Accounting Notes Power Point

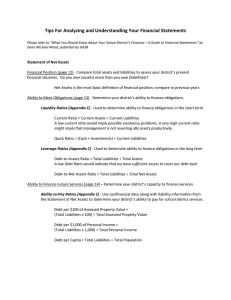

advertisement

A balance sheet shows the value of (or net worth) of a company on a given day. It is a snapshot of a company’s financial affairs at a single point in time. It is usually done at the end of a month and companies often compare the balance sheet with those of previous months to determine whether their assets or liabilities are growing. Things that the company owns and has a dollar value › Examples: car, real estate, computer Fixed Assets - Assets of a long-term nature, such as land and buildings. The business has acquired these assets ordinarily in order to use them in the production of other goods and services. Account Receivable – (A/R) money owed to the business Current Assets – Assets used up within one year. Ex. Inventory, materials, cash. These will be turned into cash within one year. Debts the organizations owes to other organizations › Examples: Accounts Payable – (A/P) Money the business owes other companies Current Liabilities - Owed and must be paid within the year Long-term liabilities - A debt or portion of a debt that does not have to be paid within a year The value of the business = the amount of money the owner initially invested in the business plus accumulated profits and minus money taken out of the business (drawings or dividends) Assets – liabilities = Owner’s Equity Or A = L + OE Revenue is the money or promise of money received from sale of goods or services Expenses are the costs incurred to run a business (e.g., salaries, utilities, advertsing, etc.) Revenues – Expenses = Net Income Revenues – Expenses = Net Loss Summarizes the items of revenue and expenses Determines the net income or net loss for a stated period of time Accounting period may be a month, quarter (three months), six months, year or any regular period of time Fiscal period is a synonym for accounting period W. Puma Tutoring Company Income Statement Three months ended March 31, 2004 Revenue who what when $2100 Expenses: Office Supplies Software Postage Gas General Net Income $240 850 50 375 20 Indent one column 1535 $565 Total here Double underline $ at top of any column & below any line