Budgeting

advertisement

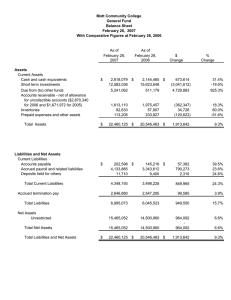

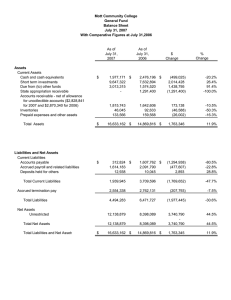

Budgeting Money Management THE BASIC ECONOMIC PROBLEM: Limited Resources And Unlimited Wants And Needs FINANCIAL PLANNING STEPS: Set Goals Analyze Information Create A Plan Implement The Plan Monitor and Modify The Plan (Evaluate) Set New Goals (Continue Process) FINANCIAL PLANNING PROCESS DECISION-MAKING PROCESS Set Goals Identify the Goal Analyze Informatio n Create A Plan Gather Information Analyze Outcomes Examine Alternatives Implement the Plan Alternative Choices Monitor and Modify the Plan Make A Decision Set New Goals Set New Goals Evaluate Results MY SMART GOALS Worksheet For Short-Term, Medium-Term and Long-Term. Complete Two Goals For Each Time Frame. 1.Short-Term-achievable in 0-3 months. 2.Intermediate or Medium-Term-achievable in 3-12 months. 3.Long-Term-achievable from 1 year or greater. Achievement Date Timeline (Short, Intermediate, Or Long-Term) Estimated Cost Buy Christmas Presents 12/25/05 Short $200 $67 [200/3] Beach Trip 07/04/06 Intermediate $500 $18 [500/28] Down payment on car 08/05/07 Long $1000 $12 [1000/84] Specific Goal Amount to Save Per Week n t s : $ 1 1 0 , 0 W 0 a 0 g . e 0 s 0 $ 1 5 , 8 0 R 0 e . n 0 t 0 G a s a n d E l e c t r i c p $ 3 , 2 5 0 . 0 0 $ 1 1 5 , 0 0 0 . 0 0 _ _ _ _ _ _ _ _ _ _ $ 1 5 , 8 0 0 . 0 0 _ _ _ _ _ _ _ _ _ _ $ 3 , 3 8 0 . 0 0 _ _ _ _ _ _ _ _ _ _ _ Balance Sheet is helpful in setting goals when budgeting Cash Flow Statement is helpful in establishing budget categories Balance Sheet Assets Liabilities Checking account 500.00 Home mortgage 50,000.00 Savings account 2,000.00 Credit card balance 300.00 Home $90,000.00 Loan $2,000.00 Automobile 5,000.00 Furniture $6,000.00 Total Liabilities $52,300.00 Computer $1,500.00 Jewelry $1,000.00 Owner’s Equity Total Assets minus Total Liabilities $53,700.00 Total Assets $106,000.00 Total Liabilities And Owner’s Equity $106,000.00 Personal Cash Flow Statement Monthly Cash Inflows (Income) Net Income (take home pay) $1,500.00 Other Income (interest) Total Income $30.00 $1,530.00 Monthly Cash Outflows (Expenditures) Savings Rent $150.00 $400.00 Food $350.00 Clothing $50.00 Electricity/Gas $90.00 Telephone $30.00 Car $250.00 Personal Expenses $20.00 Entertainment $50.00 Total Savings and Expenditures $1,390.00 Net Cash Flow $140.00 Budget •a plan for saving and spending •helps achieve financial goals •helps avoid credit problems •must be evaluated from time to time •is essential for consumers, businesses and governments occur regularly same amount each time differ each time Monthly Budget Get a NEFE High School Financial Planning Guide [yellow books near the phone]. Turn to Unit Three You are to read page 27 – 32. Don’t complete any of these worksheets, we’ll do them together in class.