage is helpful (higher eps) If EBIT/TA < interest cost, higher leverage is harmful (lower eps) 33 Comments on EBIT/eps analysis Positives – Indicates EBIT values when one capital structure may be preferred over another – Analysis of expected EBIT can focus on the likelihood of actual EBIT exceeding the indifference point Drawbacks – Does not capture risk – Value-maximizing eps is probably less than maximum eps (Figure 18.8) 34 Risk and the Income Statement Sales Operating –Variable costs Leverage –Fixed costs EBIT –Interest expense Financial Earnings before taxes Leverage –Taxes Net Income eps = Net Income Number of Shares 35 Business Risk Unit volume variability Price-variable cost margin Fixed cost Degree of operating leverage (DOL) = % change in EBIT/% change in sales = Sales – variable costs Sales – variable costs – fixed costs 36 Degree of Financial Leverage DFL = = percent change in eps percent change in EBIT EBIT / (EBIT - Interest) 37 Degree of Combined Leverage DCL = = percent change in eps percent change in sales DOL x DFL 38 Leverage Example THIS YEAR Net sales $700,000 Less: variable costs (60% of sales) 420,000 Less: fixed costs 200,000 EBIT 80,000 Less: interest 20,000 EBT 60,000 Less: taxes 18,000 Net income $42,000 10% SALES INCREASE $770,000 462,000 200,000 108,000 20,000 88,000 26,400 $ 61,600 39 Leverage Calculations Percent change in sales +10.0% Percent change in EBIT +35.0% Percent change in net income +46.7% DOL = 35% / 10% = 3.50 DFL = 46.7% / 35% = 1.33 DCL = 46.7% / 10% = 4.67 DCL = DOL x DFL = 3.50 x 1.33 = 4.67 40 Insights from Theory and Practice Taxes and Non-debt tax shields Bankruptcy costs Static tradeoff hypothesis Benefits of tax-deductible interest payments versus higher risk of bankruptcy Agency costs – Cross-border differences in shareholder protection help explain global financing patterns 41 Insights from Theory and Practice Type of Assets (tangible versus intangible) Pecking order theory Prefer to use internal financing, then debt, then equity to finance growth Market timing theory Current capital structure is the cumulative result of past financing decisions and attempts to issue securities when prices are high Pecking order and Market timing: is there an optimal capital structure? 42 Flavors of Debt and Equity Debt: – convertible or straight – maturity: can be extended/shortened – interest: fixed or variable Equity: – preferred stock – common stock – different classes of common stock 43 Guidelines for Financing Strategy Business risk Taxes and non-debt tax shields Mix of tangible and intangible assets Financial flexibility Control of the firm Profitability Financial market conditions Management’s attitude toward debt and risk 44 Web Links www.ibbotson.com www.mergent.com www.sternstewart.com www.stern.nyu.edu/~ealtman www.cfo.com 45