File

advertisement

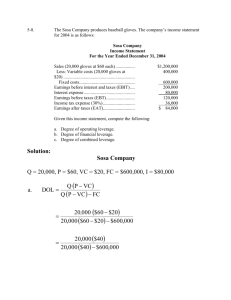

FINANCE FINAL PROJECT MINI CASE # 1 FROM CHAPTER 12 By: Siraj Haq SCENARIO • I am a new hire Financial Analyst for a highly leveraged Ski manufacturer “SKI PALACE” in Colorado’s Rocky Mountains. • The company manufacturers only one product.. State of the Art snow ski called ‘SNOOKI’ SCENARIO • Meeting next week with CFO, Maria Sanchez • To help her discuss the business and financial risks with the CEO, she has asked me to prepare an analysis focused on these 3 questions… Q1. What is the firms break-even point in sales dollars? Q2. If sales should increase by 30%(as president expects), by what percentage would the EBT(earnings before taxes) and net income increase? Q3. Prepare another income statement using sales with new 30% increase. COST STRUCTURE OF THE COMPANY • The following information is provided. Output level 80,000 units Operating assets $4,000,000 Operating asset turnover 8 times Return on operating assets 32 % Degree of operating leverage 6 times Interest expense $600,000 Tax rate 35% WORKING PLAN? Determine the Break-Even Point (BEP) Prepare Current Income statement Analyze how EBIT, EBT and NI change if 30% increase in sales Prepare supporting documents and a new Income Statement WHAT IS A BREAK-EVEN POINT??? • The Break-even Point is the level of output (in sales or in units) that allows the company to cover all of its variable costs. • The Breakeven Point (in sales dollars or units) is a very important figure because it is this figure that enables the manager to make a decision as to whether or not the firm should stay in business. WHAT IS A BREAK-EVEN POINT??? The Break Even Analysis enables the CFO: 1. Determine the quantity of output that must be sold to cover all the operating costs 2. Calculate the EBIT , that will be achieved at various output levels At the break even quantity of output EBIT is equal to ZERO OTHER IMPORTANT TERMS ??? Operating Leverage • The level to which a company is dependent on sales of individual products. • A company with only a few sales has a high operating leverage because it must use these few sales to pay its operating expenses. • On the other hand, a company with many sales has a low operating leverage and may therefore sell more or fewer products without it affecting its profitability as much OTHER IMPORTANT TERMS ??? Fixed Costs Costs that do no vary in total dollar amount as sales volume or quatitiy of output changes Ex : Administrative salaries Depreciation Insurance Property taxes Rent OTHER IMPORTANT TERMS ??? Variable Costs Costs that fixed amount per unit of output, but vary in total as the output changes Ex : Direct Labor Direct materials Energy costs packaging sales commisions STEP 1 : WHAT IS THE REVENUE OF SKI PALACE? Operating Asset turnover = 𝑁𝑒𝑡 𝑠𝑎𝑙𝑒𝑠 𝑜𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝐴𝑠𝑠𝑒𝑡𝑠 Solving for Revenue ( Sales) gives us Revenue ( Sales) = Operating Asset turnover * Operating Assets Revenue ( Sales) = 8 * $4,000,000.00 Revenue ( Sales) = $32,000,000.00 STEP 2 : WHAT IS THE OPERATING PROFIT MARGIN OF SKI PALACE? Operating profit Margin = Operating profit Margin = Return on Operating Assets Operating Asset Turnover 0.32 8 Operating profit Margin = 0.04 or 4 % STEP 3 : WHAT IS THE EARNINGS BEFORE INTEREST AND TAXES (EBIT) OF SKI PALACE? EBIT = Revenue (sales) * Operating profit margin EBIT = $32,000,000.00 * 0.04 EBIT = $1,280,000.00 STEP 4: WHAT IS THE REVENUE BEFORE FIXED COSTS OF SKI PALACE? Revenue before Fixed Cost = EBIT * Degree of operating Leverage Revenue before Fixed Cost = $1,280,000.00 * 6 Revenue before Fixed Costs = $7,680,000.00 STEP 5: WHAT IS THE TOTAL VARIABLE COSTS OF SKI PALACE? Total variable cost = Revenue (sales) - Revenue before Fixed Cost Total variable cost = $32,000,000 - $7,680,000 Total Variable cost = $24,320,000.00 STEP 6: WHAT IS THE TOTAL FIXED COSTS OF SKI PALACE? Total Fixed cost = Revenue before - EBIT Fixed Cost Total Fixed cost = $7,680,000 - $1,280,000 Total Fixed cost = $6,400,000.00 STEP 7: WHAT IS THE PRICE PER UNIT OF A A ‘SNOOKI’ BY THE SKI PALACE? Price per unit = 𝑅𝑒𝑣𝑒𝑛𝑢𝑒 (𝑠𝑎𝑙𝑒𝑠) 𝑂𝑢𝑡𝑝𝑢𝑡 𝑙𝑒𝑣𝑒𝑙 Price per unit = $32,000,000 80,000 𝑢𝑛𝑖𝑡𝑠 Price per Snooki = $400.00 STEP 8: WHAT IS THE VARIABLE COST PER UNIT OF A ‘SNOOKI’ BY THE SKI PALACE? Variable Cost per unit = Variable Cost per unit = 𝑇𝑜𝑡𝑎𝑙 𝑣𝑎𝑟𝑖𝑎𝑏𝑙𝑒 𝑐𝑜𝑠𝑡 𝑂𝑢𝑡𝑝𝑢𝑡 𝑙𝑒𝑣𝑒𝑙 $24,320,000.00 80,000 units Variable Cost per Snooki = $304.00 STEP 9: WHAT IS THE BREAK-EVEN POINT IN UNITS OF THE SKI PALACE? Break-Even Point = Break-Even Point = 𝑇𝑜𝑡𝑎𝑙 𝐹𝑖𝑥𝑒𝑑 𝑐𝑜𝑠𝑡𝑠 (𝑃𝑟𝑖𝑐𝑒 𝑝𝑒𝑟 𝑈𝑛𝑖𝑡 − 𝑉𝑎𝑟𝑖𝑎𝑏𝑙𝑒 𝑐𝑜𝑠𝑡 𝑝𝑒𝑟 𝑢𝑛𝑖𝑡) $6,400,000.00 ($400 − $304) Break-Even Point = 66,666 units STEP10: WHAT IS THE BREAK-EVEN POINT IN SALES OF THE SKI PALACE? Break-Even Point = 𝑇𝑜𝑡𝑎𝑙 𝐹𝑖𝑥𝑒𝑑 𝑐𝑜𝑠𝑡𝑠 𝑇𝑜𝑡𝑎𝑙 𝑣𝑎𝑟𝑖𝑎𝑏𝑙𝑒 𝑐𝑜𝑠𝑡𝑠 (1− ) 𝑅𝑒𝑣𝑒𝑛𝑢𝑒 𝑠𝑎𝑙𝑒𝑠 $6,400,000.00 Break-Even Point = $24,320,000.00 (1− ) $32,000,000 Break-Even Point is sales = $ 26,666,666.67 Prepare Current Income statement INCOME STATEMENT 2012 SEASON Revenue (sales) $32,000,000.00 Variable Costs ($24,320,000.00) Revenue before fixed Costs $7,680,000.00 Fixed Costs ($6,400,000.00) EBIT $1,280,000.00 Interest Expense ($600,000) Earnings before taxes $680,000.00 Taxes Expense (35%) (238,000) Net Income $442,000.00 Analyze how EBIT, EBT and NI change if 30% increase in sales Q2. IF SALES AT THE SKI PALACE WERE TO INCREASE BY 30 % ? Degree of Operating Leverage = % 𝑐ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝐸𝐵𝐼𝑇 % 𝑐ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝑅𝑒𝑣𝑒𝑛𝑢𝑒(𝑠𝑎𝑙𝑒𝑠) % change in EBIT = Degree of Operating Leverage * % change in Revenue(sales) % change in EBIT = 6 * 30% % change in EBIT = 180 % Q2. IF SALES AT THE SKI PALACE WERE TO INCREASE BY 30 % ? The New Revenue(sales) = Old sales = 30 % The New EBIT = The previous EBIT + 180 % Revenue before fixed cost remains the same The New EBT = The EBIT – the interest expense The New Net Income = The new EBT – (.35 of the new EBT) Preparing the New Income Statement INCOME STATEMENT WITH 30% SALES INCREASE Revenue (sales) $41,600,000.00 Variable Costs ($31,616,000.00) Revenue before fixed Costs $9,984,000.00 Fixed Costs ($6,400,000.00) EBIT $3,584,000.00 Interest Expense ($600,000) Earnings before taxes $2,984,000.00 Taxes Expense (35%) ($1,044,400) Net Income $1,939,600.00 30% 180% 339% 339% IMPORTANCE OF OPERATING LEVERAGE • Because of the Operating leverage, any percentage change in change in sales results in a much greater percentage fluctuation in the EBIT and even greater in the EBT (earnings before tax). • Operating leverage therefore should be handled with care, a good financial manager should be very careful when introducing fixed costs into the capital structure. DEGREE OF FINANCIAL LEVERAGE Degree of Financial Leverage = EBIT / (EBIT-Interest) Degree of Financial Leverage = $1,280,000 ($1,280,000−600,000) Degree of Financial Leverage = 1.882 DEGREE OF COMBINED LEVERAGE Degree of Combined Leverage = Degree of Financial Leverage * Degree of Operating Leverage Degree of Combined Leverage = 1.882 * 6 Degree of Combined Leverage = 11.292 DEGREE OF COMBINED LEVERAGE USED AS PROOF % Change in EBT = % change in sales * Degree of Combined Leverage % Change in EBT = 30% * 11.292 = 338.76 or 339% As shown in the new income statement, the % change in the New EBT is also 339% Thus we can conclude our calculations are done correctly THANK YOU ANY QUESTIONS ??