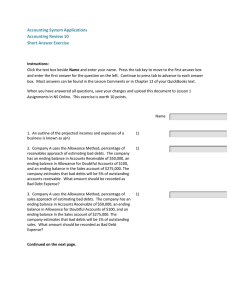

Accounting: The Key to Success

advertisement

Valuing Accounts Receivable Methods for accounting for uncollectible accounts: 1. Direct method (does not satisfy GAAP) 2. Allowance method (satisfies GAAP) a) b) 1 Income statement approach (percent of sales) Balance sheet approach (calculates the required balance in AFDA) © 2013 McGraw-Hill Ryerson Limited. LO 2 Allowance Method • • The matching principle requires that bad debts expense be matched and reported in the same period as the sale that generated the receivable. The allowance method satisfies the matching principle by matching expected bad debts losses (expenses) with revenues that produced the losses. 2 © 2013 McGraw-Hill Ryerson Limited. LO 2 Recording Estimated Bad Debt Expense Adjustments for bad debts are made at the end of the accounting period. Adjustments use a contra-asset account called Allowance for Doubtful Accounts. • • 3 © 2013 McGraw-Hill Ryerson Limited. LO 2 Recording Estimated Bad Debt Expense - Allowance Method Example: The estimated bad debts for TechCom is $1,500. The period end entry to record bad debts is: Bad Debts Expense 1,500 Allowance for Doubtful Accounts 1,500 An allowance account is used since we do not know which accounts will be uncollectible. 4 © 2013 McGraw-Hill Ryerson Limited. LO 2 Writing Off a Bad Debt Allowance Method Example: A specific customer’s account (Jack Kent) is considered uncollectible. The entry to record the write-off is: Allowance for Doubtful Accounts 520 Accounts Receivable - Jack Kent 520 Note that there is no expense recorded when the account is written off. The estimated expense was previously recorded. 5 © 2013 McGraw-Hill Ryerson Limited. LO 2 General Ledger Balances Bad Debts Expense 1,500 Allowance for Doubtful Accounts 1,500 To record estimated bad debts Allowance for Doubtful Accounts 520 Accounts Receivable - Jack Kent To write off an uncollectible account Accounts Receivable Allow. For Doubtful Accts. bal. 20,000 1,500 520 520 bal. 19,480 6 520 bal. 980 © 2013 McGraw-Hill Ryerson Limited. LO 2 Realizable Value Before and After Write-off Accounts Receivable Allow. For Doubtful Accts. bal. 20,000 1,500 520 520 bal. 19,480 bal. 980 Before Write-off Accounts Receivable Less: Allowance for Doubtful Accounts Est. Realizable Accounts Receivable 7 © 2013 McGraw-Hill Ryerson Limited. After Write-off $20,000 $19,480 1,500 980 $18,500 $18,500 LO 2 Recovery of a Bad DebtAllowance Method Example: Jack Kent pays his account in full after the account had been written off. Entries are needed to record the reinstatement of the account and the subsequent collection. The entries are: Accounts Receivable-Jack Kent 520 Allowance for Doubtful Accounts 520 To reinstate customer’s account. Cash Accounts Receivable-Jack Kent To record collection of account. 8 © 2013 McGraw-Hill Ryerson Limited. 520 520 LO 2