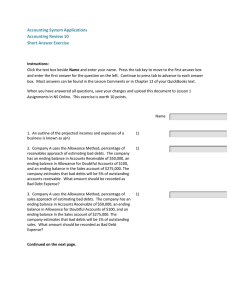

Estimating the Amount of Bad Debts Expense

advertisement

Estimating the Amount of Bad Debts Expense pp. 411-417 Three Approaches • I) Using the Income Statement • II)Using the Balance Sheet • III)Aging Accounts Receivable Approach I) Estimating Bad Debts Using the Income Statement Example: Credit sales = $400,000 in 2006. Based on past experience, the company estimates that 0.6% of credit sales will be uncollectible. 400000 x 0.6% = 2400 will be uncollectible DR Bad Debts Expense 2400 CR Allowance for Doubtful Accounts 2400 • This entry does not mean that the fiscal year end balance in the “Allowance for Doubtful Accounts” will be $2400. It would only be $2400 if the account had a zero balance prior to. Never expect the Allowance for Doubtful Accounts to have an unadjusted balance of 0 at the end of the year 1) Past entries would have accumulated in the account 2) Bad debts must estimated every year and these do not equal the amounts written off 3) Amounts written off probably relate to credit sales made during the year. These debits affect the unadjusted Allowance for Doubtful Accounts Expressing bad debts expense as a percentage of sales is an estimate based on past experience. Different rates may be used in other periods. II) Estimating Bad Debts Using the Balance Sheet • Based on the assumption that a portion of the end-of-period accounts receivable will not be collected • Done in two ways • The simplified balance sheet approach • Aging the Accounts Receivable approach See HANDOUT called “ESTIMATING BAD DEBTS USING THE BALANCE SHEET” III) Aging Accounts Receivable Approach • Produces a more refined estimate based on past experience and also based on present information • Each a/r is examined to estimate the amount that is uncollectible • Amounts are classified based on how long they have been outstanding • Estimates that are uncollectible are made based on the assumption that the longer an amount has been outstanding, the more likely it will be uncollectible III) cont’d • To age a/r outstanding, you must examine each account and classify the outstanding amount by how much time has passed since they were created • The classes are based on 30 day periods • Past experience is used to estimate the % of each class that will become uncollectible • These % are applied to the amounts in the classes to determine the balance of “Allowance for Doubtful Accounts” • SEE HANDOUT # 2 FOR DAY 6 Which Method is more reliable? The income statement approach the bad debts expense was estimated to be $2400 The balance sheet approach estimated the bad debts expense to be $2300 The aging of accounts receivable estimated the bad debts expense to be $2090 • All three approaches produced different numbers for the bad debts estimate. • However, the aging of accounts receivable is based on a more detailed look at specific outstanding accounts and is usually the most reliable. DIRECT WRITE-OFF METHOD OF ACCOUNTING FOR BAD DEBTS • This method does not estimate uncollectible accounts or bad debts expense • No adjusting entries are made • Accounts are written off: • DR Bad Debts Expense • CR Accounts Receivable • This approach mismatches revenues and expenses because bad debts expense is not recorded until an account becomes uncollectible • Useful when the amounts to be written off are small – materiality principle • If payment is received after an account has been written off: First: DR A/R CR Bad Debts Expense To reinstate the account Second: DR Cash CR A/R For full payment of account The Materiality Principle • States that the requirement of accounting principles may be ignored if the effect on the financial statements is unimportant to the uses. The work to be done • Progress Check 8-10 to 8-11 • Exercise 8-5 to 8-7 • Problem 8-3 to 8-5