P. Mon. March 31--TAXATION REVIEW & EXAMPLE OF HOW

advertisement

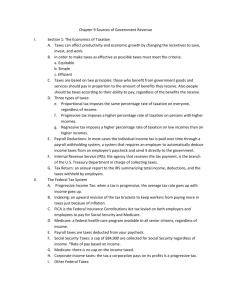

Taxation Review 1. Why do various levels of government collect taxes? 2. Identify each of the three types of taxation, briefly define each type, and give an example of each tax: Type of tax Definition Example of this type of tax 3. Explain how the U.S. progressive income tax system works. 4. Both individuals and corporations must pay tax on their incomes. (Circle One) 5. Do you believe that the progressive tax system is fair? Why or why not? 6. For each of the following taxes, identify the type of tax and the level of government that collects the tax: Specific Tax Property tax Medicare tax Sales tax Personal income tax Type of tax (progressive, regressive, or proportional) TRUE or FALSE: Level of government that collects the tax (local, state, national or some combination) In addition to paying federal income taxes people must also pay: State Income Taxes (varies by state, about 9% of income in California) Social Security Taxes (FICA) (12.4% on first 105,000 of income, employer pays half & you pay half) Medicare Taxes (about 1.5% income with no limit) Finally, on most purchases consumers pay an additional sales tax of 8.75% in California. What do people actually pay in taxes? Here are two examples below. However, you can calculate taxes for different scenarios using the paycheck tax calculator on my website…. 1) John is single and earns $360,000 per year 2) Mary is single and earns $60,000 per year JOHN Salary per year __________ MARY Salary per year __________ Federal Income Taxes ___________ Federal Income Taxes ___________ Social Security Taxes ____________ Social Security Taxes ____________ Medicare Taxes ___________ Medicare Taxes ___________ State Tax ___________ State Tax ___________ ------------------------------------------------------ ------------------------------------------------------------- Take-home Pay ___________ Take-home Pay ____________ Pay per month: ___________ Pay per month: ___________ Total Taxes Paid ____________ Total Taxes Paid ____________ ============================================================================ Who pays the most taxes: % Taxes Paid % Income Earned Top 1% of Income ($343,000 and up) _____________ ____________ Top 10% Income earners _____________ ____________ Bottom 50% Income earners _____________ ____________