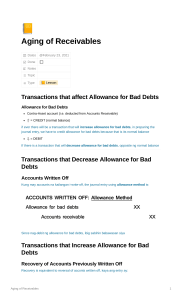

Adjusting (BAD DEBTS) Bad Debts - Uncollectible Receivables from customers. 2 methods of recording Bad Debts 1. Direct Write Off Method -- Means that the company has an assurance that the receivables are no longer collectible. 2. Allowance Method - Means that the company will have an allowance for the possible Uncollectible Accounts. The company will give a certain rate for the allowance. 4 Sources/Basis of giving rate as an allowance. 1. Competitor 2. Receivables 3. Sales/Revenue 4. Experience Receivable is the common source. 1. Bad Debts Write Off Method Sample Ledger shows 90k account receivables Assured Uncollectible - 10k due to deceased customer. Adjusting Entry Debit Bad Debts Expense Credit Accounts Receivable 2. Allowance Method Sample Ledger Shows 90k accounts Receivable The company decided to give 5% from AR as an allowance Debit Bad Debts Expense Credit Allowance for Bad Debts Or Debit Doubtful Accounts Credit Allowance for Doubtful Accounts