CES education programs - DeVry

advertisement

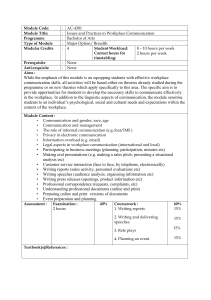

New and improved education for a broad range of needs Make Sure I’m On Track Get Me Started In A New Job Establishing an investing strategy Enrollment, budgeting and debt management ► ► Getting on the Right Path with Your Workplace Savings Taking Control of Your Personal Finances ► ► Planning for retirement and other financial goals Building a Portfolio for Any Weather ► Allocating Your Workplace Savings ► ► ► ► Making the Most of Your Workplace Savings Transition ► Evaluating Your Investment Options ► ► Wise Choices for Your Old Workplace Savings ► Wise Choices for Your Old Workplace Savings ► ► Education on workplace plan fundamentals 1 * A letter of direction (LOD) may be required Direct Me Through Big Changes Keep Me On Track Designing Your Financial Roadmap* Monitoring Your Portfolio Remaining Confident in a Volatile Market Distribution and income planning needs ► ► Creating a Plan for Lifetime Income in Retirement* Deciding What to do With Your Workplace Savings Planning for College Creating a Plan for Lifetime Income in Retirement* Establishing and Maintaining Your Estate Plan Wise Choices for Your Old Workplace Savings Education for retirement and beyond Engage employees through hands-on learning Our education programs are designed to address the unique needs of your employees by making education available through multiple channels. We’re able to engage your employees and bring them hands-on learning through self-paced online learning and live interactive session on the web or onsite. The most effective Education Action Plan includes a combination of these strategies and solutions to provide your employees with the flexibility to access education, no matter what financial decision they are facing. Maximize the advantages of the Web On Demand Workshops Available on demand, virtually 24 hours a day, days a week May be customized to include your plan’s specific details Best for employees: • Who prefer self-paced online learning at their convenience • At various locations across the country Make the most of in-person events Live Onsite Workshops Live sessions conducted onsite at your location May be customized to include your plan’s specific details Best for employees: • At a single-site organization or where there is a large concentration of employees Live Web Workshops Live, interactive sessions conducted online through NetBenefits® May be customized to include your plan’s specific details Best for employees: • At remote locations or those who travel • At various locations across the country 2 25% Of employees have taken action and applied their newly learned skills after attending a meeting or self-paced program, either online or in person* * Results based on Participant Measurement Data for the 3 year period ending on 12/31/2008. Fidelity Workplace Education Services. Get me started in a new job— Helping new employees get on the right financial path Saving for retirement begins in the workplace. Our curriculum of educational workshops for new employees helps to get them on the right financial path by reinforcing the importance of saving early, providing tips for budgeting and debt management, and exploring options for simplifying finances for increased control and management of savings. Workshop Title Who Should Attend Key Topics Delivery Options On Demand Live Web Live Onsite • Employees not yet enrolled • Employees who are under-contributing in their plan • • • • • • Advantages of a savings plan Review of your plan’s details Identifying ways to save Developing a budget Setting a savings goal Choosing a contribution amount • Employees in the current plan affected by transition • • • • • • Review of plan specifics Key dates Transitional events Plan details and investment options Identifying ways to save Newly-available plan features Taking Control of your Personal Finances • New employees who may benefit from saving more, creating a budget, and managing debt • How spending and saving behavior impacts the ability to save • Credit card and debt management • Credit ratings and identity theft • Steps to better saving Wise Choices for Your Old Workplace Savings Plan • Employees who want to understand their options for their former workplace savings accounts • Understanding your distribution options • Benefits of simplifying finances Getting On the Right Path with Your Workplace Savings (English or Spanish) Can customize to include your plan’s details Making the Most of Your Workplace Savings Plan Transition (English or Spanish) Can customize to include your plan’s details 3 Make sure I’m on track— Helping active participants maximize their workplace plan Most employees can benefit from following three key financial principles—save more, invest better, and consider simplifying finances. Our curriculum of educational workshops for active participants encourages them to increase contributions, explains the fundamentals of asset allocation, and explores options for simplifying finances for increased control and management of savings. Workshop Title Who Should Attend On Demand Live Web Live Onsite • • • • • • Allocating Your Workplace Savings • New employees or those who want to change their current or future Investment mix • Identifying your current investment strategy • Comparing your current and target asset mixes Evaluating Your Investment Options • Employees interested in evaluating their investment choices and understanding performance measures • • • • Wise Choices for Your Old Workplace Savings Plan • Employees who want to understand their options for their former workplace savings accounts • Understanding your distribution options • Benefits of simplifying finances (English or Spanish) Can customize to include your plan’s details Review of your plan’s details Estimated need in retirement Principles of asset allocation Diversification (risk/return) Asset classes defined Building an investment strategy Delivery Options • Active employees looking to improve their investment mix through asset allocation and diversification Building a Portfolio for Any Weather 4 Key Topics How to monitor investments Using market benchmarks Rates of return Comparing investment options Keep me on track— Providing holistic guidance for active participants As employees progress in their careers, their financial needs do, too. Our curriculum of educational workshops for active participants provides guidance on prioritizing and managing multiple financial goals, including retirement and personal savings needs. Workshop Title Who Should Attend Delivery Options On Demand Live Web Live Onsite • Employees who are maximizing their workplace plan and looking to address additional savings needs • • • • Building a financial foundation Planning for retirement Addressing additional savings goals Protecting your assets Monitoring Your Portfolio • Active plan participants who want to review their portfolio as part of an annual maintenance plan • • • • Reviewing your current portfolio Asset allocation strategies Evaluating performance When to rebalance Remaining Confident in a Volatile Market • Employees who want to understand how to manage their portfolio based on historic and current market conditions • • • • Current market activity Historical perspective on the markets Basic investment concepts and strategies Staying the course in any market Planning for College • Employees who are interested in learning more about the college savings process • • • • The college finance system Planning for a college education Different investment vehicles Resources and Web tools Creating a Plan for Lifetime Income in Retirement • Employees over age 55 who are 5 to 10 years from retirement • Five key financial risks in retirement • Withdrawal strategies • Managing your plan (2hr) • Social Security and Medicare • Medical coverage, insurance and estate planning Designing Your Financial Roadmap (LOD may be required) (LOD may be required) 5 Key Topics Establishing and Maintaining your Estate Plan • Employees interested in learning more about estate planning • • • • Wise Choices for Your Old Workplace Savings Plan • Employees who want to understand their options for their former workplace savings accounts • Understanding your distribution options • Benefits of simplifying finances Benefits of estate planning Identifying your estate assets Key estate planning tools Reviewing your estate plan 1-hr or 2-hr Direct me through big changes— Reviewing distribution and retirement income options for separated employees Whether changing jobs or entering retirement, separated employees need to make important decisions about their savings. Our curriculum of educational workshops reviews the distribution options employees have when transitioning to a new job and helps retirees develop a retirement income plan so they don’t outlive their assets. Workshop Title Creating a Plan for Lifetime Income in Retirement Who Should Attend • Employees over age 55 who are 5 to 10 years from retirement (LOD may be required) Deciding What to do With Your Workplace Savings 6 • Employees who have recently experienced a job change (layoff, merger, early retirement, or plan termination) Key Topics Delivery Options On Demand Live Web Live Onsite • Five key financial risks in retirement • Withdrawal strategies • Managing your plan (2hr) • Social Security and Medicare • Medical coverage, insurance and estate planning • • • • • • Key compensation and benefit information Establishing a budget Understanding insurance needs Unemployment benefits Distribution options IRAs 1-hr or 2-hr Important additional information For plan sponsor use only. Guidance is provided by Fidelity Representatives through the use of Fidelity’s suite of guidance tools, these tools are educational tools and are not intended to serve as the primary or sole basis for your investment or tax-planning decisions. Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917 537327.1.0 7