Credit and the 5 C*s of Credit

advertisement

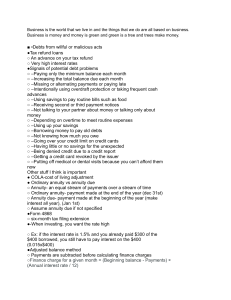

Credit and the 5 C’s of Credit What is credit? Credit Trust given to another person for future payment of a loan, credit card balance, etc. Creditor A person or company to whom a debt is owed. When to use credit WHEN TO USE CREDIT Can you describe a situation when it is a good time to use credit and when it is NOT a good time to use credit? Questions to ask before using credit 1. Do I need it or do I want it? 2. How much am I actually going to pay for the item? (time payments incur interest) 3. Where am I getting the $$ to pay for it? 4. What reward can I receive by using card? (airline miles, etc. ) Questions to ask when applying for credit? 1. What is the annual percentage rate (APR)? 2. What is the annual fee? 3. When are payments due? 4. What is the minimum payment required each month? 5. Is there a grace period? 6. What is the credit limit? THE FIVE Cs OF CREDIT C = Capital C = Collateral C = Conditions C = Character C = Capacity Capital Banks want to see that you have a financial commitment; that you have put yourself at risk. Have you paid off debts? (ie. Car loans) Collateral How much cash/wealth/ property do you have that could cover debts if you fail to pay? Most collateral is in the form of real estate, your bank accounts, and parents promise to provide support. Conditions What is your current economic condition? Are you sensitive to economic downturns. The bank wants to know that you are good at managing expenses. Character Banks want to put their money with clients who have the best credentials and references. The way you take responsibility, your timeliness in fulfilling obligations - that's character. Capacity What is your borrowing history and track record of repayment. How much debt can you handle? Will you be able to honor the obligation and repay the debt? Measure of Credit Worthiness: Debt to Income Ratio DTI is the percentage of a consumer's monthly gross income that goes toward paying debts. In order to qualify for a mortgage for which the lender requires a debt-to-income ratio of 28/36: Yearly Gross Income = $45,000 / Divided by 12 = $3,750 per month income. $3,750 Monthly Income x .28 = $1,050 allowed for housing expense. $3,750 Monthly Income x .36 = $1,350 allowed for housing expense plus recurring debt. COSTS OF CREDIT How much can credit cost? If you make only the minimum payment for an item, here are some examples of what you might actually pay and how long it will take you to pay it. 13 Slide 4 – Costs of Credit Lesson Reference: Credit, Activity 5 – Handout 2