ISM_Barakonyi_IV_

advertisement

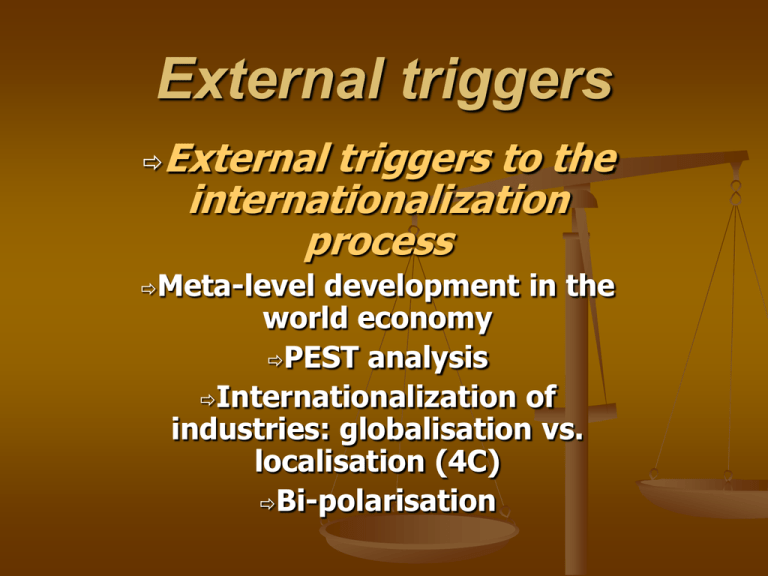

External triggers

External triggers to the

internationalization

process

Meta-level

development in the

world economy

PEST analysis

Internationalization of

industries: globalisation vs.

localisation (4C)

Bi-polarisation

External triggers to the

internationalization process

Driving forces toward globalization - opposite

forces => tensions

Current phase => Triggers may create conditions

=> Discontinuity => Next phase

Movement: bidirectional

increasing int’l exposure

decreasing

3-Externel triggers-a 34 /

2

External triggers

INTERNATIONALISATION

Market

penetration

Product

extension

Meta trends

Intern’l

business

development

Restricted

national

market scope

Geographical

expansion

Industry

competition

Product

development

Organizational

dynamics

Vision

mindset

RETRENCHMENT*

Internal triggers

Figure 2.1. Developing

an triggers-a

international

business strategy

3-Externel

34 /

3

External triggers

Discontinuity

Current phase

New international

strategic thrust

Next phase

Internal triggers

Figure 3.1. External and internal triggers to a stage change

3-Externel triggers-a 34 /

4

Three levels:

–meta level

–industry level

–Firm-specific level

Interrelatedness!!!

Meta level:

broad trends, collectively help to shape

competitive environment

Question: how they relate to individual

industries and competititors

3-Externel triggers-a 34 /

5

External triggers

TRINITY

Meta level

World trade

PEST analysis

Industry level

Firm level

Globalisation v

localisation

Bipolarisation

Figure 3.2. External triggers at the meta, industry and firm-specific levels

3-Externel triggers-a 34 /

6

External triggers

External

triggers to the

internationalization process

Meta-level

development in the

world economy

PEST

analysis

Internationalization of

industries: globalisation vs.

localisation

Bi-polarisation

Meta-level development in

the world economy

the “Triad”

interblock trade

direct investment

dynamic adjustment

3-Externel triggers-a 34 /

8

3-Externel triggers-a 34 /

9

Triad

1/5 of global population, 4/5 of world

output (GNP)

more manufacturing/service divisions

nationality of companies: outdated

national government can not obstruct or

impede

raising import penetration: interlinked

nature

USA import:

– 1970: 4.1% GNP

– 1980: 9.1 % GNP

– 1990: over 18%

Main competitors for indigenous firms

are increasingly

to

be

foreign!

3-Externel triggers-a 34 /

10

Capitol market

Global marktes

Conflicts of national

policies

Goods, services

Regionals

markets

Regionals

markets

National

markets

Regionals

markets

Integration,

harmonization and

protectionist regional

policies

Labor markets

National employment,

training and fiscal policies

3-Externel triggers-a 34 /

11

35%

740 m

Western Europe

28%

350 m

Central & Eastern Europe

7%; 390m

34%

760m

NAFTA

30%

370 m

South & Central America

4%; 390m

6%

The

‘Triad’

25%

2300m

Japan, Australia &

‘Tigers’ 20% 400m

China, other Asian-Pacific

developing 5%; 1900 m

1700m

Africa, Middle East, Indian subcontinent

Figure 3.3. The ‘Triad’ and the world economy, 1991: percentage of world GNP; population in

3-Externel triggers-a 34 /

12

millions

NAFTA

28%

South & Central

America

40%

Western Europe

34%

Central & Eastern

Europe

22%

Japan and ‘Tiger’

economies

68%

26%

China & Asia Pacific

Africa, Middle East &

India

2001

1991

47%

0

2000

4000

6000

8000

10,000

Figure 3.4. Forecast growth of world ‘Triad’ markets, 1991-2001: levels of GNP (billion

3-Externel triggers-a 34 /

13

USD) and estimated percentage changes over the period {World Bank]

1995: Uruguay Round of the GATT: significant reduction in the

trade barriers

cuts in tarifs

bringing in farm products, textiles, services

intellectual property rights

conditions: when a state allowed imposing trade barriers

World trade growth > world outcome=>

XXI. Century: interlinked economy is likely grow faster =>

international competition is increasing more quickly than

output grows

EU, NAFTA: large unified regional trading area

Liberalization promoted

inter- and

intra-block trade!

3-Externel triggers-a 34 /

14

Intra-Europe 1214.0 $bn (35,4%)

Europe

129.3 $bn (3.7%)

174,7 $bn (4.9%)

152.7 $bn

(4.4%)

184.8 $bn

(5.3%)

Asia

America

153.6 $bn (4.4%)

236.4 $bn (6.7%)

Intra-Americas 270.4 $bn

(7.7%)

Key:

= Exports to

Intra-Asia 413.5 $bn (11.8%)

Others: 14.9%

Figure 3.5. Projected merchandise trade in US$ billion and as a percentage of world

3-Externel

34 /

15

trade for the

year triggers-a

2005 [GATT

Report]

1987

1988

1989

1995

87

100

80

63

63

54

60

40

20

0

-7

-20

-40

-22

-5

-25

-8

-24

-33

-18

-18

-21

-34

-60

-51

Europe

USA

Japan

Rest of world

Figure 3.6. Trade balance of world electronics industry: surplus/deficit in US$ billion

3-Externel triggers-a 34 /

16

Direct investments

raising exchange rates (Japan, Germany)

hard to raise productivity

Foreign assets: Japan $514 bl, Germany $300bl

(1992)

World trade flows increasingly reflect the locational

decisions of international competitors and not just

the competitive position of indigenous nationally

owned companies!

…never has an economy passed so quickly as Japan from nonindustrialised backwater, through industrial giant, and now towards

threatened industrial3-Externel

dinosaur

all

triggers-a-34

/ in one generation.*

17

Dynamic adjustment

success eventually brings attendant difficulties

(Japan, Germany)

facing structural challenges: raising affluence erroding cost bases

home manufacturing base: less and less

competitive

loss of export sales and employment adjustments (time leg)

Undermines the success of the

previously rapidly growing economies

=>

Enables new countries to become

preferred production base!

Trade protection: only a temporary solution

Protection removes the competitive pressure

Protection removed:

adjustment

more dramatic!!*

3-Externel triggers-a

34 /

18

The dynamics of the TRIAD world economy create

instability and change, but there can be no such thing

as absolute winners or losers.

•Winning becomes increasingly expensive as wages and

currencies are adjusted upwards.

•Loser economies, by contrast, are able to rejuvenate in the

long term since an unemployed workforce is available at

reasonable cost and backed by a week currency.

Time legs to this process ensure that the adjustment

process is slow, with changes in political, technological

and social factors

•either reinforcing the economic adjustment process

•or retarding it.*

3-Externel triggers-a 34 /

19

External triggers

External

triggers to the

internationalization process

Meta-level development in

the world economy

PEST analysis

Internationalization

of

industries: globalisation vs.

localisation

Bi-polarisation

PEST analysis

– Political-Economic drivers

– Social (lifestyle) changes

– Technological development

–Linking PEST and meta-level

changes

3-Externel triggers-a 34 /

21

Political-Economic drivers-1

Indian car component industry

Indian companies: equipment suppliers

Main advantages:

low cost,

lax environment controls

long engineering tradition

Cost effective country for hot and dirty

operations:

forging of heavy components

manual assembly

3-Externel triggers-a 34 /

22

Political-Economic drivers-2

Disadvantage:

adequate infrastructure

reputation for poor quality

Rejected as original equipment manufacturers =>

only spare parts =>

low cost, low quality spares (half price) =>

undermines to supply original equipment

LOW COST IS AN INSUFFICIENT

COMPETITIVE BASE!

3-Externel triggers-a 34 /

23

political forces: brought liberalization

economic forces: responsible for

many of underlying dynamics

– cost differencials

– exchange rates

– must recognise all inputs

– customers: not looking for low cost at

the expense of quality

worldwide shift in economic location:

attributed to labor cost

competitiveness; but:

– productivity

– quality 3-Externel triggers-a 34 /

24

Germany

25.10

Japan

24.89

USA

16.98

16.32

Italy

France

15.30

seats

exhausts

UK

13.74

Spain

12.66

brakes

2.10

Mexico

0.00

Figure 3.7. World

10.00

20.00

Labour costs per hour/US$

30.00

component

supplies,

labour

costs per hour (US$)

3-Externel

triggers-a 34

/

25

Germany

100

UK

60

Italy

51

50

USA

Japan

47

France

Germany: 100%

40

Spain

27

12

Mexico

0

20

Figure 3.8. Index

40

60

80

labour 3-Externel

cost per

unit of output (US$)

triggers-a 34 /

100

26

Home based production =>

continuing appreciation in the

country’s exchange rate

–drive down costs

–locate production cross-border

–increase cross-border production

Otherwise: squeezed out of

international markets

The location of low cost

economic facilities is

constantly changing!

3-Externel triggers-a 34 /

27

SANRITSU ELECTRIC

(Tokushima

plant, appreciation

Shikoku island – currently:

Reason:

yen’s sharp

idle)

Plus:product

prices

fell for 26 years (CD,

Sanyo

Electric’

supplier

- intensified

competition

radio,

casette player)

1993 August:

nohigher

longercost

ordering

Japanese

firms with

=> increasingly

source products oversees!

New source: Singapur!

October: Tokushima run out of orders!

3-Externel triggers-a 34 /

28

Entry of KIA Motors into the US car market

1994: replicate Japanese entry strategy in a high

competitive market

- under-price products

- similar quality

KIA-strategy:

models

in the low

superiorreplace

levels ofJapanese

standard

equipments

price segments

Japanese

producers: increase price (response to

$/yen rate) => gap appeared at the bottom end

Japanese

Toyotamanufacturers:

Corolla, Honda Civic: from $12.000

•unable

to match the lower cost base of new

Kia Sephia:

$8.495

entrants

•unable to give premium price at luxory cars

•increasingly caught in the middle

3-Externel triggers-a 34 /

29

Social (lifestyle) changes

Powerful influence on customer choice

World is becoming a smaller place

–reduced costs of int’l travel

–enhanced communication: information on

products

–worldwide homogeneity of consumers

preference

–convergence of customer requirements

(cameras,

jeans,

soft drinks)

Lifestyle

trends:

critical

external trigger

Continuing

opposite directions

may operatediversity:

either

–cultural

andthe

language

identities

•to accelerate

convergence

of the global

–national

economy states, separate groups: differences

orbe recognized

•continue to promote diversity

3-Externel triggers-a 34 /

30

NISSAN

Manufacturing: Japan,Europe, North America

Strategy: need to penetrate successfully Triad markets

•customers in each Triad markets: vastly different needs

No averaging across markets to reach a compromise

•sub-markets:

also

design!

- looks at Triad region by region

Nissan’s believe: no universal world car!

- identifies each market’s dominant

•Basic

models: meet some of the needs of each => to halve

requirements

•3/4 of sales: designed for specific markets

‘lead country’ model => tailored to distinct needs of the

dominant national markets

3-Externel triggers-a 34 /

31

Technological development

information technology

data collation, analysis,

transfer

Promotescoordinate

changes, adoption

to

changes

activities from

satellitediffuse

technology

location

more e-trade,

quickly, cheaply

e-finance

pan-country media,

communication

pan-continent media

=> linking stock markets

=> linking financial systems

=> finance company

operations

travel and transport

3-Externel triggers-a 34 /

32

Developing technologies

Gene splicing

biotechnology (USA 70’s), pharmaceutical industry

Magnetic resonance imaging (MRI)

body scanners showing images + biochemical reactions,

medical equipment industry

High-temperature superconductivity

80’s, new ceramic materials lose electrical resistance at

workable temperature

Personal computers

continuing advances: portable PCs rapid growth (Atari

=> Psion)

3-Externel triggers-a 34 /

33

Neutral networks

military applications (Internet), industrial

and financial sector: recognition,

forecasting

Communication satellites

continuing growth and advancement

(Berlin Olimpic Games => Telstar =>

moon “landing’ => Sidney Olympic

Games)

3-Externel triggers-a 34 /

34