Chapter 5

advertisement

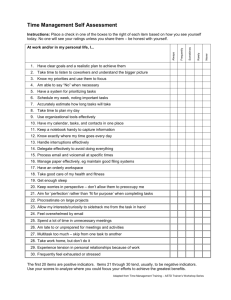

Chapter 5 Market Efficiency Fundamental Analysis • Evaluation of firms and their investment attractiveness • Based on – firm’s financial strength, – competitiveness, – earnings outlook – managerial strength, etc. Technical Analysis • Method of evaluating securities and forecasting future price changes • Based only on past price and volume behavior Efficient Market Hypothesis (EMH) • Theory that market correctly prices securities in light of known relevant information • 3 Forms – Weak – Semistrong – Strong Weak Form EMH • Past stock price return movements cannot be used to predict future price changes • Implies technical analysis cannot consistently provide superior returns Semistrong Form EMH • Market prices quickly and accurately reflect all public information • Suggests fundamental analysis applied to publicly available information and data cannot systematically yield superior returns Strong Form EMH • Market prices quickly and accurately reflect all public and nonpublic information • Suggests even insider information will not consistently result in superior returns Random Walk • Documented by initial research on security returns • Random motion of stock prices as likely to move in one direction as another, regardless of past price behavior • Consistent with the weak form of the efficient market hypothesis (EMH) – If stock prices change randomly, past price movements cannot be used to predict future price movements. Why Stock Prices May Change in Random Manner • Prices based on expectations of future news and events • If expectations unbiased, then: – when actual news and events better than expected, stock prices go up – when actual news and events worse than expected, stock prices go down • Random whether news better or worse than expected! Market Success and EMH • If EMH is true, can anyone can beat the market? – • At any point in time, half of investors will have “beaten” market. If someone beats market, does this automatically invalidate the EMH? – Some will occasionally flip 10 heads in a row. Testing the Weak Form of the EMH • Serial Correlation – • Tests for statistically significant relationships between returns Filter Rules – – Form of technical analysis that advocates buying stock when price rises by given percent or selling when price falls by certain percent Successful with small filters, but only if transaction fees are ignored Conclusions About Technical Analysis • Research does not confirm the consistency of technical analysis techniques • Tools of technical analysis have multiple interpretations • There are so many techniques that definitive statements can not be made Tests of Semi-Strong and Strong EMH: • Anomaly – Condition in security markets that allows for persistent abnormal returns on a consistent basis after adjusting for risk Potential Causes of Market Inefficiency • Small Firm Effect – possible anomaly to the efficient market hypothesis – Tendency for small firms to earn above-rates of return – Not all investors have resources and expertise to properly access stocks – Some misevaluation may only be captured if one is able to take control of a company Potential Causes of Market Inefficiency (Continued) • Dogs of the Dow – Buy top ten stocks with highest dividend yield on a list of 30 picks – Change list at one year time intervals – Has not performed well since 1987 Potential Causes of Market Inefficiency (Continued) • January Indicator – January performance is said to forecast the year – Evidence is not impressive Potential Causes of Market Inefficiency (Continued) • Other Potential Causes – Day-of-the-Week Effect – Additions to the S&P 500 – Insider Trader Technical Market Indicators • Data series or combination of data series said to be helpful in forecasting market’s future direction or market indicator • Can be categorized as sentiment indicators, flow of funds indicators and market structure indicators Sentiment Indicators • Assumes sentiment of investors can be ascertained by certain indicators • Sophisticated Investor Rationale: Sophisticated investors right more often than wrong. Seek an indicator that reveals whether sophisticated investors are buying or selling and do same • Contrarian Rationale: Some investors with limited resources are wrong more often than right; seek an indicator of what the “small guys” are doing and do the opposite. Sentiment Indicators (Continued) • Odd-Lot Ratio: measures the amount of odd-lot purchases or sales and assumes that people who trade in odd-lots are inexperienced trades • Mutual Fund Cash Position: assumes that mutual fund managers build up cash at market bottoms • Barron’s Confidence Index: ratio of high-grade to average grade bond yields reflect confidence of smart investors Sentiment Indicators (Continued) • Trin: acronym for trading index and assumes that market movements are more sustainable when accompanied by heavy volume Volume of declining stocks/Number of declining stocks Trin = Volume of advancing stocks/Number of advancing stocks • Put/Call ratio: calculated as ratio of either outstanding puts to calls or volume of puts to calls. Flow of Fund Indicators • Attempts to determine where cash is going or where it might go – Short Interest: assumes that a rise in short interest forecasts a rally Short Interest Ratio Total Short Interest Average Daily Trading Volume – Cash Balances in Brokerage Accounts: viewed as a measure of near term buying Market Structure Indicators • Moving Average • Breadth Indicators • Relative Strength Indicators Market Structure Indicators: Dow Theory • Charting theory originated by Charles Dow • Market uptrend is confirmed if primary market index hits new high that is soon followed by high in secondary index • Downtrend signaled in similar fashion • To make profit in stock market investors should take advantage of primary market trend • Whenever primary trend is up, each secondary trend will produce peak higher than last one – reverse true for down trend • Any true indicator of primary market trend confirmed relatively quickly by similar action in different stock price averages Charting • Attempt to forecast stock price changes from charts of past price and volume data • Form of technical analysis Bar Chart • Type of graph that plots price over time • Typically contains data on high, low, and volume Bar Chart Example Resistance Level • Price range that, according to technical analysis, tends to block further price increases or decreases Support Level • Floor price that, according to technical analysis, tends to restrict downside price moves Head and Shoulders Formation • Pattern of stock price trends that looks like a head and shoulders • Believed by some technical analysts to forecast price decline • Neckline: price at the bottom of the shoulders Point-and-Figure Chart • Technical chart that has no time dimension – X is used to designate an upward price movement of a certain magnitude, while a “0” denotes a similar size down move – X’s are stacked on top of each other as long as the direction of movement remains up – New column is begun when direction changes. • Technical analysts use these charts to predict future price movements Point-and-Figure Example Major Premises for Chartists • Stock prices movements occur in patterns consistent enough to be predictable • Contains resistance and support levels • Volume goes with the trend in some methods