Selection of our due diligence work in Asia

advertisement

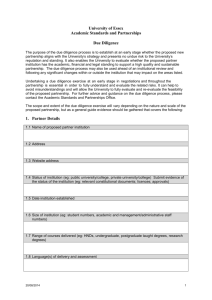

Overview of financing opportunities in the TMT space in Asia Amrish Kacker, Lim Chuan Wei February 2010 Ref: 5445-66 2 Contents Introduction About Analysys Mason Financing opportunities in the Asia–Pacific region Our general methodology Our due diligence expertise Ref: 5445-66 3 Introduction With the thawing of capital markets in the wake of the financial crisis, financing activity worldwide, including in Asia, is widely expected to pick up in 2010 Within the TMT sectors, financing opportunities – both new and those postponed previously due to the crisis – should emerge or resurface quickly in the immediate period This brief presents Analysys Mason’s perspectives and insights into the financing opportunities for the TMT sectors in Asia The remainder of this document is structured as follows: About Analysys Mason – a short introduction on who we are and what we do Financing opportunities in the Asia–Pacific region – our views on what financing opportunities may be available, why they would interest financial institutions, and which are the most attractive to pursue Our general methodology – our analytical methods for supporting such opportunities Our due diligence expertise – our capabilities and experience in transactional support and due diligence Ref: 5445-66 4 Introduction About Analysys Mason Financing opportunities in the Asia–Pacific region Our general methodology Our due diligence expertise Ref: 5445-66 About Analysys Mason 5 Analysys Mason is the world’s premier adviser in telecoms, IT and media Global presence and experience Integrated service offering Strategy Planning Market intelligence Review Implementation Assignments completed Analysys Mason office Through our global presence, we deliver strategy advice, operations support and market intelligence to leading operators, regulators, financial institutions, broadcasters, vendors and enterprises in over 80 countries Our people have had a major influence on the industry for more than 20 years: led the liberalisation of telecoms across Europe and Asia and mediated in policy issues for operators and regulators supported several hundred transactions and licence acquisition processes for operators and financial institutions provided strategic and operational support to major operators in the roll-out and expansion of businesses across the sector, enhancing enterprise value Ref: 5445-66 About Analysys Mason 6 Our consulting advice is valued across all sectors Enterprise users Public sector In particular, we have provided commercial and technical due diligence services to financial institutions and mobile and fixed operators worldwide Providing ICT and procurement advice for emergency services and public bodies Mobile operators Delivering value through strategy planning and implementation Helping to maximise returns from investment in ICT Regulators Establishing and implementing policy frameworks in telecoms and media markets Media companies Helping to maximise revenue in converging markets Financial institutions Supporting vendors, sellers and financiers of industry transactions Fixed operators Defining new strategies, optimising service portfolios and supporting policy development Ref: 5445-66 About Analysys Mason 7 Our success is built upon a deep and rigorous understanding of key sector issues Mobile Impact of mobile broadband WiMAX – threat or opportunity? Revenue-maximising pricing propositions Broadband Regulation Media ICT infrastructure Next-generation access strategies: FTTx versus wireless Wholesale product definition in NGNs Strategies for fixed–mobile convergence Capitalising on the digital dividend Regulatory environments to deliver NGA and NGN TV regulation in a converging market Content distribution strategies in a converging market Creation and distribution of ‘three-screen’ services Maximising value of advertising inventory ICT consolidation and cost optimisation Service fulfilment and assurance OSS/BSS legacy migration RAN sharing and other cost reduction strategies OSS/BSS optimisation Evaluating advertising opportunities Value migration from infrastructure to services and content Efficient NGN procurement processes OSS/BSS and customer support Effective spectrum management strategies Licence allocation and acquisition processes Delivery of end-user experience Regulation for a converged industry Assessing the impact of media players entering the telecoms market OSS/BSS process optimisation WAN acceleration Construction, location and optimisation of contact centres and control rooms Ref: 5445-66 About Analysys Mason 8 We have an established track record of working with the major financial institutions Analysys Mason has undertaken over 100 due diligence assignments since 2002 We have undertaken a similar number of projects in support of vendor financing, M&A and private placements We have worked with a wide range of operators, investment banks, private equity firms, strategic investors and governments Selection of businesses on which we have undertaken due diligence BTC, Bahamas (2009) • JTL, Kenya (2009) • Avea, Turkey (2008) • Aktel, Bangladesh (2008) • MTN, Africa (2008) • ONI, Portugal (2008) PCCW, Hong Kong (2008) • Zain, Nigeria (2008) • Excelcomindo, Indonesia (2007) • Safaricom, Kenya (2007) • Lattelecom, Latvia (2007) ONE, Austria (2007) • Camtel, Cameroon (2007) • MTC, Saudi Arabia (2007) • National Grid Wireless, UK (2007) • Vivatel, Bulgaria (2007) TIM, Greece (2006) • Magticom, Georgia (2006) • Bite, Lithuania, Latvia (2006) • Armentel, Armenia (2006) Selection of financial institutions that have chosen Analysys Mason for due diligence assignments ABN AMRO • Apax Partners • Bank of Ireland • BBVA • BC Partners • BNP Paribas • Capital Partners • Carlyle • CDC Group Citigroup Credit Suisse • Deutsche Bank • EBRD • Export Development Canada • Eurazeo • Finnvera • GE Capital • HSBC • ING • JP Morgan Kohlberg Kravis Roberts • Lazard • Lloyds TSB Bank • NM Rothschild & Sons • The Royal Bank of Scotland Group • SACE Société Générale • Standard Bank • TecCapital Investments • TD Bank Financial Group • UniCredit Banca Mobiliare WestLB • World Bank Group Selection of operators that have chosen Analysys Mason for due diligence assignments Telkom South Africa • Telstra Europe • Zain Nigeria • Bahamas Telecommunications Company • Cable & Wireless UK • ONI Portugal Mauritius Telecom • Reliance • National Grid • Safaricom • Etisalat • Vodafone Australia • Thus Ref: 5445-66 About Analysys Mason 9 We have in-depth market experience in the Asia–Pacific region to help financial institutions evaluate opportunities … Project experience in the Asia–Pacific region by sector Mobile Broadband Fixed Media Regulatory ICT East Asia China & Mongolia Japan & South Korea Hong Kong & Macau Taiwan South Asia India Pakistan Bangladesh Sri Lanka South-East Asia Indonesia Thailand Cambodia, Laos & Vietnam Philippines Malaysia & Brunei Singapore Oceania Australia New Zealand Company experience Additional project experience of core Singapore team Ref: 5445-66 About Analysys Mason 10 … having worked on a variety of projects across the region Selected projects in the Asia–Pacific region 1 2 Development of a detailed cost accounting system Estimation of revenue forecast in China for mobile broadband services 3 Comprehensive mobile LRIC cost study for a mobile operator, to calculate termination 4 (a) Several studies for a mobile operator, including assessment of telematics and FMC. (b) For a content player, devised an entry strategy into the European market. 5 Review of strategic rationale for proposed merger between two operators 6 (a) Assessed a mobile operator’s business model to evaluate a 3G opportunity. (b) Due diligence of integrated telecoms and media operator. 7 Due diligence of cellular operator 8 (a) Due diligence of an integrated wireline and wireless operator. (b) Supported an integrated operator in growing its international voice business. 9 Study of regulation and competition in the wireless local loop market 10 Business planning for WiMAX new entrant 11 A range of projects for a mobile operator, including business planning, compensation negotiation and 3G licence support 12 (a) Evaluated the 3G opportunity and alternate business structures for a mobile operator. (b) Mobile operator’s MVNO strategy and wholesale pricing. (c) WiMAX business planning for new entrant 3 2 1 8 7 6 9 13 12 4 5 10 11 14 15 Assignments completed 16 13 (a) Pricing strategies for an incumbent operator. (b) Due diligence of CDMA WLL operator / WiMAX licence holder 14 (a) Due diligence of a mobile operator. (b) Assessed strategic options in infrastructure sharing / MVNOs for new 3G operator. (c) WiMAX business plan for a new entrant 15 For Vodafone Australia, undertook a critical review of a bottom-up mobile network cost model developed on behalf of the regulator. 16 Provided expert advice on the TSLRIC for both LLU and co-location services. Ref: 5445-66 11 Introduction About Analysys Mason Financing opportunities in the Asia–Pacific region Our general methodology Our due diligence expertise Ref: 5445-66 Financing opportunities in the Asia–Pacific region 12 Markets are recovering, and players in the TMT sectors are looking to take advantage Recovery trends in major Asia–Pacific stock indices Shanghai Composite (2009) Nikkei 225 (2009) India BSE 30 (2009) Straits Times Index (2009) Ref: 5445-66 Source: Yahoo Finance Financing opportunities in the Asia–Pacific region 13 Financing requirements will arise from network deployments, M&A and new transmission platforms Network deployments Some operators in the region, particularly in emerging markets, are undertaking network expansion and upgrades As expanding or upgrading networks is capital intensive, operators will be looking for financing to support these efforts M&A M&A activity is expected to pick up further in the next year, with various opportunities in the TMT sectors across Asia On the buy-side, PE firms and strategic investors will be seeking financing to support their acquisitions New transmission platforms With some markets in the region on the verge of issuing 3G and/or WiMAX licences, telecoms operators – both incumbents and new players – will be looking for financing to back their forays into new technologies Some mobile/cable operators will look into fibre optic roll-out to support additional revenue generation With the pick-up in activity in the TMT sectors, operators will increasingly seek financing to back new or postponed projects This likely increase in demand for financing presents opportunities for commercial banks and other financial institutions Ref: 5445-66 Financing opportunities in the Asia–Pacific region 14 Network deployment activity in the region will be driven by network expansion, upgrades and greenfield deployment China India Regional operators in India are looking towards national expansion … … while impending 3G/WiMAX licensing will trigger further network deployment and upgrades (est. USD2 billion) Chinese operators are rolling out 3G networks after receiving their licences, but funding support will likely be tied up by Chinese banks Regional Some players in East and South East Asia are exploring potential regional WiMAX deployments Vietnam Bangladesh 3G and WiMAX licences are expected to be issued in 2010, which will trigger network deployment (est. USD300 million) Operators in Vietnam are just beginning to roll out their 3G networks with the recent issuance of 3G licences in 2009 Thailand Indonesia Indonesian operators are pushing forward with WiMAX deployment 3G and WiMAX licensing in Thailand have stalled … … but operators will be looking to kickstart network deployment and upgrades when and if the process gets back on track (est. USD300 million) Ref: 5445-66 Financing opportunities in the Asia–Pacific region 15 M&A activity is widely expected to heat up in 2010 Effective M&A deal value in Asia-Pacific, by quarter (USD billion) 180 160 With the thawing of capital markets in the second half of 2009, M&A activity has begun to pick up There was reportedly a 32% increase in number of worldwide M&A transactions in 4Q 2009 M&A activity is expected to continue heating up into 2010 156 155 Deal value (USD billion) 140 Quotations from industry 120 “The future looks encouraging for M&A with strong indicators in the last quarter…we anticipate deal activity to increase in 2010…” 104 100 92 86 +30% 80 60 40 58 47 Neil Masterson, Global Managing Director of Investment Banking, Thomson Reuters 61 “Global M&A activity would rise as much as 35% in 2010 as improving economic conditions bolster dealmaking…” Research firm Sanford C. Bernstein 20 0 "The relatively high volume of deals recorded in the fourth quarter of 2009 hints at a resurgence of M&A activity for the new year…" Research firm Dealogic Ref: 5445-66 Source: Thomson SDC, press releases, Analysys Mason Financing opportunities in the Asia–Pacific region 16 The roll-out of new transmission platforms such as 3G, WiMAX, and fibre will create a need for financing 3G WiMAX Markets such as India and Bangladesh (and possibly Thailand) are on the verge of licence issuance – financing support will likely be required for bid submissions as well as network roll-outs In Vietnam, licences have recently been issued, and operators will be looking for more funding to build the network, as well as to develop and market their 3G services Financing requirements driven by the deployment of new transmission platforms Markets such as India and Bangladesh (and possibly Thailand) are on the verge of licence issuance – financing support will likely be required for bid submissions as well as network roll-outs Existing WiMAX players in the region are looking to expand their operations, both domestically as well as regionally In Indonesia and possibly Taiwan, consolidation is expected between WiMAX players Other operators are looking to expand their 3G networks Fibre optic Some operators in the region have embarked on fibre optic roll-out of the core and/or access network cable operators, for instance, are upgrading their infrastructure to better compete some mobile operators are investing in fibre to enter the broadband space mobile operators are also upgrading their core/backbone infrastructure Ref: 5445-66 Financing opportunities in the Asia–Pacific region 17 In East Asia, the largest financing opportunities are likely to be in China Assessment of opportunities in East Asia Market 1 Restructuring of PCCW Hong Kong 2 Spin-off of handset manufacturing operations of Huawei and/or ZTE China 3 Acquisition of mobile VAS providers China 4 Sale of Shaw Brothers’ stake in TVB Hong Kong 5 Buyout of i-cable Hong Kong 6 Buyout of ATV Hong Kong 7 Buyout of Vibo Telecom Taiwan High Possible funding requirement Opportunity 2 MEDIUM HIGH ATTRACTIVENESS 1 ATTRACTIVENESS 4 5 3 6 MEDIUM 7 ATTRACTIVENESS Low Low High Possibility If you are interested in discusssing any of these opportunities further, please contact Amrish at amrish.kacker@analysysmason.com or Chuan Wei at lim.chuan.wei@analysysmason.com Ref: 5445-66 Financing opportunities in the Asia–Pacific region 18 The possible restructuring of PCCW remains an opportunity to watch What is happening? PCCW has been exploring potential restructuring options for sale of its assets, but has not been successful Most recently, PCCW dropped a privatisation bid in April 2009 after regulators blocked the plan due to allegations of shareholder manipulation It remains possible that PCCW will renew such efforts in the wake of a pick-up of activity in capital markets How Analysys Mason can provide support We are able to provide commercial and technical pre-due diligence, and due diligence services in support of this opportunity These include: review of the Hong Kong telecoms market review of the competitive environment review of business plan and potential risks review of network assets valuation of stake and identification of possible downsides Why this is of interest A potential buyer looking to take a stake in PCCW could seek financing support Given the likely size of this deal, the financing requirement could be substantial Ref: 5445-66 Financing opportunities in the Asia–Pacific region 19 In South Asia, the most compelling opportunities are in India Assessment of opportunities in South Asia Opportunity Market 1 National expansion of mobile operators India 2 3G/WiMAX licence bid and roll-out India MEDIUM HIGH 3 Merger/acquisition between Africa-Indian operators India ATTRACTIVENESS ATTRACTIVENESS 4 3G/WiMAX licence bid and roll-out Bangladesh 5 Divestment of SingTel’s stake in PBTL Bangladesh 3 Potential funding requirement High 21 4 5 MEDIUM ATTRACTIVENESS Low Low Possibility High If you are interested in discusssing any of these opportunities further, please contact Amrish at amrish.kacker@analysysmason.com or Chuan Wei at lim.chuan.wei@analysysmason.com Ref: 5445-66 Financing opportunities in the Asia–Pacific region 20 In South-East Asia, 3G and WiMAX deployments would likely drive needs for financing support Assessment of opportunities in South-East Asia Market 1 Roll-out of 3G by mobile operators Vietnam 2 Expansion of networks Indonesia, Laos, Cambodia, Philippines 3 Regional WiMAX deployment SEA region 4 Capitalisation of TRUE Move Thailand 5 Capitalisation of Sun Cellular Philippines 6 Acquisition/expansion of broadband operations by mobile operators Malaysia, Philippines, Singapore 7 WiMAX expansion in Indonesia Indonesia 8 Buyout of Jasmine Thailand 9 Buyout of u-mobile Malaysia 10 Divestment of towers by incumbents Thailand 11 Merger of Astro and Maxis Malaysia High Potential funding requirement Opportunity MEDIUM HIGH ATTRACTIVENESS ATTRACTIVENESS 1 3 2 11 10 5 4 6 MEDIUM 8 Low 7 ATTRACTIVENESS 9 Low Possibility If you are interested in discusssing any of these opportunities further, please contact Amrish at amrish.kacker@analysysmason.com or Chuan Wei at lim.chuan.wei@analysysmason.com High Ref: 5445-66 Financing opportunities in the Asia–Pacific region 21 Operators in Vietnam are now in the process of making the transition to 3G How Analysys Mason can provide support We are able to provide commercial and technical pre-due diligence, and due diligence services in support of potential investments in Vietnam These services include: What is happening? 3G licences were issued in 2009, and all three operators (Viettel, Vinaphone and Mobifone) are now rolling out 3G networks and services Why this is of interest The roll-out of 3G networks and services means that Vietnamese operators will be in need of capital to fund their network and technology upgrade review of the Vietnam mobile market review of the Vietnam regulatory environment review of the competitive environment assessment of new entrant threat review of the technology landscape, including 3G, and implications for target review of target’s business plan and potential downsides, especially with 3G valuation of target and review of bid Ref: 5445-66 22 Introduction About Analysys Mason Financing opportunities in the Asia–Pacific region Our general methodology Our due diligence expertise Ref: 5445-66 Our general methodology 23 Our focus has made us the adviser of choice for due diligences of companies within the TMT sectors Our assignments cover all sectors of the TMT market: we have undertaken due diligence on numerous mobile, fixed and cable network operators, carriers, equipment vendors, broadcast operators, tower companies and solutions providers We have significant experience in working on both the buy-side and sell-side of due diligence We have a comprehensive knowledge of technologies, networks and operations throughout the various sub-sectors of the telecoms market Fixed Wireless Cable ISP Carriers Satellite Application Equipment Virtual Our structured methodology, supported by rigorous research, ensures that: we address all key issues, for example, crosschecking business model revenue forecasts with a top-down, macroeconomic affordability analysis we meet tight deadlines, and can deliver a red-flag report two weeks into a project, to provide early warning of any critical issues Our broad international project experience and access to in-house benchmarks, combined with proprietary tools and proven techniques, provide a framework for robust forecasting of key telecoms indicators, identifying and assessing sensitivities, covenant setting and monitoring We have in-house network design and operations consultants who can provide: high-level network designs to test network capability and capex projections aligned with business and market plans the ability to deliver telecoms services on a timely basis and to optimise the customer experience while minimising opex and assuring revenue Ref: 5445-66 Our general methodology 24 With our structured approach, we address all the commercial and technical issues efficiently and robustly Commercial environment & strategy Service portfolio Pricing policy, risks and price positioning Marketing strategy: subscriber acquisition, distribution, advertising Competitive landscape: Regulatory environment profiling of competitors market shares and new entrant scenarios fixed-line market convergence and substitution offers Assessment of opportunities and threats Recent and expected developments in: interconnect regime operator licensing spectrum licensing numbering universal service price controls National regulator’s activity and agenda, dispute resolutions Licences held and specific obligations Company revenues and margins Achievability of market share in view of commercial and network strategy and competitive landscape Review of the subscriber base segmentation Achievability of revenue and pricing Review of operations and opex Retention, acquisition & marketing expenses Cost of services and interconnection Staffing levels versus subscriber forecasts and reorganisation plans Tariffs and structures, in view of market prices and affordability Expected gross margins: bottom-up assessment and benchmarking OSS/BSS, network management, customer care and enterprise IT G&A and bad debt expenses Procurement and quality assurance Board, management, agent and supplier activities Technology and capital expenditure Network capability and technological roadmap Capex breakdown and timing of expenditure: subscriber and capacity forecasts subscribers geo-dispersion and coverage licence obligations network service strategy, availability of technology Benchmarking of capex Equipment allocation of network expenditure based on contract prices versus estimates Ref: 5445-66 Our general methodology 25 Analysys Mason can tailor its approach to the specific needs of a due diligence High-level red-flag report based on interviews and information available from the data room Short report focusing on key questions already identified during the first phases Review of management’s assumptions and key market and profitability drivers Full review of the management’s detailed operational plan Development of company’s business plan based on public information integrating information from the data room integrating inputs from other due diligence workstreams (e.g, accounting, legal) consistent with data from management interviews and with the regulatory horizon including sensitivities on key parameters highlighting critical inputs Comprehensive strategic review of the company going forward Complementary and comprehensive technical due diligence report, drawing on our expert technical and operations consultants Due diligence documentation including bid book, information memoranda, presentations to investors, market and business models Illustrative timeline of a due diligence 22-Feb 23-Feb 24-Feb 25-Feb 26-Feb 27-Feb 28-Feb 1-Mar 2-Mar 3-Mar 4-Mar 5-Mar 6-Mar 7-Mar 8-Mar 9-Mar 10-Mar 11-Mar 12-Mar 13-Mar 14-Mar 15-Mar 16-Mar Potential deliverables T F S SM TWT F S SMTWT F S SMTWT F Due diligence Management presentation Data room One-on-one Site visits (on request) <--------------- Submission deadline Deliverables Due diligence reports Business plan validation Preliminary valuation Final Board presentation Board meeting Final documentation Financing Finalise financing case Proposal to credit committee Credit committee approval <----------- <----------<----------- On-site presence Indicative range of deliverables Ref: 5445-66 Our general methodology 26 The objective of a technical due diligence is to identify and mitigate investment risk in technology and operations Technical due diligence provides a substantiated capex and opex position, highlighting and quantifying potential risks and unrealised benefits to help develop a robust business plan Telecommunications networks and operations require significant investment, up to the order of billions of pounds From a cost point of view, the business case for a telecommunications service, or portfolio of services, is driven by network and operations capex and opex Under-investment, or untimely investment, can lead to: not being able to meet market demand not being able to maximise revenue and profit poor services, poor customer experience, high churn, a poor brand and, ultimately, low customer acquisition/market share Over-investment, or investment in sub-optimal technology, can lead to stranded assets, an inefficient operation, and therefore an unprofitable business When investing in telecommunications networks and operations, the investor must be confident that the budgeted capex and opex is optimised to support the business and market plan Ref: 5445-66 Our general methodology 27 Our process delivers key benefits that help ensure a successful business plan In particular, the benefits that we have identified, include: ensuring that the network and operations can deliver the market plan from a capability, timing and budget point of view placing a focus on leveraging technical and operational synergies, and mitigating against future risk optimising the value of major financial investment clearly defining the required network/systems, operational strategy and technology roadmap preventing stranded technical assets clearly identifying material risk, and providing an appropriate actionable mitigation plan financially quantifying material business risk driving towards an efficient operation developing a robust business case supported by realistic, optimised and benchmarked capex and opex Ref: 5445-66 Our general methodology 28 A rigorous methodology is key to delivering value, often in short timescales and complex environments High-level review and red-flag report Information gathering Issue request for information (RFI) document Undertake interviews of key personnel Visit and examine key operational sites Walk through key processes with operational staff High-level review of key documents Analysis of key financial and operational benchmarks Initial identification of major risks to be examined in more detail, potentially by all parties in the due diligence project ‘To be’ requirements definition ‘As is’ review Review and document current network, systems and operations: technology design dimensioning processes capex opex Driven by the business and market plan Determine required technology road map to deliver services Determine network/ systems, high-level design and dimensioning Determine required capex and opex budget Gap analysis and recommendations Determine incremental technology strategy, network and systems plan Quantify investment required for current business Quantify investment required to meet future network and operations to deliver market plan A key challenge to delivering a due diligence project is obtaining the required information in a short period of time As well as focusing on key documentation, if it is available, our highly experienced technical consultants are able to ask critical questions, the answers to which have significant business impact Ref: 5445-66 Our general methodology 29 We create value for clients through our independence, in-depth experience and multi-disciplined consultants Independence and experience We are completely independent of any equipment providers or other professional service providers We have successfully provided advice to our clients for over 20 years We have delivered hundreds of due diligence and other related projects We also provide technical and operational strategy, network design and procurement services, therefore maintaining our best-in-class network and operations knowledge Multi-disciplined specialists All of our consultants are TMT specialists We have significant experience in many types of TMT businesses We are able to review all layers of the network and operations from the physical infrastructure, through the active layers, BSS/OSS to the customer care systems Our consultants are very used to working in multi-disciplined, multi-party due diligence teams Benchmark data We are able to benchmark equipment and application costs gathered from many projects* We are able to benchmark financial investment ratios against other business plans We also procure networks on behalf of clients, therefore providing us with post-negotiated pricing and technology roadmaps to ensure a solid, realistically costed, technology strategy We also undertake organisational and operational reviews providing us with associated benchmark data for efficient processes and organisational structures Ref: 5445-66 (*) This is done anonymously to maintain strict commercial confidentiality 30 Introduction About Analysys Mason Financing opportunities in the Asia–Pacific region Our general methodology Our due diligence expertise Ref: 5445-66 Our due diligence expertise 31 We have extensive due diligence experience across Asia, Africa and Europe Europe Asia Albtelecom (2007) AKTEL (2008) Altice (2005) Etisalat (2008) Armentel (2006) Excelcomindo (2007) Astelit (2005) PacketONE (2008) Avea (2006) PTCL (2005) Baltkom (2007) Sky Mobile (2007) BITE (2007) Swan Telecom (2008) BSkyB (2008) Africa BTC (2007) Cabovisao (2004) Transaction support in Europe Cesky Telecom (2002) Cinven (2009) Atlantique (2004) Transaction support in Asia Camtel (2007) Transaction support in Africa Cell C (2006) Other Analysys Mason projects Calyon (2009) Eircom (2006) EMKTV (2004) Monaco Telecom (2004) tele.ring (2005) Libertis (2005) Fastweb (2007) NMT (2006) Telekom Slovenije (2007) Maroc Connect (2006) Globul (2002) Numericable (2006) Telekom Srpkse (2004) MTN (2007) GTS (2007) On Telecom (2006) Thus (2005) Multilinks (2007) Lattelekom (2007) ONE (2007) Turk Telecom (2005) Nitel (2005) LycaTel (2009) ONO/Auna (2005) Voxtel (2004) Safaricom (2007) Magticom (2007) RCS (2006) VTH (2001) Telecel de Loteny (2004) Mobilkom (2004) Starman (2007) Zapp (2004) Tunisie Telecom (2006) Ref: 5445-66 Our due diligence expertise 32 We support debt and equity financing of the telecoms sector Focus Recent client successes We have an extensive track record in telecoms finance, undertaking rigorous, structured due diligence and business planning in support of vendors, purchasers and lenders. We are the partner of choice for many leading investors and debt financiers We have provided IPO support in respect of: Our extensive portfolio of work spans Europe, Asia, Africa, Middle East and the Americas We continue to support investors in wireline, wireless, facilities and media-based businesses Skill set Technical and commercial due diligence on behalf of purchasers and debt financiers Vendor due diligence Covenant setting and monitoring Preparation of information memoranda Valuation in support of M&A Joint-venture structuring Safaricom Zain, Saudi Arabia (2008) We have supported the following M&As: Lattelekom (2007) ONE, Austria (2007) Casema, Netherlands Mobilkom, Bulgaria (2004) Excelmindo, Indonesia (2007) Monaco Telecom (2004) We have supported the privatisations of: Telekom Slovenia (2007) Camtel, Cameroon (2007) BTC (2007) Tunisie Telecom (2006) Nitel, Nigeria (2005) Türk Telecom (2005) We have provided lender due diligence in support of: Etisalat, Egypt (2007) Zain, Saudi Arabia (2007) Ref: 5445-66 Our due diligence expertise 33 We support operators/vendors in fulfilling M&A opportunities … Focus Skill set We undertake work focusing on support for large-scale, operator-centric transactions (typically USD billions) Buy- and sell-side support Transaction management and negotiation support Synergy appraisals Valuation In addition, we apply of our robust methodologies, detailed knowledge of relevant markets and value chains to support M&A/equity financing of SIs, OSS/BSS vendors and application developers, with transaction values typically in the range of USD10 million to 100 million … and support operators with ‘fast-close’ financial reporting Focus We apply robust methodologies to support the world’s leading telecoms operators in their financial reporting, bringing particular expertise to support requirements Our ability to work to extremely tight timetables enables our clients to meet their challenging reporting requirements Skill set IFRS3 purchase price allocation: fair value appraisal of tangible assets fair value appraisal of intangible assets Value in use appraisals and asset impairment reviews Valuation of options IFRIC12 concession accounting Ref: 5445-66 Our due diligence expertise 34 Selection of our due diligence work in Asia [1/3] Project focus Client What we achieved Due diligence for acquisition Regional operator Commercial and technical due diligence of a mobile operator in Sri Lanka. This involved analysis of primary data, third-party data and face-to-face interviews with management in order to support an assessment of the value of the target operator to our client. Our work highlighted the risks and opportunities of the potential acquisition and produced a detailed ten-year business plan, which was used as the primary input to the discounted cash flow valuation. As a result, our client decided to submit an offer for the target operator, and is currently in the negotiation phase of the acquisition Due diligence for acquisition Private company For a company looking to acquire a new entrant broadband operator in China, we provided a thorough review of the key issues involved in the investment, and an initial valuation of the deal. This included a detailed review of the broadband market potential in China, including market forecasts, a review of the technology involved, a detailed analysis of the competitive landscape, and advice on the potential regulatory issues involved Due diligence for investment Private equity firm We supported a private equity firm during the due diligence process of a major integrated (fixed, mobile and pay-TV) operator in South-East Asia. This involved attending management presentations and site visits. We carried out a detailed review of the management’s forecasts for each of the areas of the business and supported the client’s financial advisers in the development of a revised case for valuation Due diligence for merger Private equity firm For a private equity firm, we carried out a red-flag review of the strategic rationale and potential synergies for the proposed merger of a two operators in South-East Asia. During the project, we examined the potential revenue upsides that the combined entity may benefit from through bundling of services, cross-selling and the introduction of new products with reference to international case studies. We also commented on cost synergies that may be generated through the deal Due diligence for acquisition Investment bank Due diligence for a minority stake in a South-East Asian mobile operator. This involved management meetings and site visits. We performed a detailed analysis of the market considering issues such as the threat of CDMA fixed wireless access operators, likely market consolidation and subscriber price-usage elasticity. We developed a business model that was used to support the client's financial advisers in the valuation process Ref: 5445-66 Our due diligence expertise 35 Selection of our due diligence work in Asia [2/3] Project focus Client What we achieved Due diligence for investment WiMAX operator We provided an external evaluation of a WiMAX business plan that an operator had developed for a new market opportunity in a South-East Asian country. The client used our evaluation to refine the business plan and inform the decision of whether or not to pursue the investment opportunity Due diligence for acquisition Regional operator We conducted a commercial due diligence for a client interested in acquiring a minority stake in a South-East Asian mobile operator. This involved management meetings and site visits. We performed a detailed analysis of the market considering issues such as the threat of CDMA fixed wireless access operators, likely market consolidation and subscriber price-usage elasticity. We developed a business model that was used to support the client's financial advisers in the valuation process Due diligence for financing Commercial bank We assessed the competitive position of a submarine cable operator in Asia. We compiled detailed profiles of the operator’s major competitors, including assessment of their relative strengths and weaknesses. In addition, we identified major market trends, and conducted an analysis of the drivers of change in the Asian submarine cable market in the medium term Due diligence for acquisition Investment bank Due diligence of an incumbent telecoms operator in a developing Asian country. Analysys Mason assessed the market potential of the target, its current operations and its business plan. We carried out a valuation of the stake that was being offered for sale by the government Due diligence for acquisition Asset management group seeking to invest in India We assessed the business plan of a convergent service provider. The project reviewed the key assumptions used in the business plan and provided the client with an indicative valuation of the business. We drew on our international expertise and experience in assessing the opportunity of the data centre business, and our analysis helped the client in understanding the business and key drivers of the business Due diligence for stock exchange regulation Stock exchange Production of valuation certificate for an Asian wireless local loop operator. Working with a investment bank, we produced a comprehensive discounted cash flow model and filed our assumptions and opinion with the exchange authorities Ref: 5445-66 Our due diligence expertise 36 Selection of our due diligence work in Asia [3/3] Project focus Client What we achieved Due diligence for investment Private equity firm We supported a private equity group in a high-level review of the business model for a South Asian CDMA WLL operator. The operator was competing in a rapidly growing mobile market and was focusing on delivering fixed services. The review highlighted the opportunities and risks to the business Due diligence for investment Venture capital company We supported a venture capital company in undertaking a high-level commercial due diligence of a South Asian WLL and national long-distance operator. Our project assessed the development of the market with a particular focus on the role of WLL-based versus GSM-based mobility. We also assessed the regulatory environment to evaluate the mobility options that the WLL licence provided. Based on the results of our project, the client entered into a more detailed due diligence exercise Ref: 5445-66 Our due diligence expertise 37 Selection of our experience undertaking due diligences of major mobile operators [1/3] Project focus Client What we achieved Due diligence for acquisition Investment bank We developed a business plan for the valuation of a mobile operator in a Baltic state on the behalf of a Western Europe investment bank. Our cash flow model helped to inform our client’s decision on the acquisition of the target. Our work was praised for its consistency and timely delivery Due diligence for acquisition Fixed operator We helped a Nigerian fixed operator to acquire a fixed and mobile licence by bidding for an operator in sub-Saharan Africa. We co-ordinated inputs from in-house experts and developed a common, but detailed, view on the market, company revenues, and costs of services over the full length of the licence (15 years) owned by the target. Our client used our model to inform its valuation of the target and develop the best possible strategy for the company in preliminary negotiations with a potential bidding partner with strategic interests Due diligence for financing Financial institution On behalf of the leading arranger of a large debt facility, we carried out a due diligence of a new mobile entrant in the Middle East. In addition to reviewing in detail the market context and the company’s operations, we carried out a thorough due diligence of the company’s business plans, developed a revised banking case and conducted sensitivity analysis. We presented our findings to a panel of more than 70 bankers during the loan syndication phase of the transaction and provided support in answering questions from potential financiers. We also presented our findings to a credit agency responsible for guaranteeing vendor financing. Our client succeeded in raising the debt funding it required Due diligence for financing Mobile operator Due diligence assignment on an African mobile operator as part of a refinancing process. We undertook a detailed review of the company’s business plan, examining the evolution of both revenues and costs, and involved on-site visit. Our work highlighted some key risks at a critical time in the evolution of the competitive environment and quantified additional upsides. We developed a revised investment case for our client, which used our report to support its investment decision Ref: 5445-66 Our due diligence expertise 38 Selection of our experience undertaking due diligences of major mobile operators [2/3] Project focus Client What we achieved Due diligence for financing Consortium of banks We acted as market consultant of the lenders and global co-ordinators to the re-financing of a Turkish mobile operator. We assessed the operator’s revised business plan, reviewing the main assumptions and expressed our overall opinion of the plan. Subsequently, we supported the lenders in considering the implications for a lenders’ base case and associated sensitivities Due diligence for acquisition Mobile operator We supported an operator in its bid for a minority stake in a South-East Asian mobile operator. This involved management meetings and site visits. We performed a detailed analysis of the market and the target company preparing a full technical and commercial due diligence report. We developed a detailed business model that was used to support the client's financial advisers in the valuation process Due diligence for merger Consortium of banks We carried out a due diligence on the merger of two mobile operators, with a transaction value in excess of USD1 billion. We reviewed the business plan, interviewed the senior management and recommended a number of modifications to the plan. We also supported the lenders during the development of the lenders' case and facilitated key financing meetings between the company, its shareholders and the lenders Due diligence for financing Consortium of banks Due diligence on an Eastern European mobile operator for a consortium of North American and European lenders in support of a transaction in excess of USD100 million. We undertook a detailed assessment of the operator's marketing strategy, network technology, business plan and management team. Our work led to several major revisions being made to the operator's business model and financing structure Due diligence for acquisition Investment bank We undertook a due diligence of a Scandinavian CDMA 450 operator, on behalf of an investment bank. Our work included an assessment of the company’s strategy, marketing plan, operations strategy and business model (revenue and cost projections). The results of the study were used by our client to develop the financial projections for its lenders case Ref: 5445-66 Our due diligence expertise 39 Selection of our experience undertaking due diligences of major mobile operators [3/3] Project focus Client What we achieved Due diligence for acquisition Investment bank We performed a market and technical due diligence of both the fixed and mobile operations of a European operator, conducting interviews with the management team and undertaking physical network inspections. We reviewed the business plan assumptions on revenues, direct costs, operating expenditure and capital expenditure in light of the company’s current position and expected commercial and regulatory developments in the telecoms sector Due diligence for financing Investment bank Support to an investment bank in the financing of an African mobile operator for its initial launch. We carried out a due diligence of the plan and of the overall strategy of the operator. We also prepared a business plan which was benchmarked against other plans Due diligence for acquisition Investment bank Due diligence of an international mobile operator with several operations in Western Africa. For each operation, we reviewed the market, regulatory and technical background, and examined benchmarks of similar operations in comparable countries to provide an opinion on the reasonableness of the business plans under review for each market Due diligence for financing Commercial bank A due diligence in support of a syndicated loan transaction of a mobile operator in the Middle East. We reviewed the company's plans for network expansion and developed a view on the market to assess the potential demand for advanced mobile services in the country, taking into account technology, customer preference and economic conditions Due diligence for financing Investment bank and government export credit group Due diligence for a multi-billion-dollar financing. We assessed the potential demand for mobile services, taking into account subscriber affordability, technology deployment, the prevailing regulatory environment and in-country economic conditions. We reviewed planned network deployment costs to assess whether the plan had allocated sufficient capital for investments, and the capacity and quality of the network. We reviewed the key business processes to ensure that they supported the planned business strategy. From this analysis we identified the key risks to the plan and quantified the impact of these risks Ref: 5445-66 Our due diligence expertise 40 Selection of our wireless infrastructure projects and due diligence assignments [1/2] Project focus Client Mobile tower business Infrastructure company For a French highway company, we analysed its business of renting sites and towers What we achieved to telecoms operators, and recommended a new tariff policy. The project also advised on the negotiation of existing contracts with mobile operators Mobile tower business: commercial due diligence Private equity firm We supported a private equity buyer in developing a bid for a spin-off of a diverse business consisting of broadcasting/mobile towers and media services. The project involved building a detailed independent business model which required an understanding of the key changes in the market including DTT switch-over, evolution of requirements for mobile towers. Based on our business model, our client developed a valuation for the business Mobile tower business: commercial due diligence Consortium of investors We assisted investors in evaluating a mobile tower business in Europe. Following our initial development of market and financial models, we were retained to value a specific acquisition opportunity in southern Europe and to support negotiations during the formation of a bidding consortium. Our staff worked on site with the client's staff to maximise flexibility and speed of response Technical due diligence of tower company Private equity firm We provided an independent view of the vendor’s capability to deliver its stated business plan. This involved reviewing the physical assets, people and processes, as well as the forecast capex and opex needed to support the business Due diligence mobile sites Investment bank We undertook a review of the business plan, market conditions and potential of a UK mobile site provider Ref: 5445-66 Our due diligence expertise 41 Selection of our wireless infrastructure projects and due diligence assignments [2/2] Project focus Client What we achieved Cell site acquisition Private equity firm We conducted a focused review of a cell site acquisition company’s business plan. The review placed particular emphasis on the key uncertainties in the plan and served to confirm the business plan’s assumptions Mobile infrastructure market review Private equity firm We provided a high-level review of the market opportunity for mobile infrastructure provision in a number of European markets. The size of the market opportunity was assessed, and the revenue model associated with the infrastructure provider opportunity explored Assessment of investment opportunities in mobile infrastructure Investment bank We analysed the conditions for investment in mobile communications infrastructure in an East Asian country. This information was then extrapolated to the country in question. The client was then able to advise potential investors on opportunities for investment Mobile network outsourcing Equipment investor We conducted a focused review of the requirements for mobile network outsourcing in Europe. The review placed particular emphasis upon the capabilities that would be required to ensure that the outsourcing services business would prove credible in the marketplace Ref: 5445-66 Our due diligence expertise 42 Selection of due diligences of major fixed, integrated, backbone and broadband operators [1/2] Project focus Client What we achieved Internal due diligence Network operator Cable & Wireless (C&W) UK wished to invest in a next-generation network, and required an internal business case to be developed for approval by the C&W Board. We conducted an independent technical due diligence on the internally developed investment case and ratified the high-level NGN architecture and technology roadmap and migration plan. The C&W Board approved the GBP200 million investment in C&W’s NGN Due diligence for acquisition Fixed operator We undertook the market and technical due diligence of the fixed and mobile networks of the Nigerian incumbent Nitel on behalf of a large network operator. Indications of the expected value of the sale were in excess of USD1 billion. Based on our identification of significant technical and operational risks, our client decided not to invest in Nitel, and has since invested in an alternative operator Due diligence for financing Consortium of investment banks For a consortium of European investment banks, we reviewed the strategy and business plan of a fibre-based carriers’ carrier. We examined the company’s strategy, interviewed key management, and reviewed the planned revenues and costs. The final report formed an important input to the consortium’s financing decision Due diligence for acquisition Investment bank A due diligence investigation of a WLL and DSL operator in Germany. The project assessed the market opportunity for the company in voice, Internet and leased line services, in the context of the competitive environment faced by the company in its target regions. We delivered an analysis of the major issues in the company's business plan and prepared a revised base case plan Due diligence for acquisition Private equity fund specialising in emerging markets Due diligence on the incumbent fixed and mobile operator in a South Asian country. The work included a detailed assessment of the market environment, including competitor interviews, a technical assessment of the network and an in-depth appraisal of the company’s business plans Ref: 5445-66 Our due diligence expertise 43 Selection of due diligences of major fixed, integrated, backbone and broadband operators [2/2] Project focus Client What we achieved Due diligence for acquisition Private equity fund We supported Babcock & Brown Capital Management in their successful acquisition of eircom. During this process, we performed a market and technical due diligence of both the fixed and mobile operations, conducting interviews with the management team and undertaking physical network inspections. We reviewed the business plan assumptions on revenues, direct costs, operating expenditure and capital expenditure in light of the company's current position and expected commercial and regulatory developments in the Irish telecoms sector Due diligence for financing Consortium of investment banks Due diligence on a fixed operator in Central and Eastern Europe as a part of a EUR350 million debt refinancing. This involved an assessment of the market including size, growth opportunities, regulation and competition, as well as an investigation into the costs allocated in the plan and whether these were sufficient Due diligence for financing Financial institution We supported a financial institution in evaluating the funding application by a recently established fixed wireless access (FWA) operator in Nigeria and its future business potential. We evaluated the radio, transmission and core networks and associated performance, and then developed a five-year expansion plan, delivering both capacity and coverage enhancement requirements. We also created a five-year technical roll-out plan based on current traffic analysis and projected growth, and a five-year investment plan. Our work resulted in approved funding for the operator Ref: 5445-66 44 Amrish Kacker Lim Chuan Wei amrish.kacker@analysysmason.com lim.chuan.wei@analysysmason.com Analysys Mason Pte Ltd 8 Temasek Boulevard Penthouse Level Suntec Tower Three Singapore 038988 Tel: +65 6866 3203 Fax: + 65 6866 3838 www.analysysmason.com Ref: 5445-66