Cottonwood Management Consulting PO Box 44287 Tucson, AZ 85733 520-624-7127

advertisement

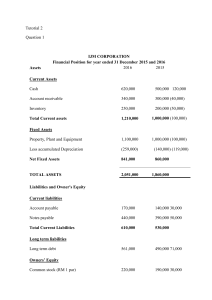

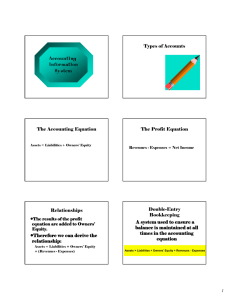

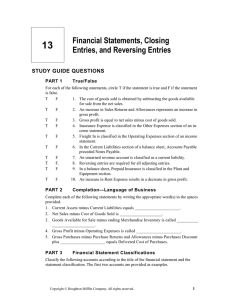

Cottonwood Management Consulting PO Box 44287 Tucson, AZ 85733 520-624-7127 Twenty five business terms to know Ratios Asset Turnover (AT) - A ratio that indicates how your receivables and inventory compare to sales. Sales/Assets=AT Current Ratio or Acid Test Ratio (CR) - Tells how many times the current liabilities can be paid with the current assets. Total Current assets/total current liabilities=CR Return on assets (ROA) - Profit before taxes divided by your total assets, measures a company’s profitability. Net income/total assets=ROA Return on Sales (ROS) - A ratio that tells you how costs and expenses compare to actual sales. Operating income/revenue=ROS Income statement General and Administrative expenses (G & A) - The income statement item that combines salaries, commissions, travel expenses and payroll expenses Overhead Costs - Rent, utilities, and insurance are typical examples of overhead costs Gross profit or gross margin - Sales minus the cost of goods sold Balance - The difference between credit and debits in an account Risk - A state in which each alternative leads to a set of specific outcomes that effect performance or financial positions Balance sheet Equity - If you have no liabilities, equity equals your total assets Current Assets (C/A) – A Company’s assets that are expected to be converted into cash within 365 days or less Fixed assets – Includes such items as land, building, machines, and furniture Long Term Debt (LTD) - Loans and obligations that have a maturity of longer than one year 1 Retained earnings - Earnings not paid out as dividend or drawn on by the owner but reinvested in the business or used to pay off debt Some more Definitions Working Capital - Current assets minus current liabilities Assets - Tangible and intangible economic resources that provide future benefit to a company Owner’s Equity - Interest of the owners of the assets of a company represented by capital contributions and retained earnings Depreciation - A non-cash expense that reduces the value of an asset as a result of age, wear and tear, or obsolescence Balance sheet - This statement gives you a snapshot of your company’s key fact as of any date General Finance Balance Sheet, Income Statement, and Cash Flow Statement - Three valuable tools that indicate the financial health of a company North American Industry Classification System (NAICS) - The standard used by the Federal government for classifying business establishments to gather statistical data Risk Management Association Financial Ratio Benchmarks - Source for researching single industry data from industry Annual Financial Statements GAAP - Generally Accepted Accounting Principles? Goodwill - The intangible value of a company’s name/reputation, customer relations the give it an edge or advantage calculated by the purchase price minus book value Decision tree - A pictorial representation of decision situations when uncertainty and risk are present 2