Estimating Bad Debts

advertisement

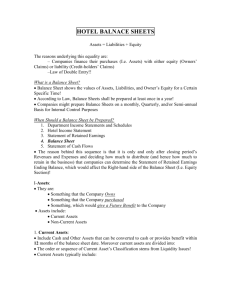

Unit 8 Estimating Bad Debts BASES USED FOR THE ALLOWANCE METHOD • Companies use either of two methods in the estimation of uncollectible accounts: 1. Percentage of sales 2. Percentage of receivables • Both bases are GAAP; the choice is a management decision. ILLUSTRATION 9-4 COMPARISON OF BASES OF ESTIMATING UNCOLLECTIBLES Percentage of Sales Matching Sales Percentage of Receivables Net Realizable Value Bad Debts Expense Emphasis on Income Statement Relationships Accounts Receivable Allowance for Doubtful Accounts Emphasis on Balance Sheet Relationships PERCENTAGE OF SALES BASIS • In the percentage of sales basis, management establishes a percentage relationship between the amount of credit sales and expected losses from uncollectible accounts. • Expected bad debt losses are determined by applying the percentage to the sales base of the current period. • This basis better matches expenses with revenues. PERCENTAGE OF SALES BASIS Example 1 Situation A: Pereira Company determines that 1% of net credit sales will become uncollectible. If net credit sales are $170,000 the estimated bad debt expense is $1700 (170,000*1%). The general journal entry is; GENERAL JOURNAL Date Account Title and Explanation Dec. 31 Bad Debts Expense Allowance for Doubtful Accounts To record estimate of uncollectible accounts. Debit Credit 1,700 1,700 PERCENTAGE OF SALES BASIS Example 2 Balance In Doubtful Accounts Situation B: Pereira Company determines that 1% of net credit sales will become uncollectible. If net credit sales are $170,000 the estimated bad debt expense is $1700 (170,000*1%). However the allowance for doubtful accounts still has a credit balance of $1500. How much is journalized? Answer: the same as in situation A. Balances in doubtful accounts are ignored. GENERAL JOURNAL Date Account Title and Explanation Dec. 31 Bad Debts Expense Allowance for Doubtful Accounts To record estimate of uncollectible accounts. Debit Credit 1,700 1,700 PERCENTAGE OF RECEIVABLES BASIS • Under the percentage of receivables basis, management establishes a percentage relationship between the amount of accounts receivable and the required balance in the allowance account. • This percentage can be applied to the total accounts receivable balance, or to individual accounts receivable balances stratified by age. PERCENTAGE OF RECEIVABLES BASIS • The required balance in the allowance account is determined by applying the percentage to the accounts receivable balance at the end of the current period. • The amount of the adjusting entry to record expected bad debt losses for the current period is the difference between the required balance and the existing balance in the allowance account. • This basis produces the better estimate of net realizable value of receivables. PERCENTAGE OF RECEIVABLES BASIS EXAMPLE 1 Net Receivables Pereira Company decides to use the percentage of receivables method to estimate bad debts. It determines that 3% of total accounts receivables will become uncollectibe. If the accounts receivables total is $40,000 the estimated bad debt expense is $1,200. (40,000*3%) GENERAL JOURNAL Date Account Title and Explanation Dec. 31 Bad Debts Expense Allowance for Doubtful Accounts To record estimate of uncollectible accounts. Debit Credit 1,200 1,200 PERCENTAGE OF RECEIVABLES BASIS EXAMPLE 2 Credit Balance in Allowance for Doubtful Accounts Pereira Company decides to use the percentage of receivables method to estimate bad debts. It determines that 3% of total accounts receivables will become uncollectibe. If the accounts receivables total is $40,000 the estimated bad debt expense is $1,200. (40,000*3%). However there is still a credit balance of $500 in the allowance for doubtful accounts remaining from last year’s adjusting entry. Therefore bad debt expense is only $700. (1,200-500) GENERAL JOURNAL Date Account Title and Explanation Dec. 31 Bad Debts Expense Allowance for Doubtful Accounts To record estimate of uncollectible accounts. Debit Credit 700 700 PERCENTAGE OF RECEIVABLES BASIS EXAMPLE 3 Debit Balance in Allowance for Doubtful Accounts Pereira Company decides to use the percentage of receivables method to estimate bad debts. It determines that 3% of total accounts receivables will become uncollectibe. If the accounts receivables total is $40,000 the estimated bad debt expense is $1,200. (40,000*3%). However there is debit balance of $300 in the allowance for doubtful accounts. In other words Pereira had more bad debts than estimated. Therefore bad debt expense is $1,500. (1,200+300) GENERAL JOURNAL Date Account Title and Explanation Dec. 31 Bad Debts Expense Allowance for Doubtful Accounts To record estimate of uncollectible accounts. Debit Credit 1,500 1,500 PERCENTAGE OF RECEIVABLES BASIS EXAMPLE 4 Aging of Accounts Pereira Company decides to use the percentage of receivables method to estimate bad debts. However it wants to use the aging of accounts receivables as a basis. Days 0-30 days 31-60 days 61-90 days 91-120 over 120 Amount $27,000 5,700 3,000 2,400 1,900 Percent 2% 4% 10% 50% 75% Bad Debt $540 228 300 1200 1425 Debit Credit Total Bad Debt Expense = $3,693 GENERAL JOURNAL Date Account Title and Explanation Dec. 31 Bad Debts Expense Allowance for Doubtful Accounts To record estimate of uncollectible accounts. 3,693 3,693 PERCENTAGE OF RECEIVABLES BASIS EXAMPLE 5 Pereira Company decides to use the percentage of receivables method to estimate bad debts. In using the aging of accounts receivables as a basis the company determines that $3,693 of receivables will become uncollectible. However there is still a credit balance of $500 in the allowance for doubtful accounts remaining from last year’s adjusting entry. Therefore bad debt expense is only $3,193 (3,693-500) GENERAL JOURNAL Date Account Title and Explanation Dec. 31 Bad Debts Expense Allowance for Doubtful Accounts To record estimate of uncollectible accounts. Debit Credit 3,193 3,193 SUMMARY OF UNCOLLECTIBLE ACCOUNTS Methods of Write-Off DIRECT ALLOWANCE PERCENTAGE OF ACCOUNTS RECEIVABLES TOTAL RECEIVABLES AGING OF RECEIVABLES PERCENTAGE OF SALES DISPOSING OF ACCOUNTS RECEIVABLE To accelerate the receipt of cash from receivables, owners frequently: 1. sell to a factor, such as a finance company or a bank, and 2. make credit card sales. DISPOSING OF ACCOUNTS RECEIVABLE • A factor buys receivables from businesses for a fee and collects the payments directly from customers. • Credit cards are frequently used by retailers who wish to avoid the paperwork of issuing credit. • Retailers can receive cash more quickly from the credit card issuer.