Assignment 7.1: Corporate Financing Problems (100 points)

advertisement

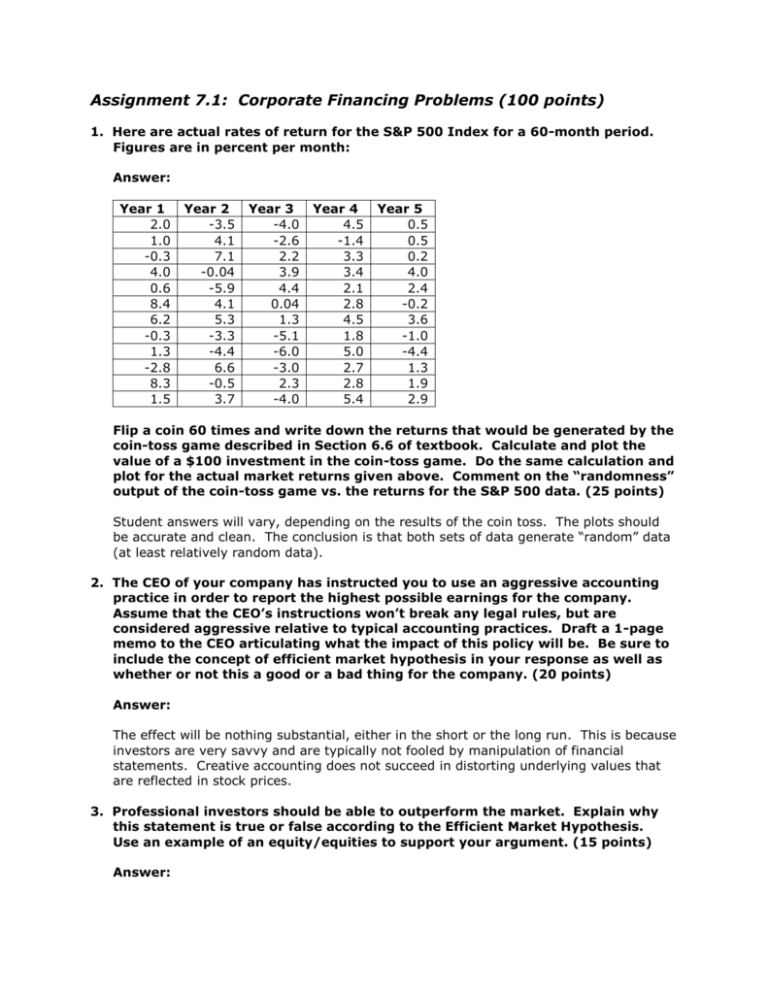

Assignment 7.1: Corporate Financing Problems (100 points) 1. Here are actual rates of return for the S&P 500 Index for a 60-month period. Figures are in percent per month: Answer: Year 1 2.0 1.0 -0.3 4.0 0.6 8.4 6.2 -0.3 1.3 -2.8 8.3 1.5 Year 2 -3.5 4.1 7.1 -0.04 -5.9 4.1 5.3 -3.3 -4.4 6.6 -0.5 3.7 Year 3 -4.0 -2.6 2.2 3.9 4.4 0.04 1.3 -5.1 -6.0 -3.0 2.3 -4.0 Year 4 4.5 -1.4 3.3 3.4 2.1 2.8 4.5 1.8 5.0 2.7 2.8 5.4 Year 5 0.5 0.5 0.2 4.0 2.4 -0.2 3.6 -1.0 -4.4 1.3 1.9 2.9 Flip a coin 60 times and write down the returns that would be generated by the coin-toss game described in Section 6.6 of textbook. Calculate and plot the value of a $100 investment in the coin-toss game. Do the same calculation and plot for the actual market returns given above. Comment on the “randomness” output of the coin-toss game vs. the returns for the S&P 500 data. (25 points) Student answers will vary, depending on the results of the coin toss. The plots should be accurate and clean. The conclusion is that both sets of data generate “random” data (at least relatively random data). 2. The CEO of your company has instructed you to use an aggressive accounting practice in order to report the highest possible earnings for the company. Assume that the CEO’s instructions won’t break any legal rules, but are considered aggressive relative to typical accounting practices. Draft a 1-page memo to the CEO articulating what the impact of this policy will be. Be sure to include the concept of efficient market hypothesis in your response as well as whether or not this a good or a bad thing for the company. (20 points) Answer: The effect will be nothing substantial, either in the short or the long run. This is because investors are very savvy and are typically not fooled by manipulation of financial statements. Creative accounting does not succeed in distorting underlying values that are reflected in stock prices. 3. Professional investors should be able to outperform the market. Explain why this statement is true or false according to the Efficient Market Hypothesis. Use an example of an equity/equities to support your argument. (15 points) Answer: There is a level of anticipated risk in the market. Investors expect to receive rewards corresponding to that level. But these returns have occurred on average for many cases over long periods of time. A similar generalization can be made for professional investors who are seeking undervalued stocks relative to the valued determined by perceived riskiness. Thus over the long run and for numerous instances, the returns will indeed have higher average amounts. Professional investors tend to do this. They are in the market for long periods of time and are making hundreds and hundreds of investments. If they undertake higher than average risks, they will tend to have higher than average returns and thus “beat the market.” But many of these professionals will fail to meet the averages from time to time, especially those who are consistently taking the higher risks. Some analysts tend to make more insightful use of available information that helps them to realize superior returns from time to time. 4. Compare the returns of an “actively” managed mutual fund portfolio with that of an index fund. In 2-3 pages (maximum), comment on the returns of both funds over the past 10 years. Ensure that you plot the information and show the trends. As part of your write-up, describe which aspect of the EMH seems to be most relevant for your observation. (15 points) Answer: Students should find data for an actively managed mutual fund and data for an index fund. Similar to Exercise 7.1, they should plot the data and discuss which fund has provided greater returns. The comment on EMH should address whether or not the actively managed portfolio outperforms the index fund. If the active portfolio outperforms the index fund over the timeframe specified, this would lean toward the “weaker” side of the EMH spectrum; the converse of this…if the index fund outperforms the active fund, this would lend credence to the strong form of EMH. 5. Calculate the market and book values of the company with the following parameters. Comment on the relationship between these two values. (15 points) Total number of shares of common stock: 175,000 Current price of stock: $34 Original price of stock 2 years ago: $53 Amount of bonds: $5,560,000 Answer: Market value of company = 175,000 x $34 = $5,950,000 Book value of company = 175,000 x $53 = $9,275,000 Typically, the market value of a company is greater than the book value because of the fact that a company’s value appreciates over time. In this case, the opposite is true: the market value is less than book, which means that the company probably has not been doing well, financially. An example of this type of scenario could be found in many of the dot com companies of the late 90’s/early 00 timeframe when their value depreciated significantly. In many cases, bankruptcy resulted. 6. A company has authorized 1.8 million shares of common stock. How many shares are outstanding if the shareholder’s equity of the balance sheet is the following (10 points): Account Common stock ($5 par) Paid in surplus Retained earnings Common equity Treasury stock Net Common equity $ Thousands 245 400 1000 1600 600 2500 Answer: The par (book) value per share multiplied by the number of shares issued equals the dollars of common stock entered on the balance sheet. So the shares issued must be equal to: $245,000 / $5 = 49,000.