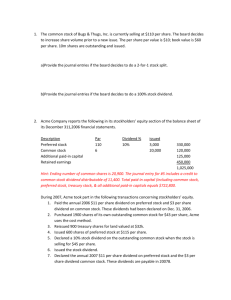

Preferred Stock Included in Capital Structure

advertisement

Chapter 18 18th Edition Earnings Per Share Intermediate Financial Accounting Earl K. Stice James D. Stice PowerPoint presented by Douglas Cloud Professor Emeritus of Accounting, Pepperdine University © 2012 Cengage Learning 18-1 Simple and Complex Capital Structures • Dilutive securities are securities whose assumed exercise or conversion results in a reduction in earnings per share, or lead to a dilution in earnings per share. • Antidilutive securities are securities whose assumed conversion or exercise results in an increase in earnings per share, or lead to antidilution in earnings per share. (continued) 18-2 Simple and Complex Capital Structures • A company’s capital structure may be classified as simplex or complex. • If a company has only common stock, or common and nonconvertible preferred stock outstanding and there are no convertible securities, stock options, warrants or other rights outstanding, it is classified as a simple capital structure. (continued) 18-3 Simple and Complex Capital Structures • If net income includes extraordinary gains or losses or other below-the-line items, a separate EPS figure is required for each major component of income, as well as for net income. These historical EPS amounts are referred to as basic earnings per share. (continued) 18-4 Simple and Complex Capital Structures • • Potential EPS dilution exists if the EPS would decrease or the loss per share would increase as a result of the conversion of securities or exercise stock options, warrants, or other rights based on the conditions existing at the financial statement date. A company with potential earnings per share dilution is considered to have a complex capital structure. 18-5 Issuance or Reacquisition of Common Stock Net Income – Preferred Dividends Weighted-Average Common Shares Outstanding The weighted-average number of shares can be computed by determining “month-shares” of outstanding stock and dividing by 12. (continued) 18-6 Issuance or Reacquisition of Common Stock Jan. 1 to May 1 10,000 × 4/12 = 3,333 May 1 to Nov. 1 15,000 × 6/12 = 7,500 Nov. 1 to Dec. 31 13,000 × 2/12 = 2,167 Weighted-average number of shares 13,000 18-7 Stock Dividends and Stock Splits A company had 2,600 shares of common stock outstanding on January 1. The following activities affecting common stock took place during the year. Dates Economic Event Changes in Shares Outstanding Feb. 1 Exercise of stock option + 400 May 1 10% stock dividend (3,000 x 10%) + 300 Sept 1 Sale of stock for cash + 1,200 Nov. 1 Purchase of treasury stock – 400 Dec. 1 3-for-1 stock split + 8,200 (continued) 18-8 Stock Dividends and Stock Splits • • All stock splits and stock dividends must be incorporated into the computation of weighted average shares outstanding. When comparative financial statements are presented, the common shares outstanding for all periods shown must be adjusted to reflect any stock dividend or stock split in the current period. (continued) 18-9 Stock Dividends and Stock Splits • Retroactive adjustments must be made even if a stock dividend or stock split occurs after the end of the period but before the financial statements are prepared. • Disclosure of the situation should be made in a note to the financial statements. (continued) 18-10 Preferred Stock Included in Capital Structure • • Basic EPS reflects only income available to common stockholders; it does not include preferred stock. When a capital structure includes preferred stock, dividends on preferred stock should be deducted from income before extraordinary or other special items from net income in arriving at earnings related to common shares. (continued) 18-11 Preferred Stock Included in Capital Structure • If preferred dividends are cumulative, the full amount of dividends on preferred stock for the period, whether declared or not, should be deducted from income in arriving at the earnings or loss balance related to the common stock. (continued) 18-12 Preferred Stock Included in Capital Structure Date No. of Shares 2012 1/1 to 6/30 200,000 Stock Dividend Portion of Year Weighted Average × 6/12 100,000 (continued) 18-13 Preferred Stock Included in Capital Structure • On June 30, 2013 the firm paid: An 8% dividend on preferred stock (10,000 shares at $100 par × 0.08 = $80,000) A $0.30 per share dividend on common stock (300,000 shares × $0.30 = $90,000) • These cash dividends would not affect the weighted-average number of shares of common stock. (continued) 18-14 Preferred Stock Included in Capital Structure On June 30, 2012, the company issued 100,000 shares of common stock. After the issuance, the firm has 300,000 shares of common stock outstanding. However, these 300,000 are only outstanding for six months, or one-half of the year. (continues) 18-15 Preferred Stock Included in Capital Structure Date No. of Shares 2012 1/1 to 6/30 7/1 to 12/31 200,000 300,000 Stock Dividend Portion of Year Weighted Average × 6/12 × 6/12 100,000 150,000 250,000 There are 250,000 weighted-average shares outstanding at the end of 2010. On May 1, 2013, the firm issued a 50% stock dividend on common stock. (continued) 18-16 Preferred Stock Included in Capital Structure Date No. of Shares 2012 1/1 to 6/30 7/1 to 12/31 200,000 300,000 2013 1/1 to 5/1 300,000 Stock Dividend 1.5 Portion of Year Weighted Average × 6/12 × 6/12 100,000 150,000 250,000 × 4/12 150,000 Now let’s “roll back” the stock dividend for all the years displayed. (continued) 18-17 Preferred Stock Included in Capital Structure Date No. of Shares Stock Dividend Portion of Year Weighted Average 2012 1/1 to 6/30 7/1 to 12/31 200,000 300,000 1.5 1.5 × 6/12 × 6/12 150,000 225,000 375,000 2013 1/1 to 5/1 300,000 1.5 × 4/12 150,000 Now let’s “roll back” the stock dividend for all the years displayed. (continued) 18-18 Preferred Stock Included in Capital Structure Date No. of Shares Stock Dividend Portion of Year Weighted Average 2012 1/1 to 6/30 7/1 to 12/31 200,000 300,000 1.5 1.5 × 6/12 × 6/12 150,000 225,000 375,000 2013 1/1 to 5/1 5/1 to 12/31 300,000 450,000 1.5 × 4/12 × 8/12 150,000 300,000 The number of shares of common stock outstanding before the stock dividend (300,000) now becomes 450,000 shares due to the stock dividend. (continued) 18-19 Preferred Stock Included in Capital Structure Date No. of Shares Stock Dividend 2012 1/1 to 6/30 7/1 to 12/31 200,000 300,000 1.5 1.5 × 6/12 × 6/12 150,000 225,000 375,000 2013 1/1 to 5/1 5/1 to 12/31 300,000 450,000 1.5 × 4/12 × 8/12 150,000 300,000 450,000 (continued) Portion of Year Weighted Average 18-20 Preferred Stock Included in Capital Structure In 2012, the firm made a net income, (including a $75,000 extraordinary gain) of $380,000. The basic earnings per share before the extraordinary gain is as follows: $80,000 dividends Net income after EI – Preferred $305,000 375,000 shares of of Weighted-average shares common stock outstanding Earnings per share from continuing operations = $0.60 (continued) 18-21 Preferred Stock Included in Capital Structure Basic earnings per common share, extraordinary gain for 2012 is as follows: Extraordinary $75,000 gain Weighted-average 375,000 shares shares of of common stock outstanding Earnings per share from extraordinary gain = $0.20 (continued) 18-22 Preferred Stock Included in Capital Structure Basic earnings per common share, net income per share (2012): Preferred Net income after – Dividend $380,000 – $80,000 extraordinary item Weighted-average 375,000 shares shares of of common stock outstanding Net income per share = $0.80 (continued) 18-23 Preferred Stock Included in Capital Structure In 2013, the firm had a net loss of $55,000 and there were no extraordinary items. The basic loss per share is as follows: ($55,000) + ($80,000) Net loss + Preferred dividends 450,000 Weighted-average shares of weightedshares of average common common stock outstanding outstanding Preferred dividends Basic loss per share = $(0.30) are included even though they were not declared. 18-24 Participating Securities and the Two-Class Method • Sometimes a company issues more than one class of stock with ownership privileges. • Different classes do not always have the same claim upon dividends. • In such a case, earnings attributed to each share of the different classes of stock are different and EPS is computed using the two-class method. 18-25 Dilutive Earnings per Share— Options, Warrants, and Rights • • The two major types of potentially dilutive securities are (1) common stock options, warrants, and rights, and (2) convertible bonds and convertible preferred stock. All computations of diluted EPS are made as if the exercise or conversion took place at the beginning of the company’s fiscal year or at the issue date of the stock option or convertible security, whichever comes later. 18-26 Stock Options, Warrants, and Rights • • Stock options, warrants, and rights provide no cash yield to the investors, but they have value because they permit the acquisition of common stock. It is assumed that exercise of options, warrants, or rights takes place as of the beginning of the year or the date they are issued, whichever comes later. (continued) 18-27 Stock Options, Warrants, and Rights • • Options, warrants, and rights are included in the computation of diluted EPS for a particular period only if they are dilutive. The FASB selected the treasury stock method and recommended it be assumed that the cash proceeds from the exercise of options, warrants, or rights to purchase common stock on the market (treasury stock) at the average market price. (continued) 18-28 Stock Options, Warrants, and Rights Treasury Stock Method Demonstrated • At the beginning of the current year, employees were granted options to acquire 5,000 shares of common stock at $40 per share. • The average market price of the stock for the year is $50. (continued) 18-29 Stock Options, Warrants, and Rights The number of shares (using the treasury stock method) to use for calculating diluted earnings per share is calculated as follows: Number of shares sold Proceeds from sale (5,000 × $40) = $200,000 Number of shares that could be purchased with the proceeds ($200,000/$50) Number of shares used for diluted EPS 5,000 4,000 1,000 18-30 Illustration of Diluted EPS with Stock Options • Rasband Corporation had net income of $92,800 for the year. • There are 100,000 shares of common stock outstanding all year. • There are 20,000 options outstanding to purchase shares. • The exercise price per share is $6. • The average market price per share during the year was $10. (continued) 18-31 Illustration of Diluted EPS with Stock Options Basic Earnings per Share $92,800 Basic EPS = = $0.93 100,000 (continued) 18-32 Illustration of Diluted EPS with Stock Options Proceeds from assumed exercise of options outstanding (20,000 × $6) $120,000 Number of outstanding shares assumed to be repurchased with proceeds from options ($120,000/$10) 12,000 Actual number of shares outstanding 100,000 Issued on assumed exercise of options 20,000 Less assumed options repurchased 12,000 8,000 Total 108,000 (continued) 18-33 Illustration of Diluted EPS with Stock Options Diluted Earnings per Share: $92,800 108,000 = $0.86 COMPARED TO: Basic Earnings per Share: $92,800 100,000 The diluted EPS is less than the basic EPS, so it is acceptable. = $0.93 18-34 Diluted Earnings per Share― Convertible Securities • The method of including convertible securities as if conversion had taken place in the EPS computation is referred to as the if-converted method. • To test for dilution, each potentially dilutive convertible must be evaluated individually. 18-35 Multiple Potentially Dilutive Securities • • • The FASB requires selection of the combination of securities producing the lowest possible EPS figure. To avoid having to test a large number of different combinations to find the lowest one, companies can compute the incremental EPS for each potentially dilutive security. Any dilutive stock options and warrants are considered first before introducing convertible securities into the computations. 18-36 Financial Statement Presentation Firms are required to provide the following disclosure items in the notes to the financial statements: 1. A reconciliation of both the numerators and the denominators of the basic and diluted EPS computations for income from continuing operations. 2. The effect that preferred dividends have on the EPS computations. (continued) 18-37 Financial Statement Presentation 3. Securities that could potentially dilute basic EPS in the future that were not included in computing diluted EPS this period because those securities were antidilutive for the current period. 4. Disclosure of transactions that occurred after the period ended but prior to the issuance of financial statements that would have materially affected the number of common shares outstanding or potentially outstanding such as the issuance of stock options. 18-38 Chapter 18 ₵ The End $ 18-39 18-40